You are here

What Are the Costs of Permanently Expanding the CTC and the EITC?

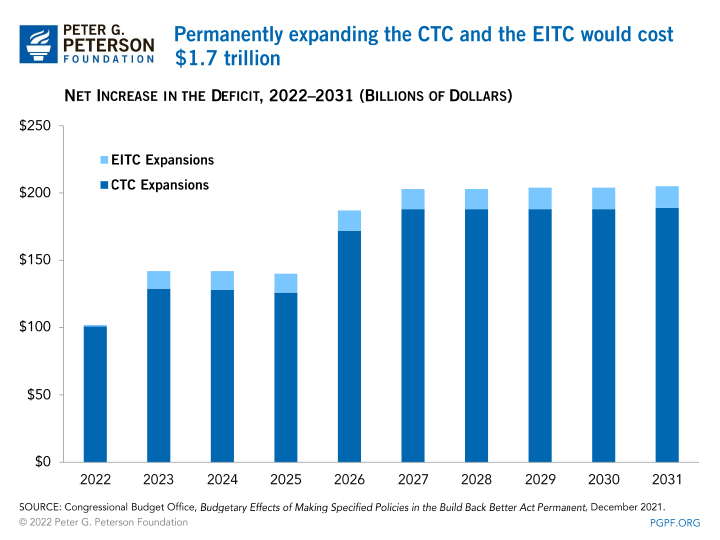

The American Rescue Plan included a one-year expansion of the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC). Both programs have proven to be popular and effective in reducing child poverty, and when the expansions expired at the end of 2021, a number of lawmakers supported extending them on a permanent basis. The Congressional Budget Office (CBO) estimates that permanently expanding the CTC and EITC would cost $1.7 trillion over the next 10 years. This piece looks at the costs and benefits of those programs and why policymakers should offset the cost of any extension.

The Child Tax Credit

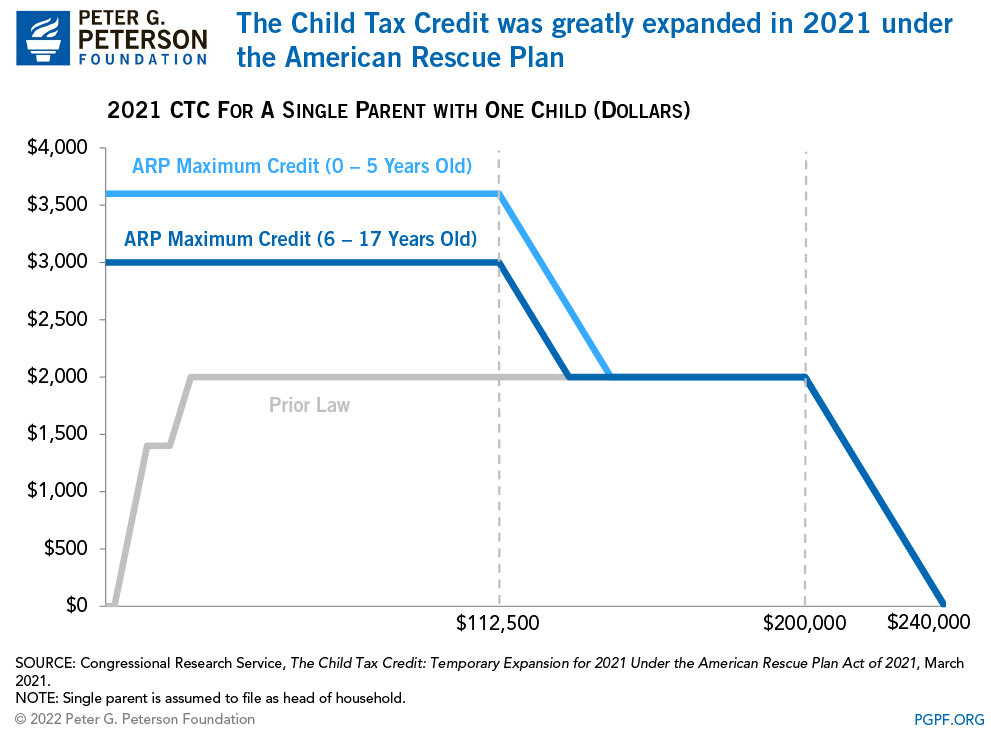

The CTC, which aims to reduce the tax liability for families with children, originally provided a credit up to $2,000 per child age 16 and under. Of the $2,000 maximum credit, up to $1,400 is refundable (taxpayers can receive payment in excess of their tax liability). The credit begins to phase out at $200,000 for single taxpayers filing as head of household and $400,000 for married couples. Under the American Rescue Plan, the maximum credit per child was raised to $3,600, eligibility was extended to 17-year-olds, and the credit was made fully refundable. In addition, the program provided half of the expected credit for 2021 through monthly payments from July through December 2021. If those expansions were to become permanent, CBO estimates that they would cost $1.6 trillion over the 2022-2031 period.

The Earned Income Tax Credit

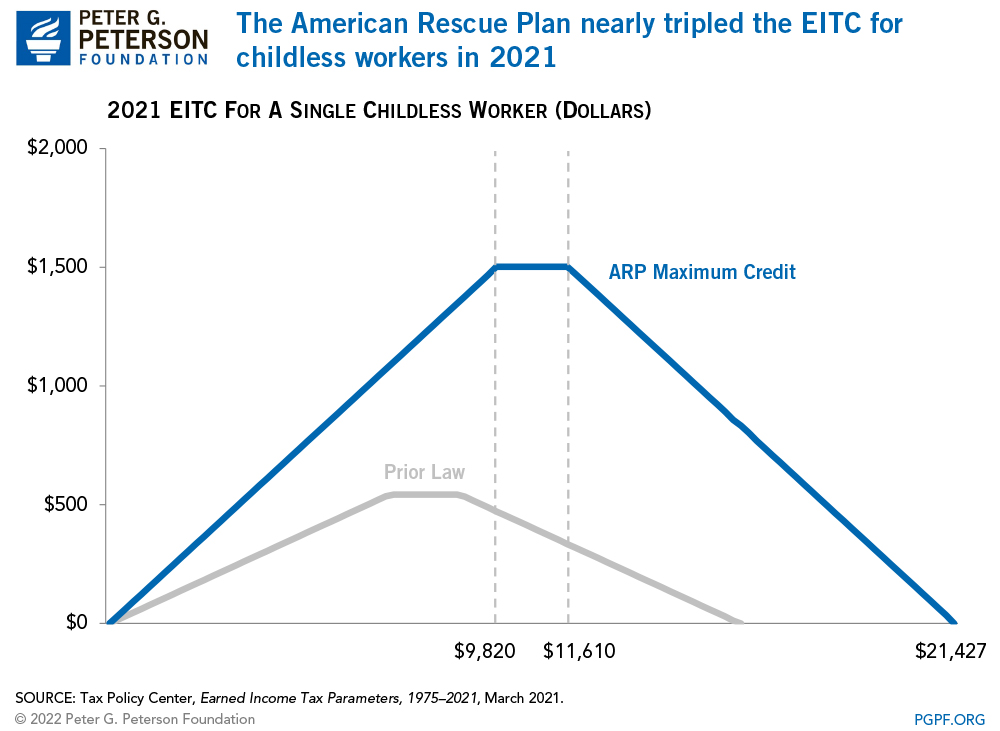

The EITC is designed to support low-wage working families; benefits are primarily determined by the taxpayer’s income. More specifically, the tax credit equals a fixed percentage of income until it reaches the maximum amount. Workers are paid the maximum credit up to a certain level of earnings, beyond which the credit phases out. In early 2021, the maximum EITC was $3,618 for a single person with one child and $543 for a childless worker. The American Rescue Plan expanded the EITC for the rest of 2021 by raising the credit percentage, increasing the maximum credit for childless workers to $1,502, increasing the income level at which the credit phases out, and reducing the minimum age for eligibility from 25 to 19. If those expansions become permanent, CBO estimates that the expansions would increase costs by $135 billion through 2031.

The expanded programs have had a significant impact in reducing child poverty. For example, the Census Bureau’s Household Pulse Survey found that food insufficiency among households with children dropped by 2.6 million people, or by about a quarter, just one month after the first monthly CTC payment went out in July 2021. Even before the American Rescue Plan was enacted, the CTC and EITC together lifted nearly 5.5 million children above the poverty line. Further studies have shown that the programs would likely continue to reduce poverty levels should their expansions be extended.

The CTC and the EITC have provided lifelines for millions of families throughout the pandemic. As lawmakers debate if and how to continue delivering assistance through the two programs, it’s important to fully understand and consider their long-term costs — and seek ways to pay for critical priorities without worsening our nation’s already precarious fiscal position.

Related: How Much Government Spending Goes to Children?

Image credit: Photo by Getty Images