You are here

Federal Deficit and Debt: June 2022

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for June 2022, which was the ninth month of fiscal year (FY) 2022.

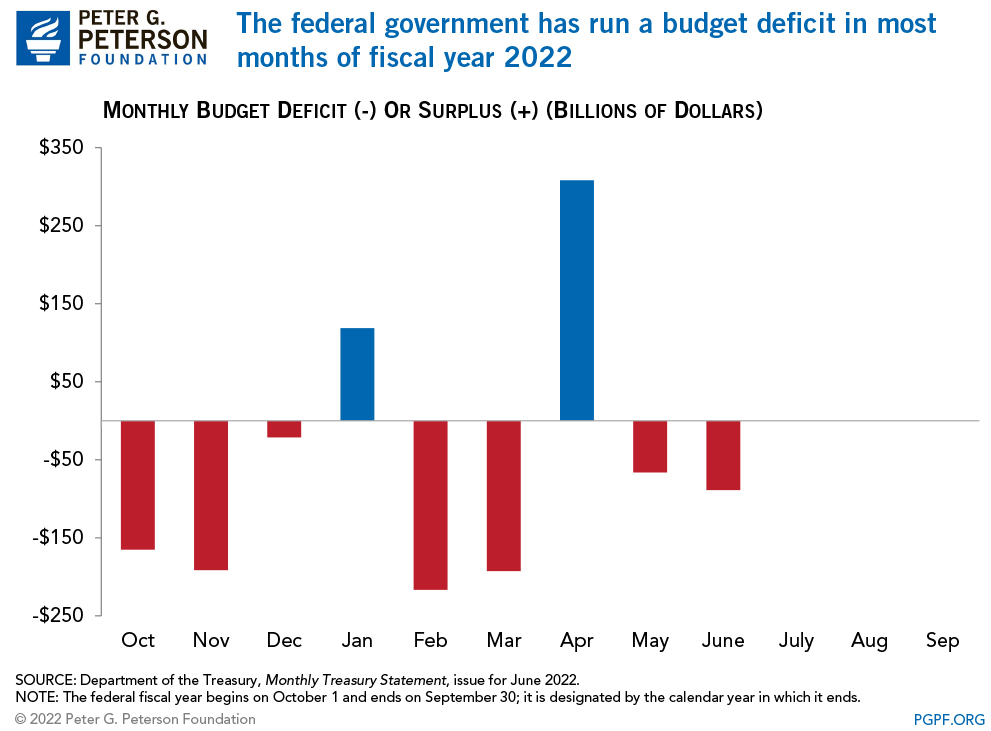

Current Federal Deficit

- Federal Budget Deficit for June 2022: $89 billion

- Federal Budget Deficit for June 2021: $174 billion

The federal government ran a deficit of $89 billion in June 2022, an improvement of $85 billion from the deficit of $174 billion that was recorded in June 2021. That improvement was reflected in outlays that were $74 billion lower in June 2022 than they were in the same month last year, and revenues that were $12 billion higher. The decrease in outlays was primarily due to lower spending on programs related to the federal government’s response to the COVID-19 pandemic.

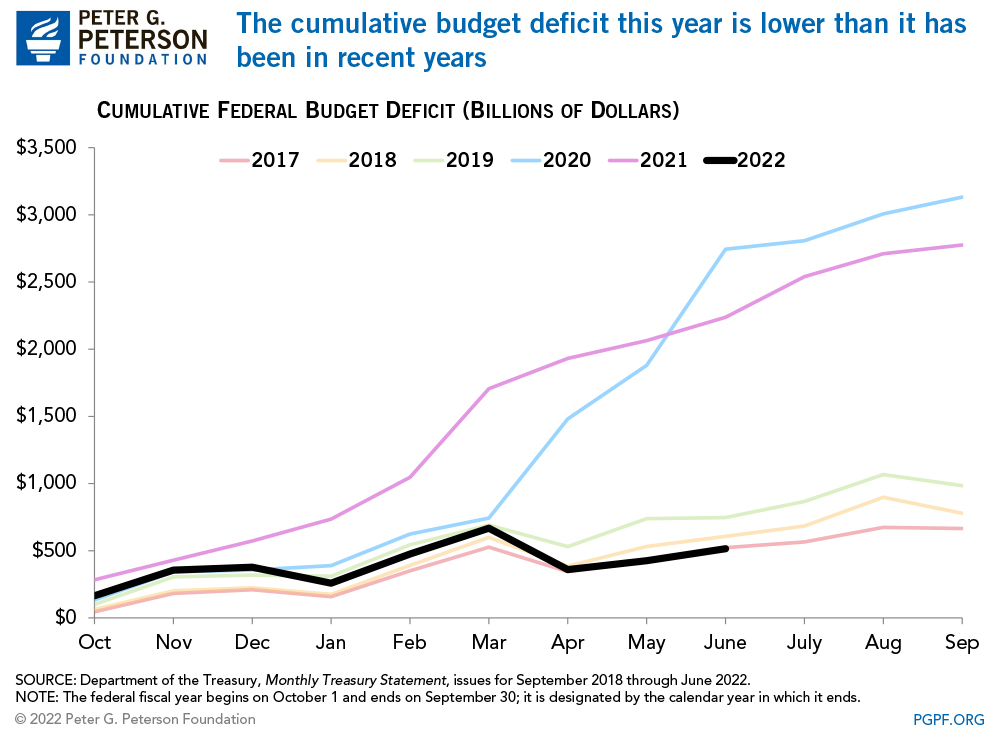

Cumulative Federal Deficit

- Cumulative FY22 Deficit Through June 2022: $515 billion

- Cumulative Budget Deficit Over Same Period in FY21: $2,238 billion

The cumulative deficit for the first nine months of FY22 was $1,723 billion (or around 75 percent) lower than it was through the first nine months of FY21, reflecting a $944 billion decrease in outlays and a $779 billion increase in revenues.

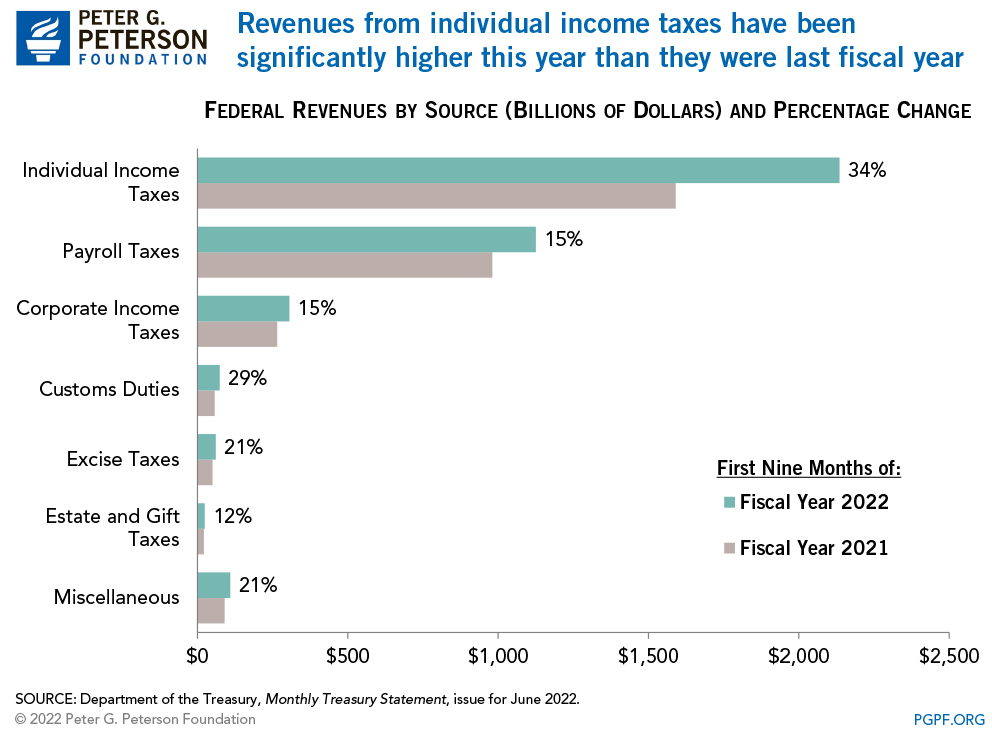

The increase in revenues was due mostly to stronger economic growth, leading in turn to larger collections of individual income, payroll, and corporate income taxes. In addition, payroll tax collections were boosted in FY22 due to a deferral of payment from FY21 that was enacted as part of the response to the COVID-19 pandemic. In May, CBO estimated that total revenue collections in FY22 would total $4.8 trillion — a year-over-year increase of 19 percent.

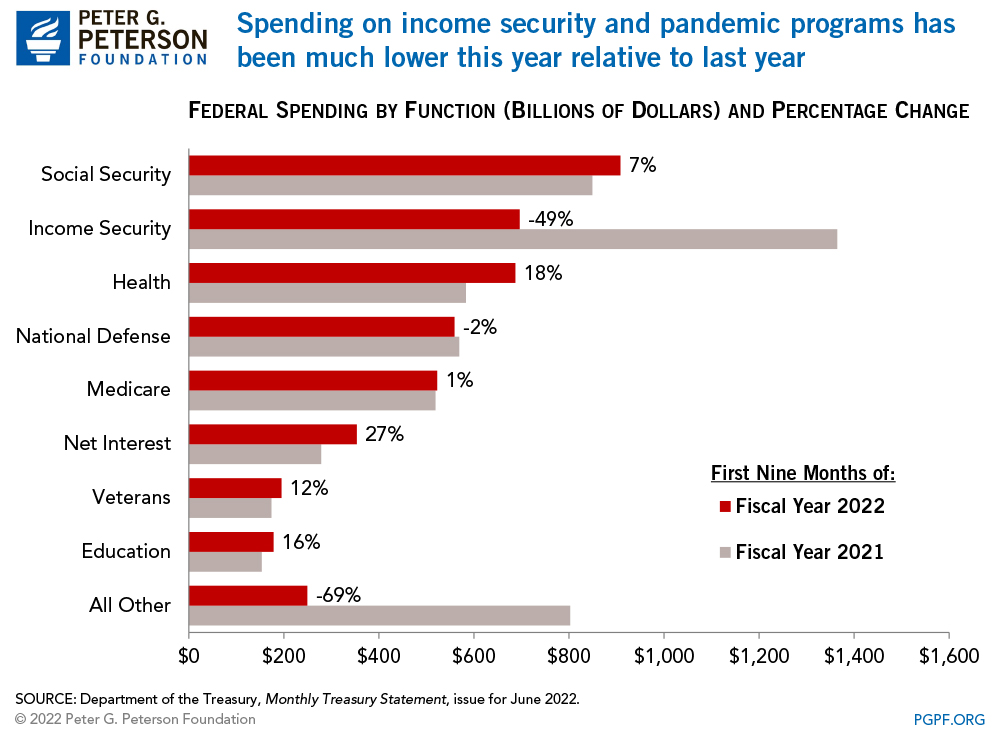

Meanwhile, the large decrease in outlays results from the waning federal response to the COVID-19 pandemic. The lack of recovery rebates in the first nine months of FY22, compared to two separate rounds of such payments during the first nine months of FY21, accounts for 45 percent of the decline in outlays between the two years. Lower spending on programs administered by the Small Business Administration and unemployment compensation also account for a significant share of the difference. CBO’s most recent estimate for outlays in FY22 was $5.9 trillion, which would be a year-over-year decrease of 14 percent.

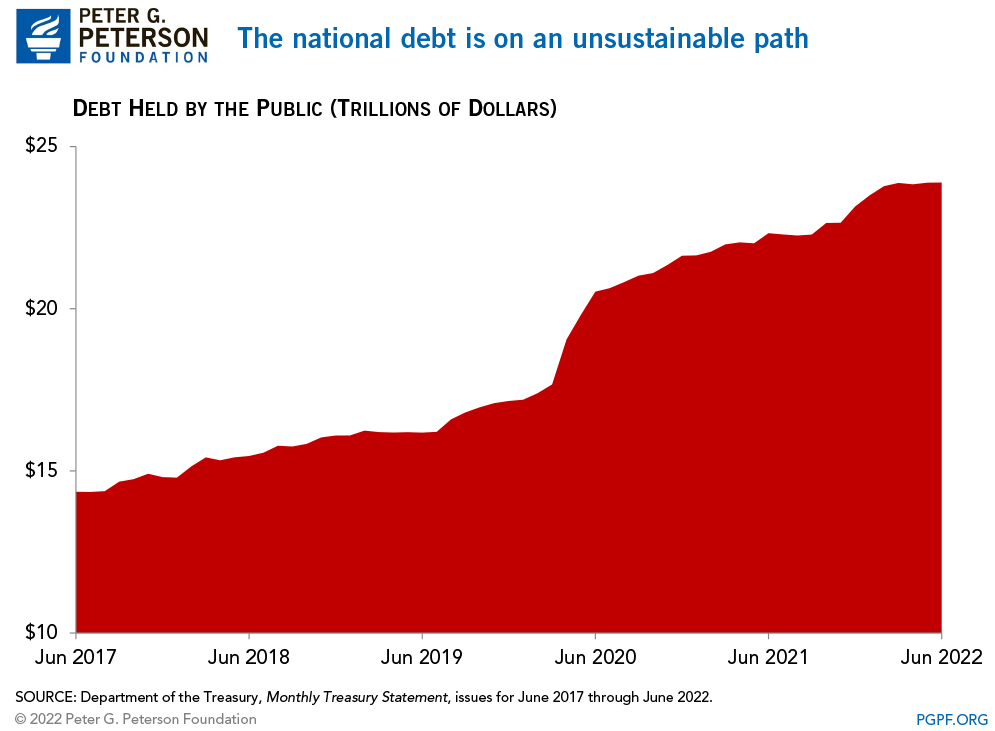

National Debt

- Debt Held by the Public at the end of June 2022: $23.9 trillion

- Debt Held by the Public at the end of June 2021: $22.3 trillion

Since the onset of the COVID-19 pandemic, debt held by the public has increased by 35 percent, and is projected to grow significantly in the future. Now that the worst of the COVID-19 pandemic is behind us, it is time to chart a comprehensive path to a sustainable fiscal future.