You are here

Federal Deficit and Debt: September 2019

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for September 2019, which was the final month of fiscal year (FY) 2019. Therefore, it also allows for analysis of full-year data on the deficit, spending, and revenues.

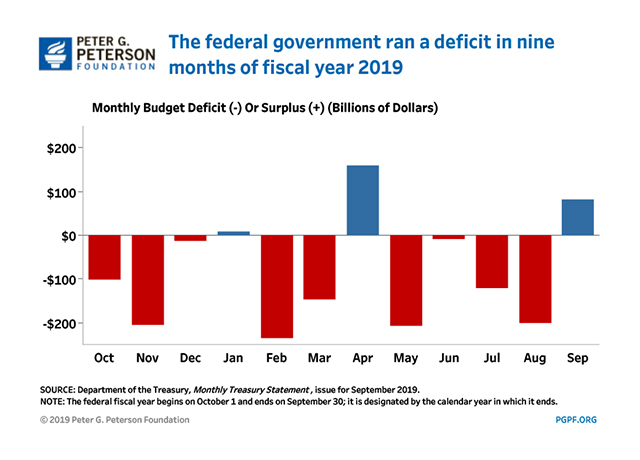

Current Federal Deficit

- Federal Budget Surplus for September 2019: $83 billion

- Federal Budget Surplus for September 2018: $119 billion

The surplus for September 2019 was $36 billion smaller than that recorded in September 2018. While outlays in both of those months were decreased by shifts in the timing of certain federal payments, the effect was larger in September 2018 than in September 2019. Without those shifts, the September 2019 surplus would have been $17 billion smaller than it was a year ago.

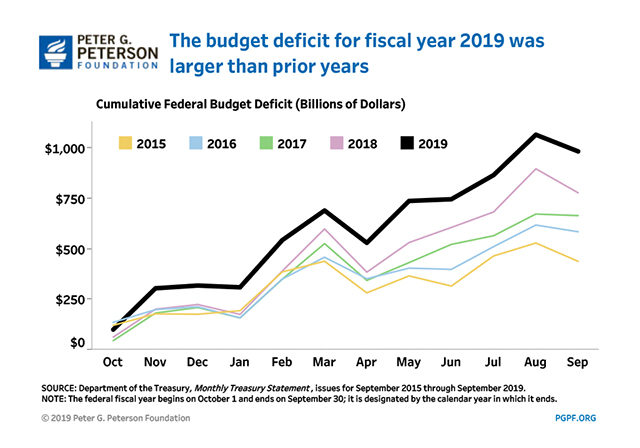

Cumulative Federal Deficit

- Cumulative FY19 Deficit: $984 billion

- Cumulative FY18 Deficit: $779 billion

Looking at full-year data, the cumulative FY19 deficit was $205 billion larger than the cumulative FY18 deficit. However, outlays in FY18 were decreased by a shift in the timing of federal payments into the previous fiscal year. If not for that shift, the cumulative FY19 deficit would have been $162 billion larger than the deficit recorded in the prior year.

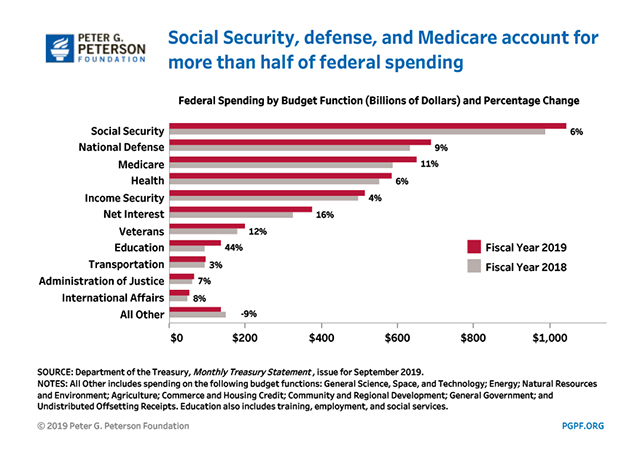

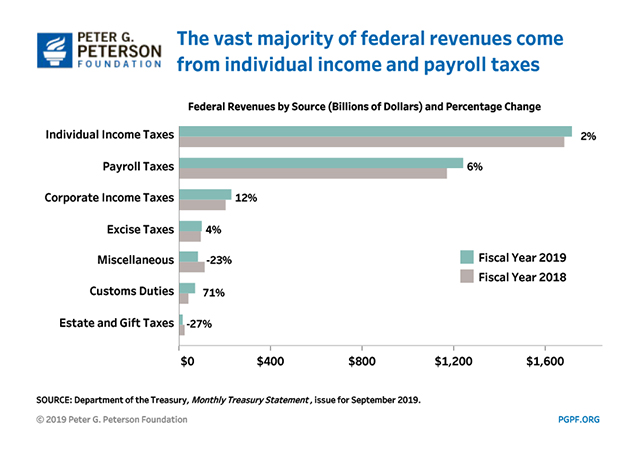

Both spending and revenues grew in FY19; however, outlays increased by 8 percent and revenues increased by just 4 percent. The charts below compare categories of spending and revenues for the past two years.

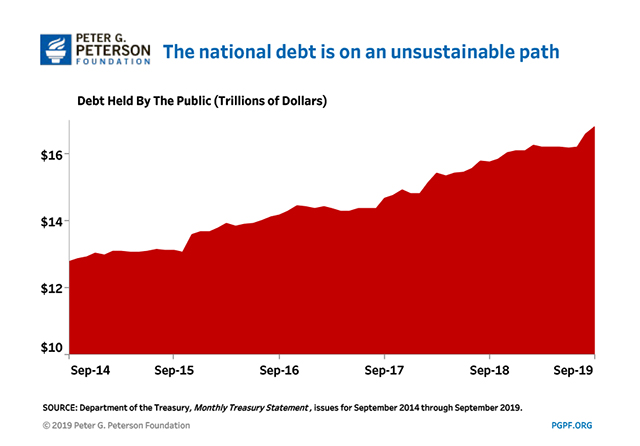

National Debt

- Debt Held by the Public through September 2019: $16.8 trillion

- Debt Held by the Public through September 2018: $15.8 trillion

While the deficit varies from month to month, and may even decline some months — for example, in April when taxpayers are submitting their personal income taxes — debt and deficits are on an unsustainable upward trajectory. The CBO projects that national debt could rise to about 140 percent of gross domestic product by 2049. That level of debt would far exceed the 50-year historical average of approximately 40% of GDP.

Why are such high levels of debt so concerning? There are many reasons that Americans should be concerned about the rising national debt — particularly if you are concerned about economic growth, investments in our nation’s future, and preservation of our social safety net.