You are here

CBO Report Highlights America’s Unsustainable — and Deteriorating — Fiscal Outlook

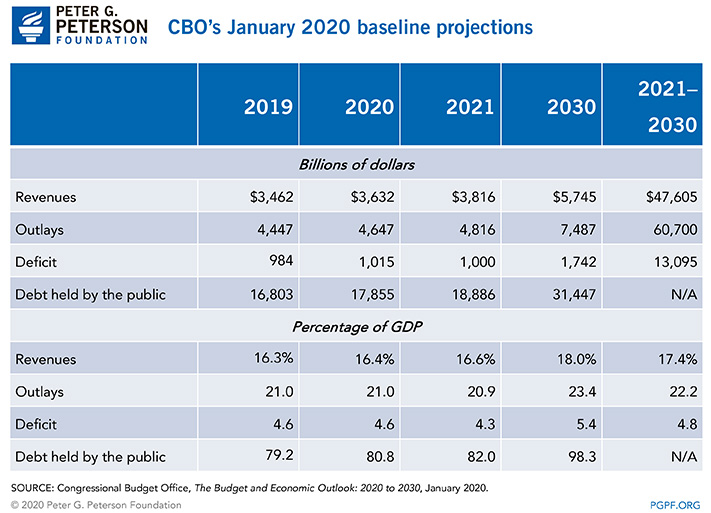

The latest report from the nonpartisan Congressional Budget Office (CBO) reiterates that the federal budget is on an unsustainable trajectory. CBO’s projections outline America’s troubling fiscal outlook if current laws remain the same:

- A budget deficit that will total $1 trillion this year and grow significantly through 2030, when it would reach $1.7 trillion.

- An average deficit of 4.8 percent of gross domestic product (GDP) over the next 10 years — very high relative to previous periods of low unemployment.

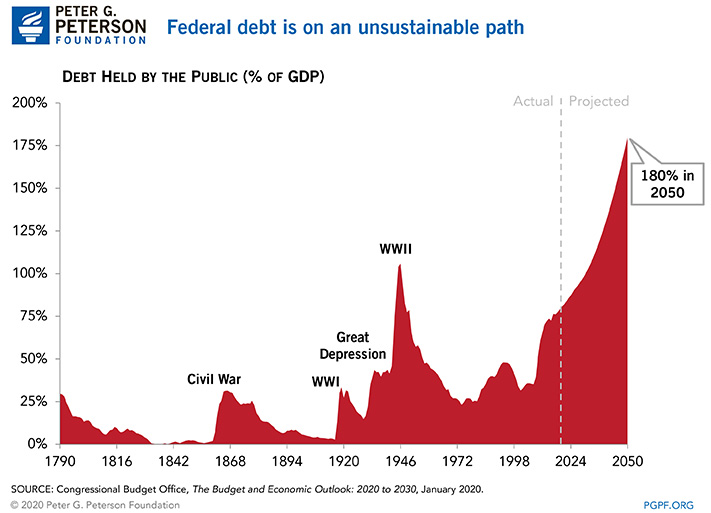

- A substantial increase in the debt held by the public to 98 percent of GDP in 2030, more than double the 50-year historical average. By 2050, CBO estimates that the debt will approach twice the size of the U.S. economy.

- Mounting interest payments that would more than double in 10 years.

CBO warns of the negative consequences of such an unsustainable fiscal trajectory:

High and rising federal debt would reduce national saving and income, boost the government’s interest payments, limit policymakers’ ability to respond to unforeseen events, and increase the likelihood of a fiscal crisis.

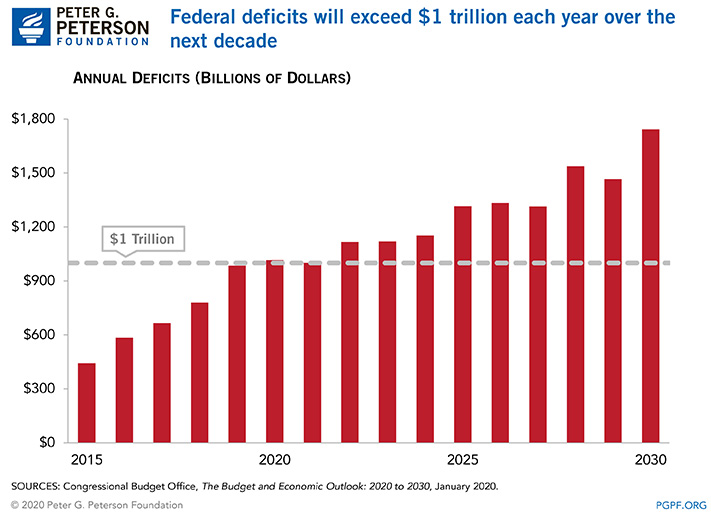

Federal Deficits Will Exceed $1 Trillion and Grow by 70 Percent Over the Next Decade

CBO projects that the federal budget deficit will remain elevated and grow substantially over the next decade and beyond. The annual deficit will top $1 trillion in 2020 and grow by more than 70 percent by 2030. That growth is driven primarily by the aging of the population, rising healthcare costs, mounting interest payments, and insufficient revenues to cover such commitments.

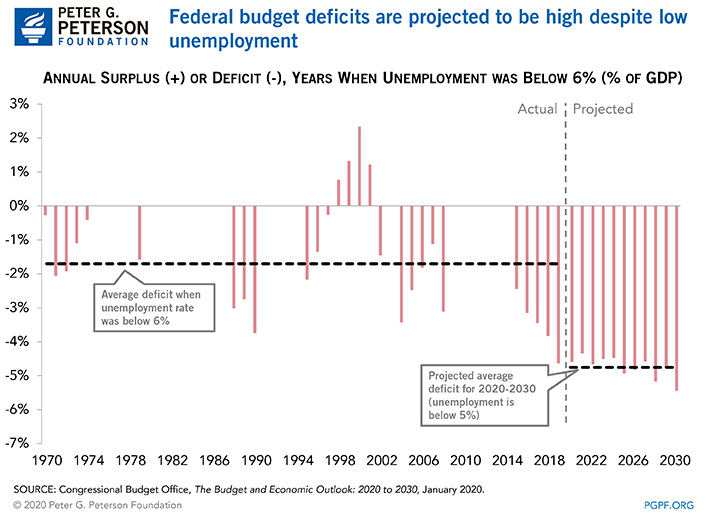

As a share of GDP, the deficit is projected to rise from 4.6 percent in 2020 to 5.4 percent in 2030 — significantly higher than the average deficit of 3.0 percent of GDP over the last 50 years. If CBO’s projections come to pass, 2024 would mark the sixth consecutive year with a deficit above 4 percent of GDP — a significant milestone that has only occurred once before, during World War II and its aftermath.

Such high and sustained deficits are particularly unusual during a time when the economy is strong; this trajectory would have a negative impact on future economic growth. Over the past 50 years, when unemployment was below 6 percent, the average budget deficit was 1.7 percent of GDP. The average projected deficit for 2021 to 2030 is 3 percentage points higher than that, despite CBO’s projection of a rate of unemployment in those years that would average less than 5 percent.

The National Debt Will Reach Historically High Levels

CBO projects that federal debt will reach 98 percent of GDP in 2030. Debt as a percentage of GDP has not reached that level since immediately after World War II. However, unlike that period and other instances of high debt, the budget outlook today is not being driven by temporary factors. The current trajectory is much more worrisome because projections show sustained increases in deficits and debt for the foreseeable future, fueled by ongoing structural factors.

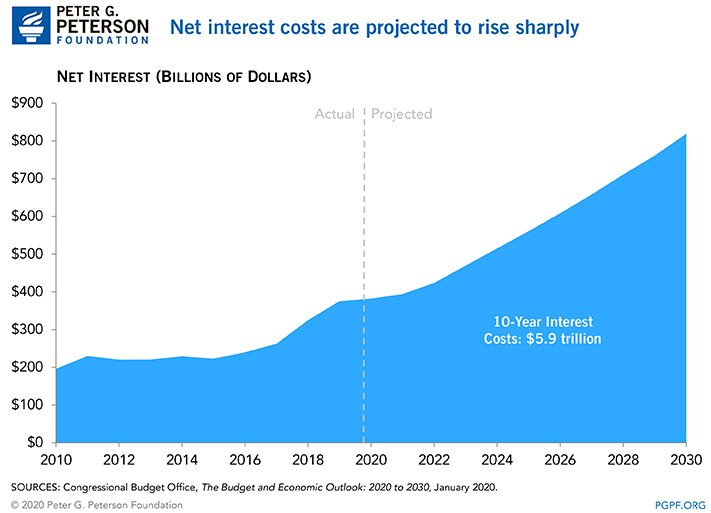

Interest Costs: The Fastest Growing Part of the Budget

As debt accumulates and interest rates increase, net interest costs — which already average $1 billion per day — are projected to more than double over the next decade, increasing from $382 billion in 2020 to $819 billion in 2030. In that year, interest costs will exceed the average amount spent over the last 50 years on investments such as infrastructure, education, and research and development. Despite the fact that interest rates are relatively low, our large and growing debt means that interest costs remain a significant factor in America’s deteriorating fiscal outlook.

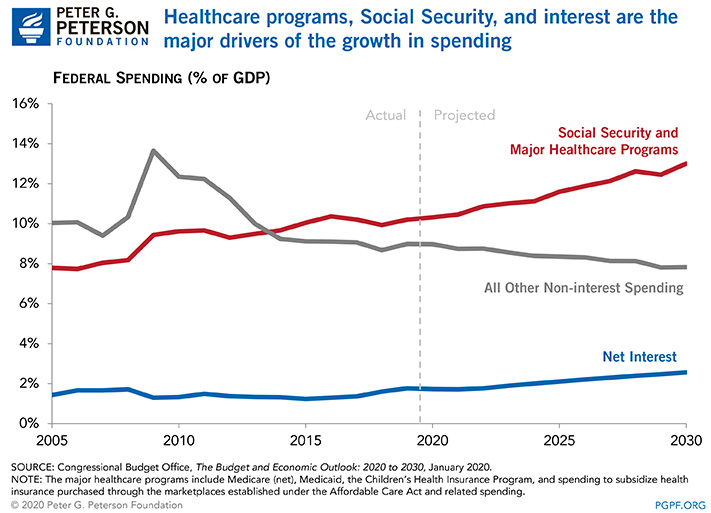

Social Security and Medicare Will Grow Relative to the Size of the Economy, While Spending Set by Annual Appropriations Will Shrink

Mandatory spending (excluding net interest) is projected to grow by approximately 70 percent from $2.9 trillion in 2020 to $4.9 trillion in 2030, driven by increases in two areas:

- Major Healthcare Programs: CBO projects that net spending on the major healthcare programs will climb from 5.4 percent of GDP in 2020 to 7.0 percent in 2030. That increase is mostly attributable to growth in Medicare spending — 7.5 percent per year, on average, over the next 10 years — which is driven by the aging of the population and rapid growth in healthcare costs.

- Social Security: Spending on Social Security, currently the largest federal program, is projected to grow at an average rate of 5.8 percent per year. That growth is primarily the result of the aging of the population and causes outlays for the program to rise from 4.9 percent of GDP in 2020 to 6.0 percent in 2030.

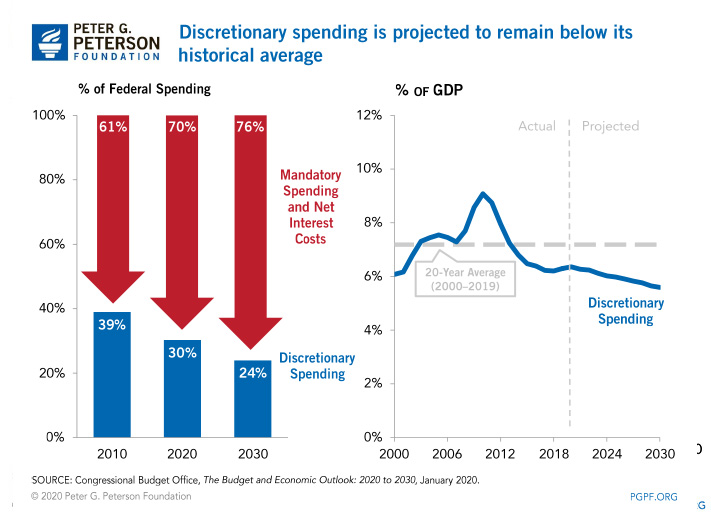

CBO estimates that federal outlays for discretionary programs (those set by annual appropriations) will equal 6.4 percent of GDP in 2020. Over the subsequent decade, though, such outlays are projected to grow more slowly than the economy; by 2030, discretionary outlays would decrease to 5.6 percent of GDP. That level of discretionary spending would be lower than any recorded year in history — and considerably lower than its average of 7.2 percent of GDP over the past 20 years. Spending in this category includes many of the programs in the federal budget that are considered investment — such as infrastructure, education, and research and development — and which already constitute a very small portion of the budget.

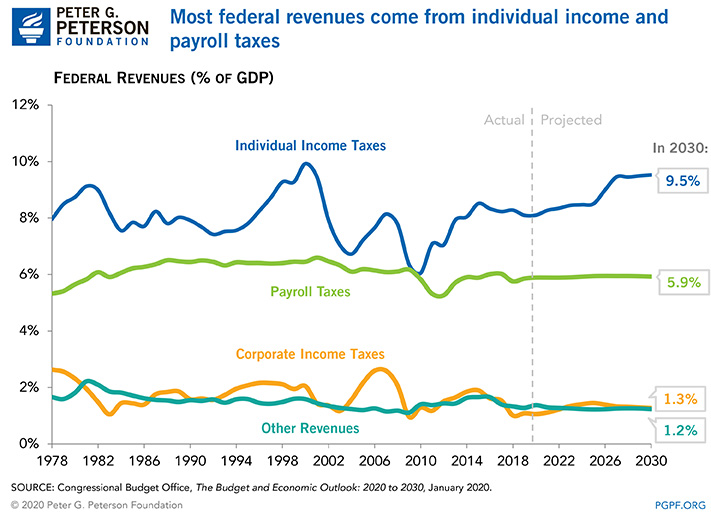

Revenues will Grow Modestly

Revenues are projected to rise from 16.4 percent of GDP in 2020 to 18.0 percent of GDP in 2030. That increase is primarily driven by individual income taxes, which grow from 8.1 percent to 9.5 percent of GDP over that period. All other revenue sources, combined, remain essentially flat. Such modest revenue growth relies on a major assumption: that the temporary tax cuts enacted by 2017 tax legislation will expire as scheduled in 2025. If instead lawmakers choose to extend those cuts, revenue growth from 2025 to 2030 would be considerably lower than currently projected. Regardless, this level of revenues is not nearly sufficient to fund the promises that we have made to our citizens.

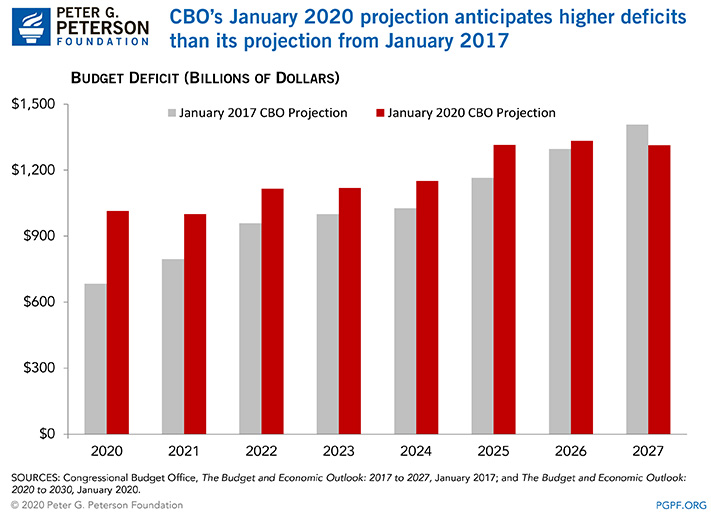

Deteriorating Fiscal Outlook Reflects Recent Legislation

In January 2017, CBO projected that deficits would total $8.34 trillion over the 2020 to 2027 period. CBO’s latest projections now show a cumulative deficit of $9.36 trillion during that period. That increase of $1.02 trillion (12 percent) is mainly due to legislation that has been enacted over the past 3 years.

In December 2017, the Tax Cuts and Jobs Act (TCJA) was enacted, which reduced revenues by cutting taxes for individuals and corporations. Then, in 2018 and 2019, lawmakers enacted legislation that led CBO to substantially increase its projections of discretionary spending. And in late 2019, the repeal of three excise taxes related to healthcare caused another significant reduction in projected revenues. Other factors partially offset the effects of those legislative changes. The largest among them were changes to CBO’s economic forecast, which led to increased projections of revenues and reduced estimates of net interest. However, those offsetting factors were not nearly enough to prevent the deficit projections from increasing overall.

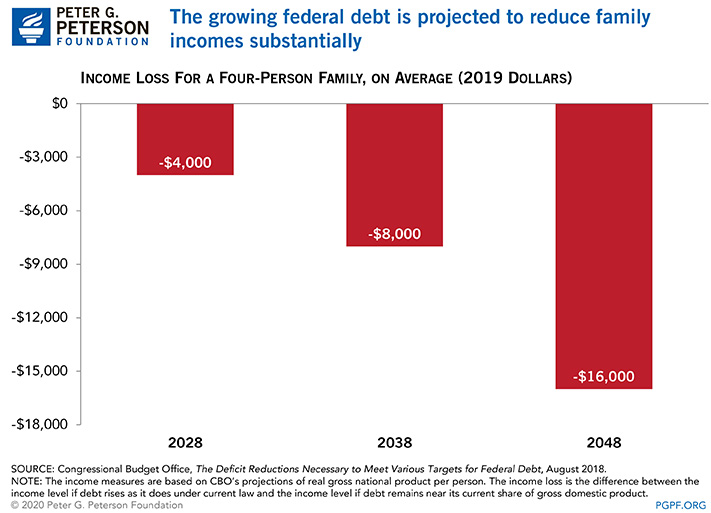

Consequences of Rising Federal Debt

CBO points out the significant negative effects on the economy from our rising debt. First, it would lead to reduced economic output — rising debt restrains economic growth because there is less capital to invest in our future, which would lead to lower productivity. Previous data provided by CBO indicate that incomes would be reduced in the future as a result of high and rising debt. Second, increased interest payments on the debt paid to foreign investors also reduce income for U.S. households over time. Third, high debt can create obstacles for policymakers as they attempt to use fiscal policy to address pressing issues, such as responding to an economic downturn or increasing military activity to counter a foreign threat.

Now Is the Time for Policymakers to Act

CBO’s latest projections show that the nation remains on an unsustainable fiscal path. Absent actions by policymakers to implement solutions, our national debt will grow in coming years to exceed the size of the entire economy. In addition, interest costs will grow rapidly and crowd out important national priorities.

The good news is that we can reform our budget to put the nation on a much more stable fiscal path, which will improve the future of our economy. By getting our fiscal house in order we can create the conditions that encourage economic growth, enhance business and consumer confidence, and build a prosperous future. Policymakers should correct past policy failures by enacting sensible reforms that put our nation on a sustainable fiscal path — and the sooner they act, the better.