You are here

Once Again, CBO’s Projections Indicate That the Fiscal Trajectory of the United States Remains Unsustainable

New baseline projections released today by the Congressional Budget Office (CBO) underscore and emphasize a fact that we’ve known for some time: the United States is on an unsustainable fiscal course marked by rising deficits. A key part of the challenging outlook is that rising debt and higher interest rates have pushed up interest payments, which threatens to crowd out other priorities. And it’s critical that we act soon, because the Social Security and Medicare trust funds will both be depleted within a decade or shortly thereafter, which would result in automatic cuts to beneficiaries and in payments to healthcare providers.

CBO’s report is the latest warning sign about the dire fiscal outlook, and there’s never been a better time for a bipartisan fiscal commission to look across the entire budget for spending and revenue solutions that would put us on a better path. Below are eight key takeaways from the report:

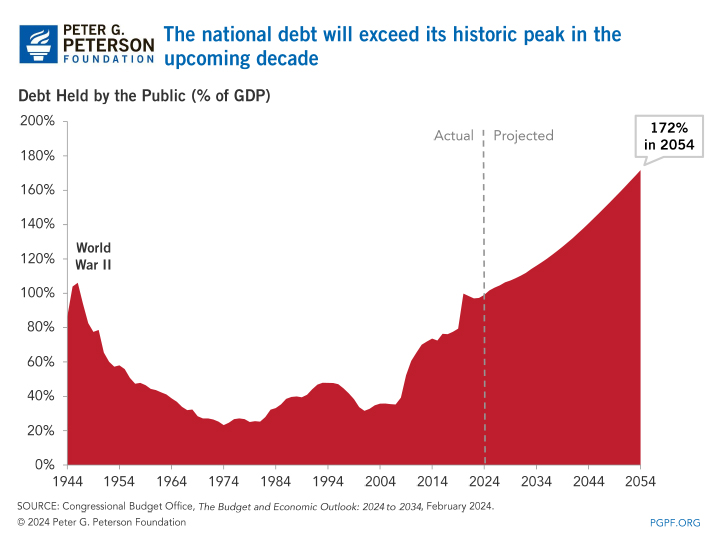

- The national debt is expected to exceed its record high within the next decade.

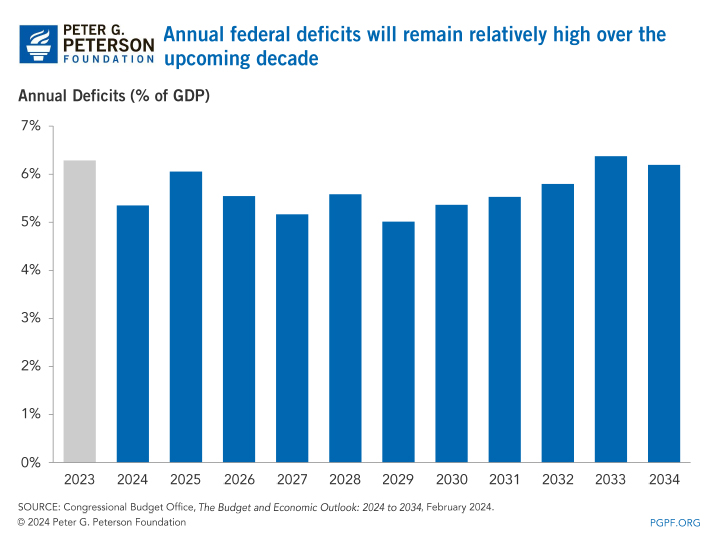

- Deficits will remain high over the 10-year period.

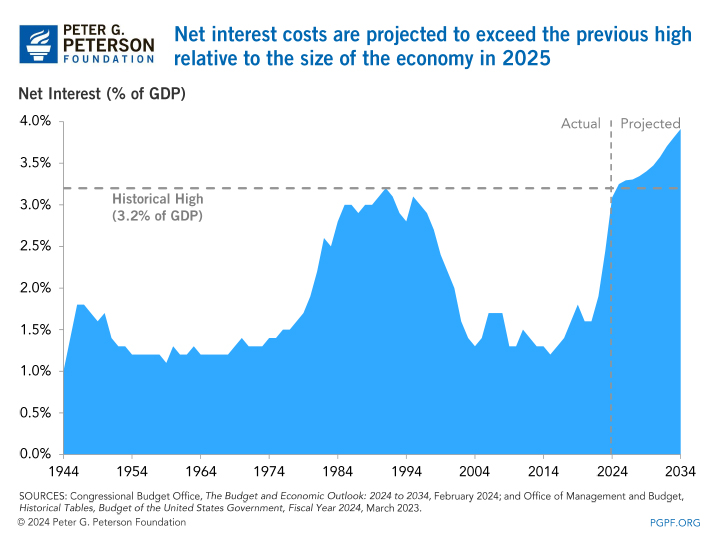

- Interest costs have spiked.

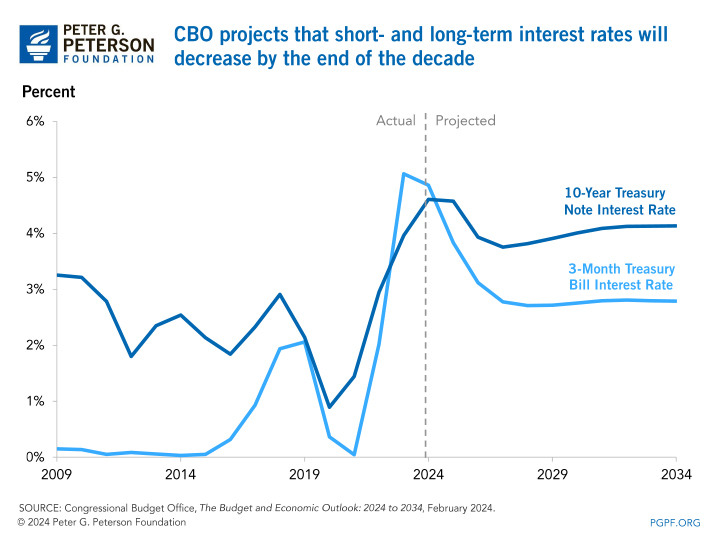

- Short- and long-term interest rates are expected to decrease by the end of the decade.

- Social Security and Medicare are key factors in spending growth.

- The major trust funds are expected to be depleted within the next decade or shortly thereafter.

- Revenues won’t keep pace with the growth in outlays.

- The fiscal outlook remains daunting.

Debt held by the public was 97 percent of gross domestic product (GDP) in 2023. However, by 2028, the structural mismatch between spending and revenues, along with higher interest payments, will cause federal debt to rise above the nation’s all-time high of 106 percent, which was reached just after World War II. CBO projects that debt will continue rising, reaching 116 percent of GDP by 2034 and climbing to 172 percent by 2054.

CBO projects that the annual budget deficit will rise over the next 10 years, climbing from $1.5 trillion in 2024 to $2.6 trillion in 2034 — with spending exceeding revenues by about one-third in that year. Relative to the size of the economy, CBO projects that the nation’s budgetary shortfall will climb from 5.3 percent of GDP in 2024 to 6.2 percent in 2034.

Higher short-term and longer-term interest rates substantially pushed interest costs up over the past two years. CBO expects that interest costs will be more than twice as high this year as they were just three years ago — rising from $352 billion in 2021 to $870 in 2024. Going forward, interest payments are projected to grow further and reach $1.6 trillion in 2034. Relative to the size of the economy, net interest reached a high of 3.2 percent in 1991; in CBO’s projections, that ratio would be exceeded in next year.

To address high inflation, the Federal Reserve has increased the Federal Funds rate to between 5.25 and 5.5 percent, and as a result, the rate on 3-month Treasury bills rose substantially over the past two years. CBO expects that rate to remain stable at 5.3 percent in the first quarter of 2024 before eventually dropping to 2.7 percent in 2027. Afterwards, the short-term rate is expected to be steady through the remainder of the decade. CBO expects that the 10-year Treasury rate will increase from 4.4 percent to 4.8 percent over the next year and then decrease to 3.7 by the end of 2026. The 10-year rate would then gradually rise to 4.1 percent towards the end of the 10-year horizon.

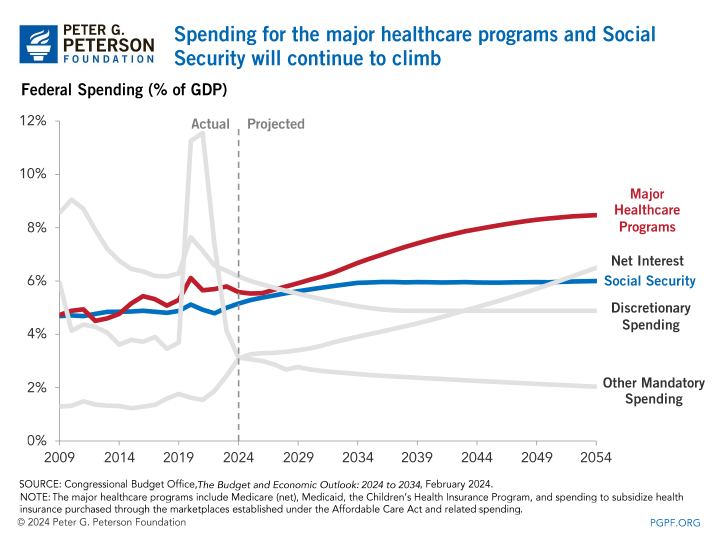

Driven by an aging population and rising healthcare costs, federal spending on major healthcare programs (Medicare, Medicaid, premium tax credits and related spending, and the Children’s Health Insurance Program) would increase from 5.6 percent of GDP in 2024 to 6.7 percent in 2034, climbing even further in the following years to 8.5 percent of GDP by 2054. Spending for Social Security will also rise over that period, from 5.2 percent of GDP in 2024 to 5.9 percent in 2034, reaching 6.0 percent of GDP by 2054. However, spending on interest will be the fastest-growing component of the budget over the next three decades and exceed the amount spent on Social Security in 2051.

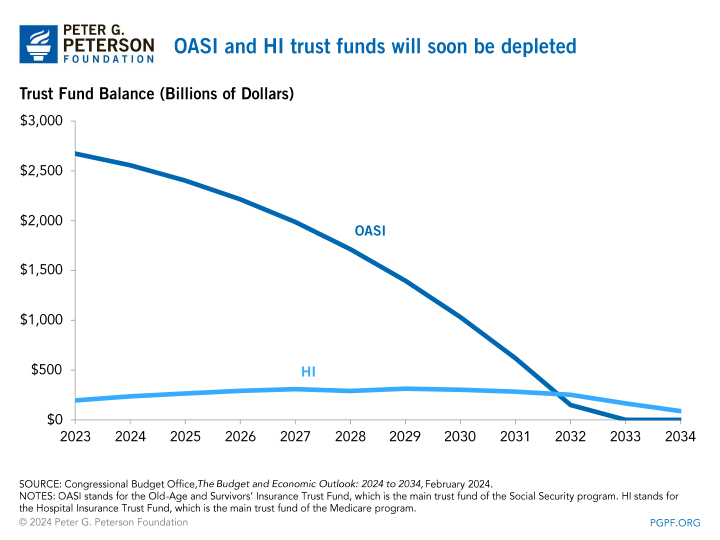

CBO projects that the balance of Social Security’s Old-Age and Survivors’ Insurance (OASI) Trust Fund will be depleted in 2033. In addition, CBO’s numbers indicate that Medicare’s Hospital Insurance (HI) Trust Fund will be depleted shortly after the projection window. At the time of depletion for each trust fund, the corresponding program will be unable to pay its full obligations. The Highway Trust Fund is projected to be depleted in 2028.

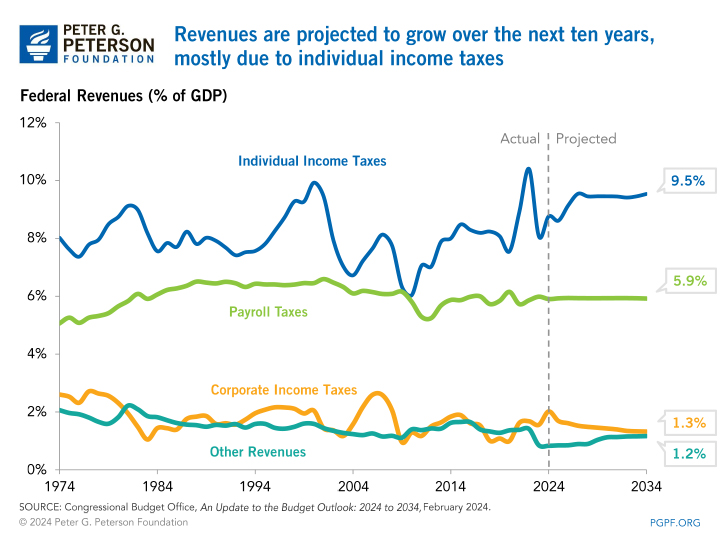

Relative to the size of the economy, federal revenues are projected to dip for one year to 17.1 percent of GDP in 2025 from 17.5 percent of GDP in 2024. CBO anticipates that such receipts will climb in most of the following years, averaging 17.8 percent of GDP from 2026 to 2034, in part because of the expiration of certain individual income tax provisions in December 2025. However, the growth in revenues will not be sufficient to cover the growth in outlays over the period.

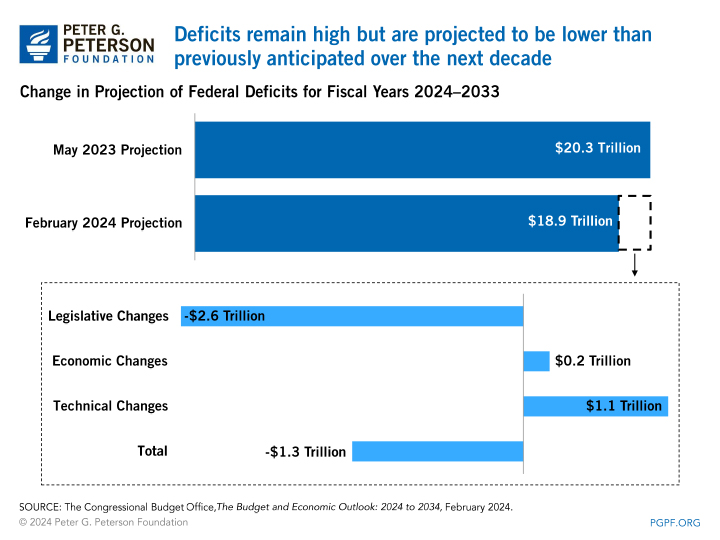

In May 2023, CBO projected that deficits from 2024 to 2033 would total $20.3 trillion. In the latest report, CBO projects a cumulative deficit of $18.9 trillion over that period. One reason for the slightly better outlook is the enactment of the Fiscal Responsibility Act of 2023, which instituted caps on discretionary spending for fiscal years 2024 and 2025. Over the 10-year period, projected spending on discretionary programs is lower because of that legislation and a reduction (to date) in emergency funding. Additionally, deficits are projected to be smaller over the decade because of certain economic and demographic factors. Partially offsetting those improvements in the outlook are higher interest rates and greater-than-expected costs for certain energy-related tax provisions enacted in 2022.

All told, however, this is, at best, a slight improvement to a truly daunting challenge for our nation. CBO’s report once again shows that America’s fiscal trajectory is on an unsustainable path. The structural mismatch between federal spending and revenues, along with the recent rise in interest rates and therefore federal borrowing costs, will pose challenges for the federal budget, our economy and the nation’s future if left unaddressed.

Related: Recent Economic Projections Show Higher Interest Rates Than Expected Earlier This Year

Image credit: Alex Wong / Getty Images