You are here

Federal Deficit and Debt: September 2020

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for September 2020, which was the final month of fiscal year (FY) 2020. Therefore, it also allows for an analysis of full-year data on the deficit, spending, and revenues.

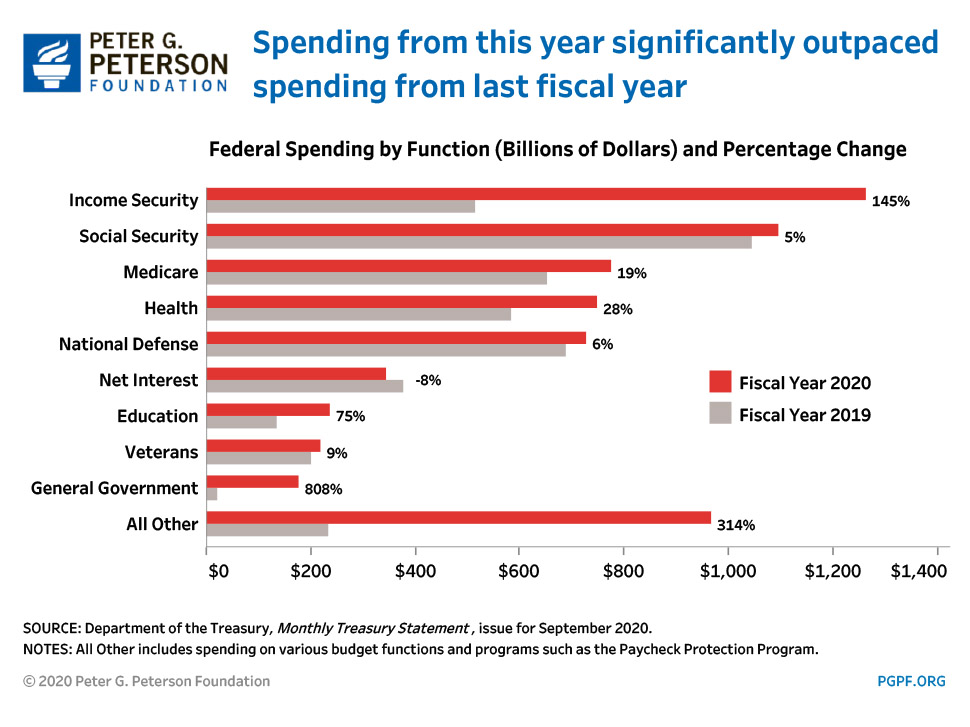

During FY20, lawmakers enacted major legislation in response to the coronavirus (COVID-19) pandemic. The budgetary effects of that legislation are incorporated in the numbers presented below.

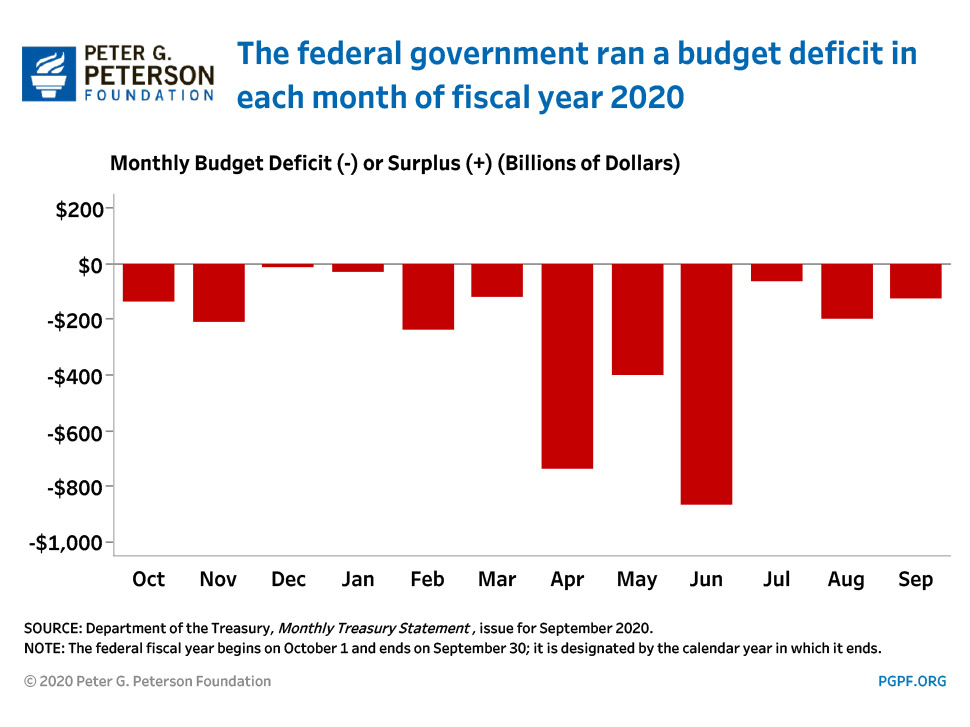

Current Federal Deficit

- Federal Budget Deficit for September 2020: $125 billion

- Federal Budget Surplus for September 2019: $83 billion

The deficit for September 2020 is in contrast to the surplus from September 2019 and every September since 2011. September 2019 was affected by shifts in the timing of certain federal payments into August because September 1st fell on a weekend. Without those shifts, the September 2019 surplus would have been just $31 billion, and the difference between the September 2020 deficit and the September 2019 surplus would have been $52 billion smaller.

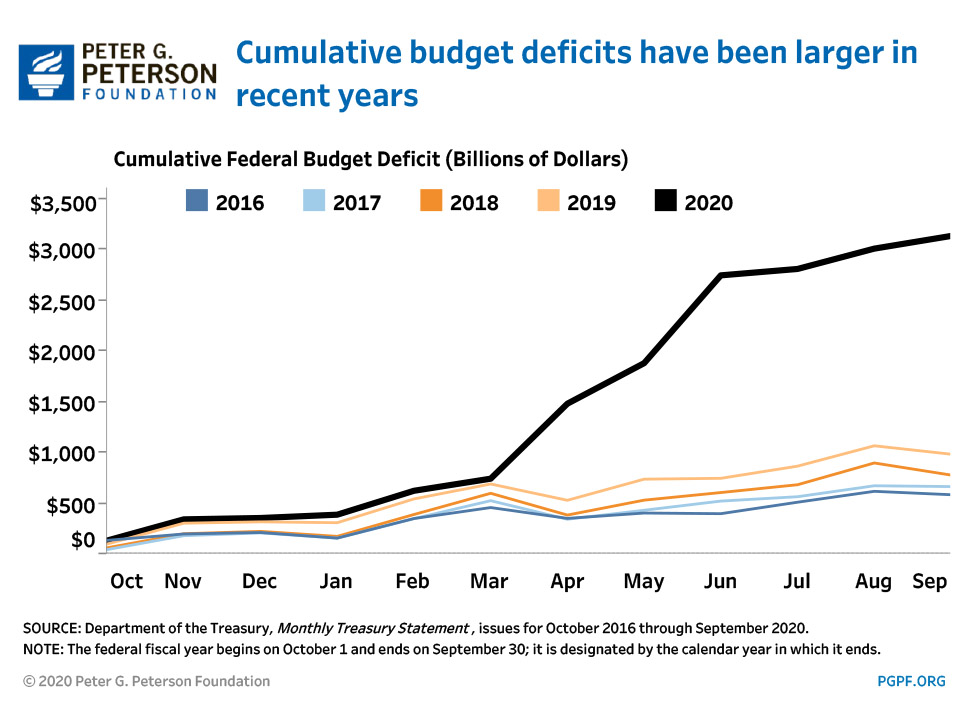

Cumulative Federal Deficit

- Cumulative FY20 Deficit: $3,132 billion

- Cumulative FY19 Deficit: $984 billion

Looking at full-year data, the cumulative FY20 deficit was $2,148 billion larger than the cumulative FY19 deficit. Relative to the size of the economy, the FY20 deficit was the largest recorded since 1945.

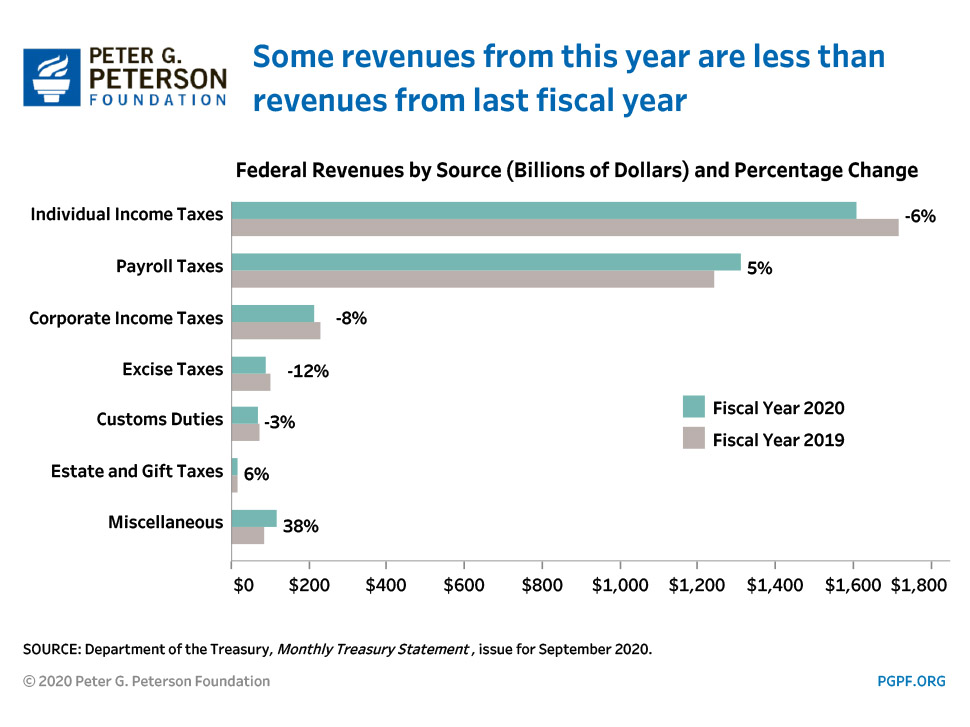

That substantial increase in the deficit is due to the COVID-19 pandemic and the legislative response to mitigate its economic damage. In FY20, outlays were $2,105 billion larger than they were in FY19, and revenues were $42 billion lower.

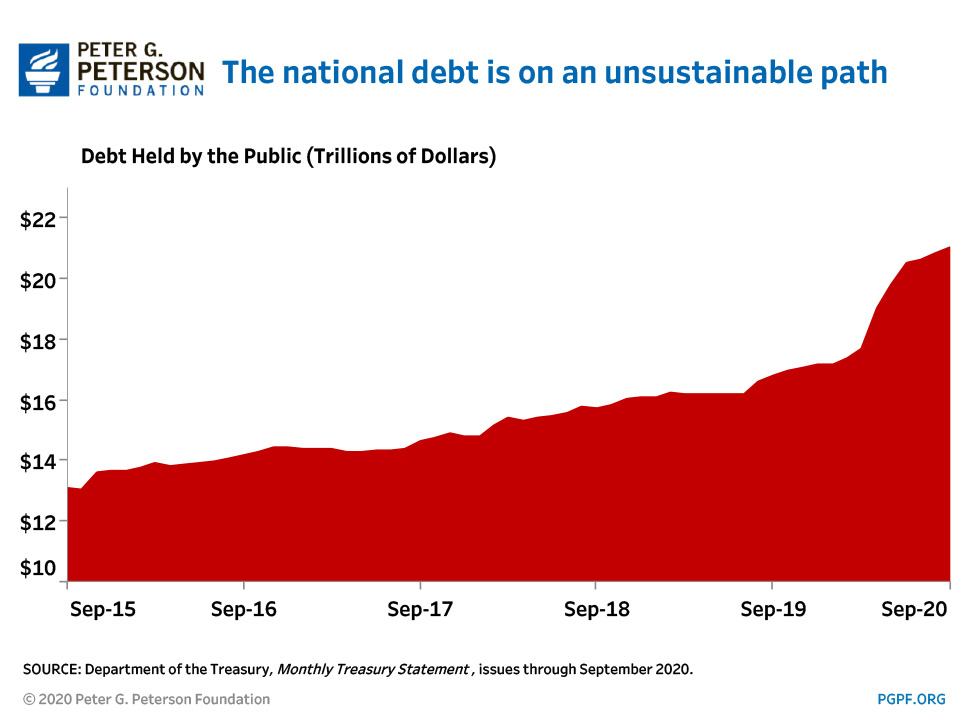

National Debt

- Debt Held by the Public at the end of September 2020: $21.0 trillion

- Debt Held by the Public through September 2019: $16.8 trillion

The deficit varies from month to month and some months may even record a surplus — for example, when taxpayers are submitting their personal income taxes at the filing deadline. The recent increase in debt reflects the effects of the pandemic and the government’s decision to support those who were harmed by the closure of much of our economy to prevent the spread of COVID-19. Eventually, once the situation has stabilized, focus needs to return to the country’s underlying fiscal situation.