You are here

Federal Deficit and Debt: July 2023

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for July 2023, which was the tenth month of fiscal year (FY) 2023.

Current Federal Deficit

- Federal Budget Deficit for July 2023: $221 billion

- Federal Budget Deficit for July 2022: $211 billion

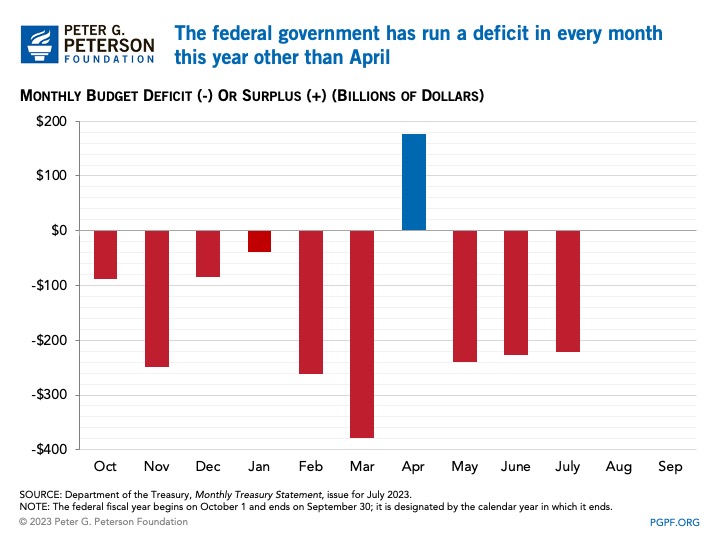

The federal government ran a deficit of $221 billion in July 2023, a $10 billion increase from the deficit of $211 billion that was recorded in July 2022. However, because July 1, 2023, fell on a weekend, certain payments that would have occurred that month were shifted into June. Excluding the effect of that shift, the deficit would have been $308 billion in July 2023, and the year-over-year difference would have been a $97 billion increase.

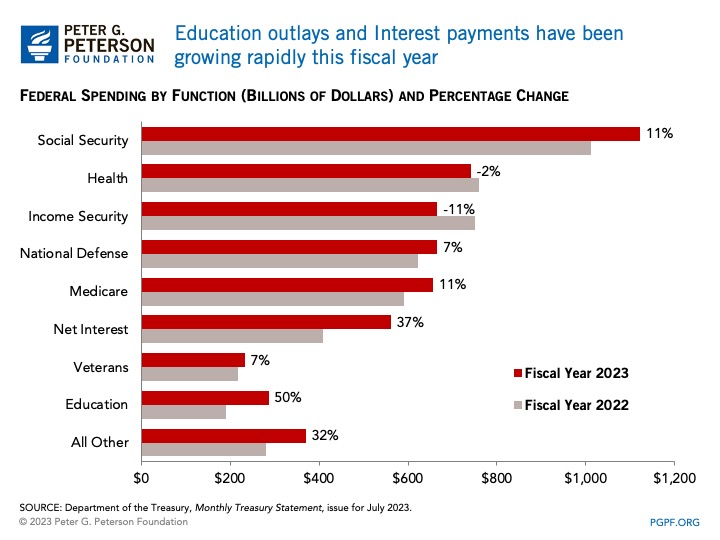

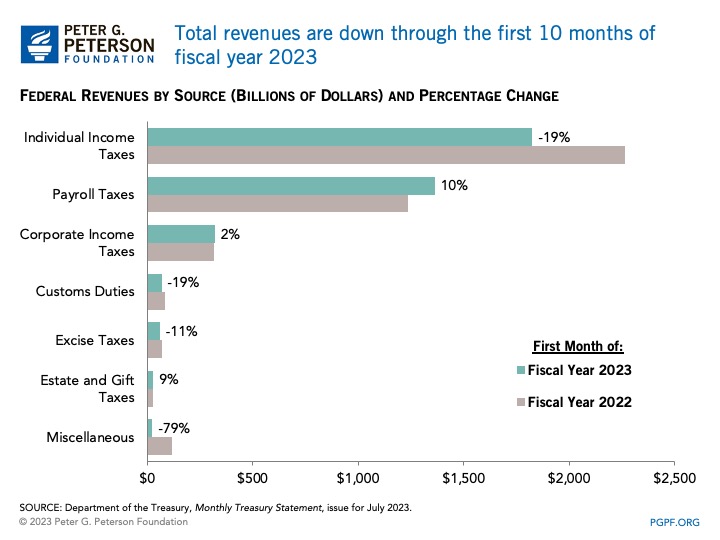

Spending in July 2023 was up by $17 billion, and revenues in July 2023 were up by $7 billion relative to the previous year. However, adjusting for the timing shift, spending was higher by $104 billion. The largest increase occurred for the Department of Education ($73 billion), primarily attributable to the recording of costs associated with modifying outstanding student loans under the Administration’s new income-driven repayment plan. Other categories that saw spending increase by more than $10 billion were Medicare ($13 billion), interest on the public debt ($12 billion), and Social Security ($12 billion). Changes in revenues were relatively small in July relative to a year ago--individual income and payroll taxes increased by $14 billion, net of refunds; that amount was partially offset by a $6 billion decline in excise tax revenues.

Cumulative Federal Deficit

- Cumulative FY23 Deficit: $1.6 trillion

- Cumulative FY22 Deficit: $0.7 trillion

This year’s cumulative deficit is more than twice the size of the deficit through July last year—$887 billion above last year’s level. However, because October 1 fell on a weekend in 2022, certain federal payments were shifted into September (the previous fiscal year), leading to a $63 billion decrease in outlays for this fiscal year. Without those effects, the deficit for FY23 to date would be $950 billion above last year’s corresponding total.

For the first 10 months of FY23, total outlays were $5.3 trillion, $471 billion higher than the same period in the previous year (not adjusting for timing shifts). The largest categories of growth in outlays were for interest payments ($152 billion larger in 2023), higher spending for Social Security ($111 billion) and the Department of Education ($96 billion), and a reduction in receipts from the auction of licenses to use the electromagnetic spectrum (which are recorded as offsets to spending and are down by $81 billion). Partially offsetting those increases were the expiration of advance payments for the child tax credit (which were recorded as outlays) and spending on pandemic relief programs for state, local, tribal, and territorial governments and public health.

Through the first 10 months of FY23, total revenues have decreased by $416 billion compared to the previous year. The largest decreases were in individual income taxes, which fell by $438 billion, and remittances from the Federal Reserve, which were down by $98 billion. Partially offsetting those effects was a $129 billion increase in payroll taxes.

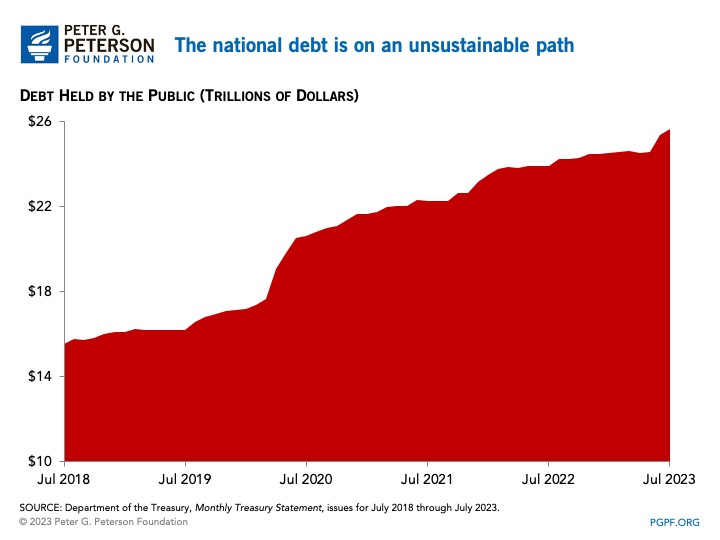

National Debt

- Debt Held by the Public at the end of July 2023: $25.6 trillion

- Debt Held by the Public at the end of July 2022: $23.9 trillion

Since the financial crisis in 2008, debt held by the public has nearly tripled relative to the size of the economy and is projected to grow even more in the future. Debt and deficits are on an unsustainable upward trajectory. With the new Congress officially in session, legislators are encouraged to work with the Biden Administration to create bipartisan solutions to improve the country’s fiscal outlook.