You are here

Federal Deficit and Debt: July 2021

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for July 2021, which is the tenth month of fiscal year (FY) 2021.

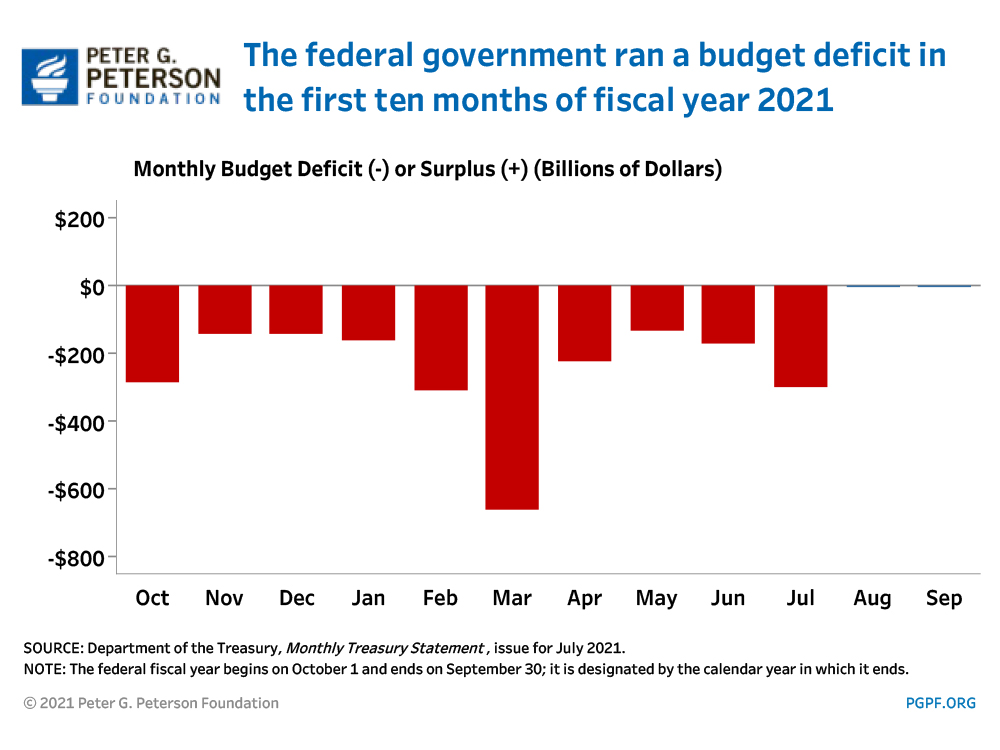

Current Federal Deficit

- Federal Budget Deficit for July 2021: $302 billion

- Federal Budget Deficit for July 2020: $63 billion

The deficit for July 2021 was $239 billion larger than the deficit recorded in July 2020. In both years, certain federal payments were shifted into July because August 1 fell on a weekend. Without those shifts, the deficit for July 2021 would have been $235 billion larger than the deficit for July 2020.

That increase in the deficit is largely due to a change last year in the filing deadlines for individual and corporate income taxes. Revenues were $301 billion lower in July 2021 than they were in July 2020 because those deadlines were extended to July last year, but occurred earlier this year.

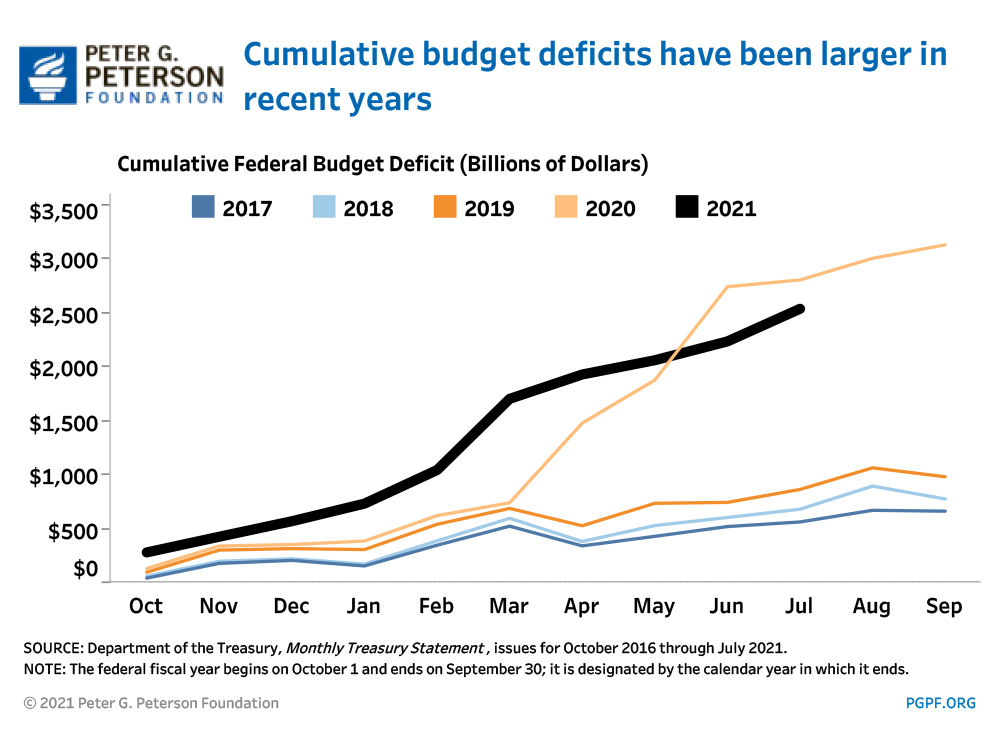

Cumulative Federal Deficit

- Cumulative FY21 Deficit Through July 2021: $2,540 billion

- Cumulative Budget Deficit Over Same Period in FY20: $2,807 billion

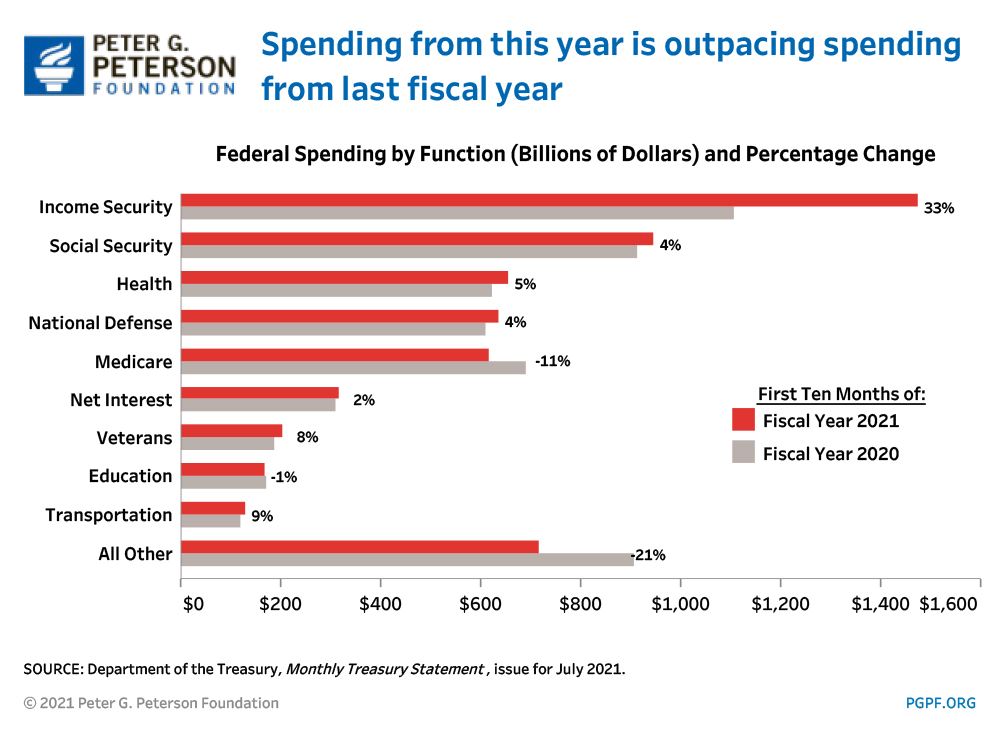

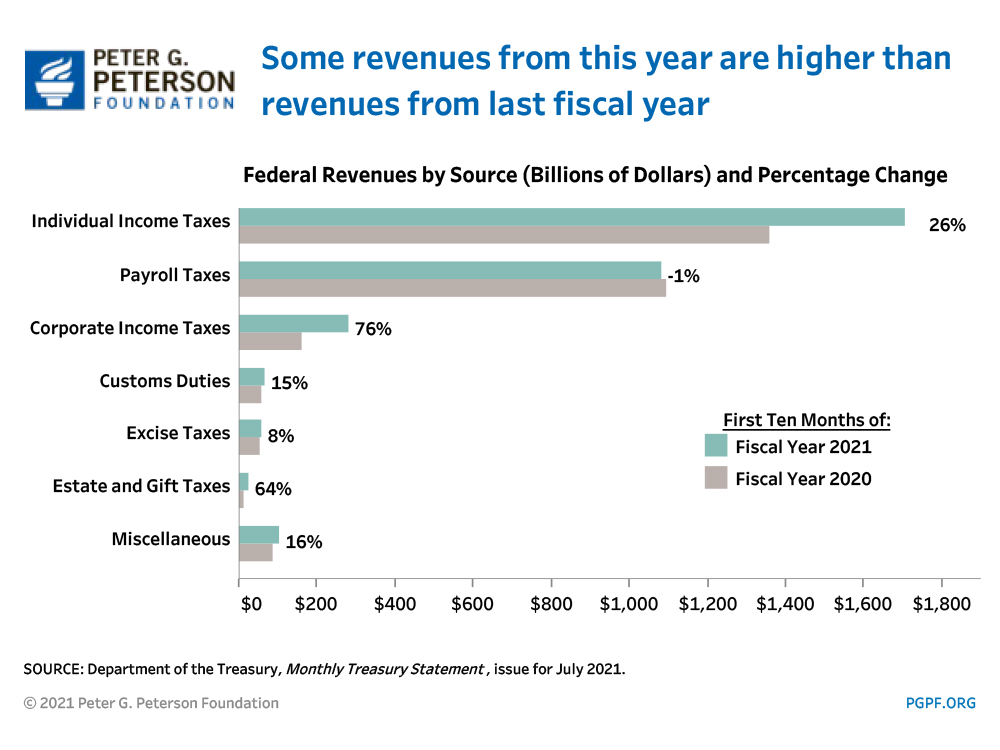

The cumulative deficit for the first 10 months of FY21 was $267 billion smaller than it was through the same period in FY20. The decrease in the cumulative deficit reflects growth in revenues this year of $495 billion that was partially offset by a $227 billion increase in spending.

The substantial growth in revenues was driven by the general strength of the economy over the past year, which has led to increases in individual and corporate income tax receipts. Outlays also grew relative to last year, primarily as a result of the federal response to the pandemic, but by a smaller amount.

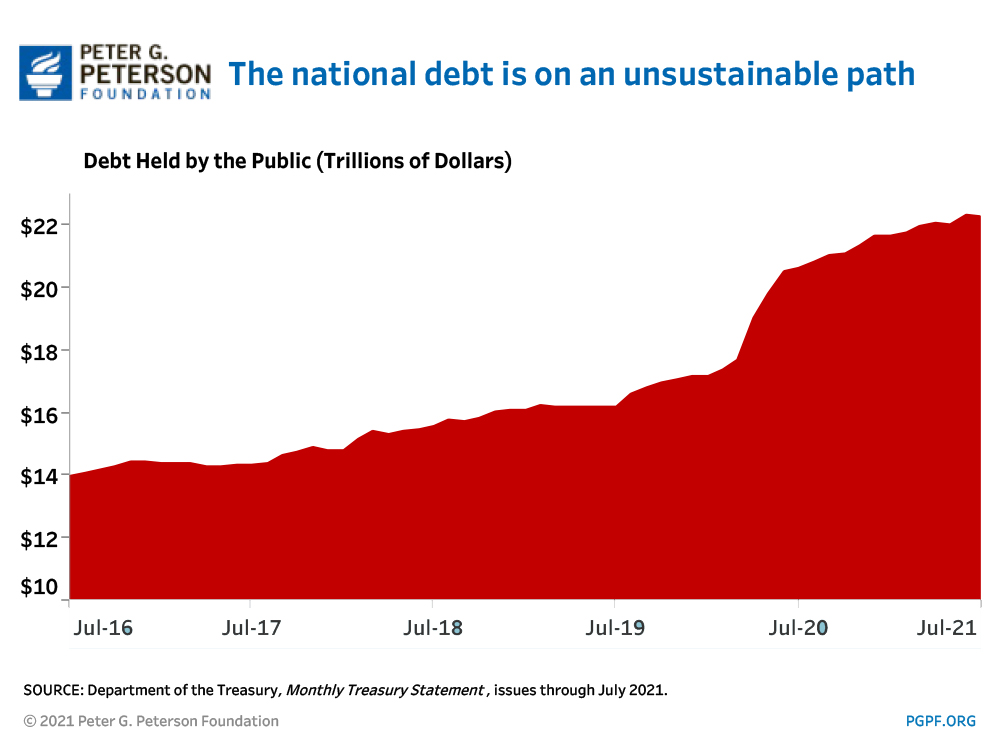

National Debt

- Debt Held by the Public at the end of July 2021: $22.3 trillion

- Debt Held by the Public at the end of July 2020: $20.6 trillion

The sizeable deficit in FY20, and so far in FY21, has pushed up the current amount of debt held by the public by more than 25 percent relative to its level from before the onset of the COVID-19 pandemic. As the situation stabilizes, policymakers should turn their focus to the country’s underlying fiscal situation.