You are here

Federal Deficit and Debt: September 2022

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for September 2022, which was the final month of fiscal year (FY) 2022.

Current Federal Deficit

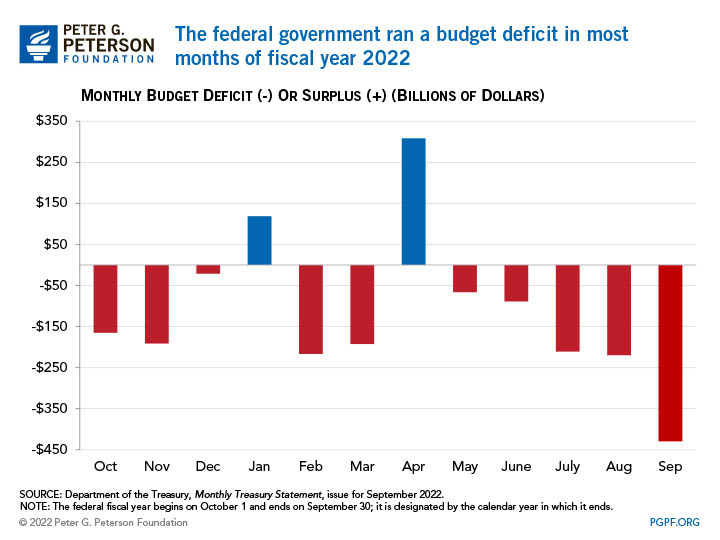

- Federal Budget Deficit for September 2022: $430 billion

- Federal Budget Deficit for September 2021: $65 billion

The federal government ran a deficit of $430 billion in September 2022, $368 billion higher than the deficit of $65 billion that was recorded in September 2021. That increase — which includes an enormous adjustment related to student loans — reflects outlays that were $396 billion higher in September 2022 than they were in the same month last year, partially offset by revenues that were $28 billion higher.

Because October 1 fell on a weekend in 2022, certain federal payments were shifted forward into September, leading to increased outlays for that month. Without such shifts, the deficit for September 2022 would have been $65 billion smaller.

Cumulative Federal Deficit

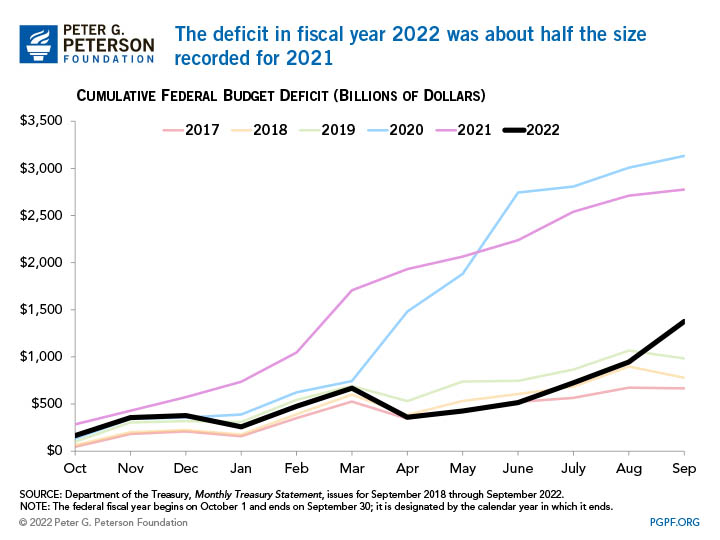

- Cumulative FY22 Deficit Through September 2022: $1,375 billion

- Cumulative Budget Deficit Over Same Period in FY21: $2,776 billion

The cumulative deficit for FY22 was $1,375 billion, around half the size recorded in the previous year. That change is comprised of an $850 billion increase in revenues and a $550 billion decrease in outlays.

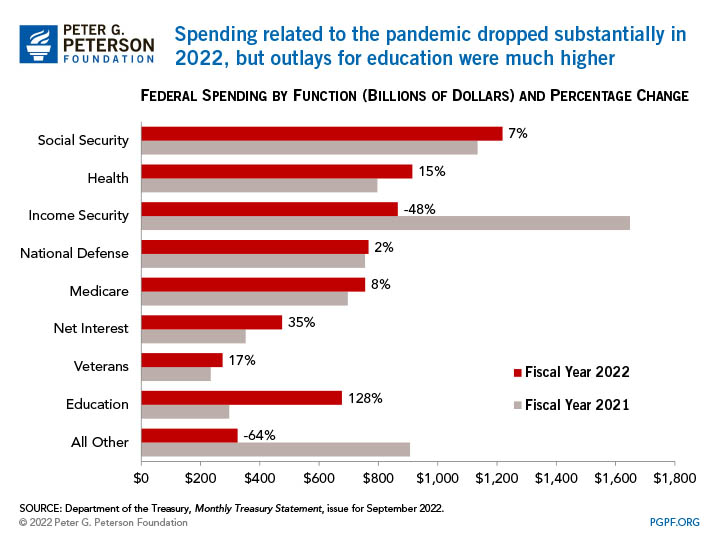

The large decrease in outlays results from the waning federal response to the COVID-19 pandemic. The lack of recovery rebates for FY22, compared to two separate rounds of such payments during FY21, and the expiration of enhanced unemployment benefits and the Paycheck Protection Program, account for a sizeable portion of the decline in outlays. That decrease is partially offset, however, by the long-term cost of student loan forgiveness, which the Administration calculates will increase outlays by $379 billion (and was recorded in September 2022). Net interest on public debt also increased by $123 billion, year over year, primarily due to adjustments stemming from high inflation and rising interest rates.

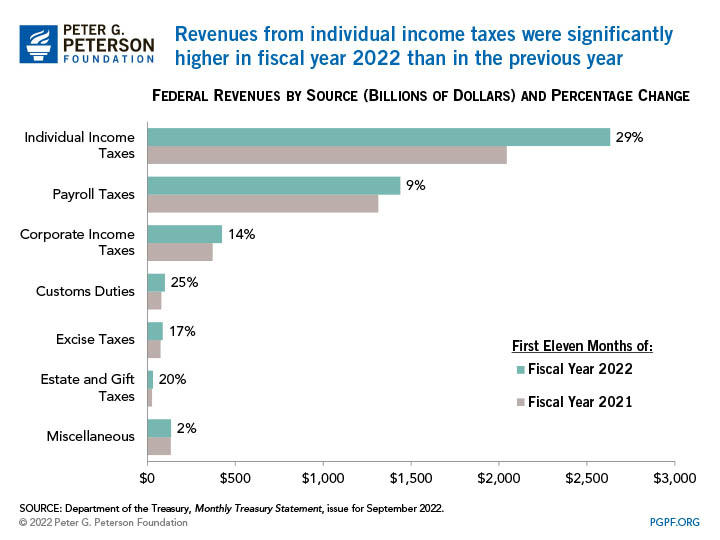

Higher collections of individual income and payroll taxes accounted for the vast majority of the increase in revenues during FY22. That development is due in part to higher wages and salaries that have led to increased tax withholding, especially among workers with relatively high incomes. In addition, pandemic-related legislation allowed for deferral of certain payroll tax payments into the early months of FY22.

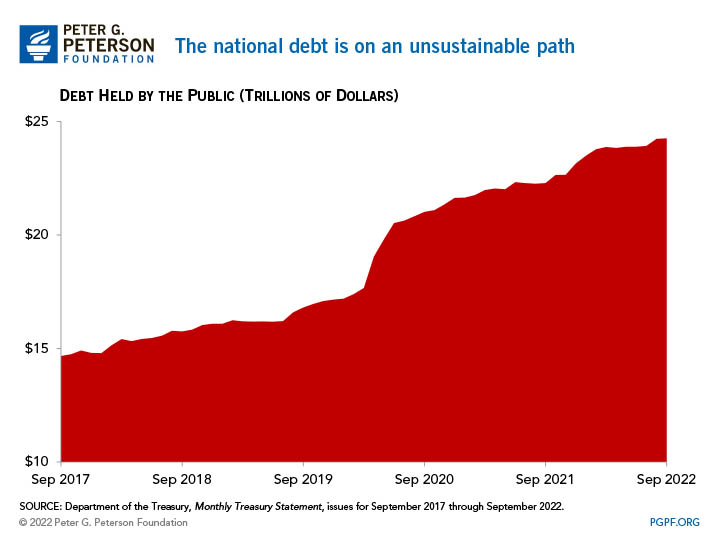

National Debt

- Debt Held by the Public at the end of September 2022: $24.3 trillion

- Debt Held by the Public at the end of September 2021: $22.3 trillion

Since the onset of the COVID-19 pandemic, debt held by the public has increased by 37 percent, and is projected to grow significantly in the future. Now that the worst of the COVID-19 pandemic is behind us, it is time to chart a comprehensive path to a sustainable fiscal future.