You are here

Federal Deficit and Debt: April 2019

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for April 2019, which was the seventh month of fiscal year 2019.

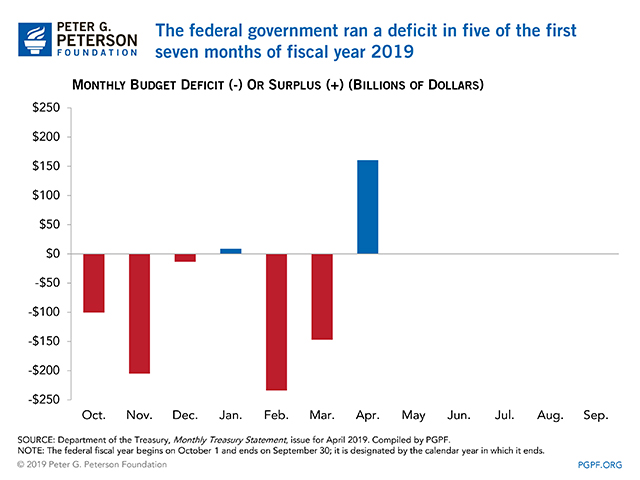

Current Federal Deficit

- Federal Budget Surplus for April 2019: $160 billion

- Federal Budget Surplus for April 2018: $214 billion

The surplus for April 2019 was $54 billion smaller than recorded in April 2018. However, outlays in April 2018 were decreased by shifts in the timing of certain federal payments. Without those shifts, the April 2019 surplus would have been $8 billion smaller than it was a year ago.

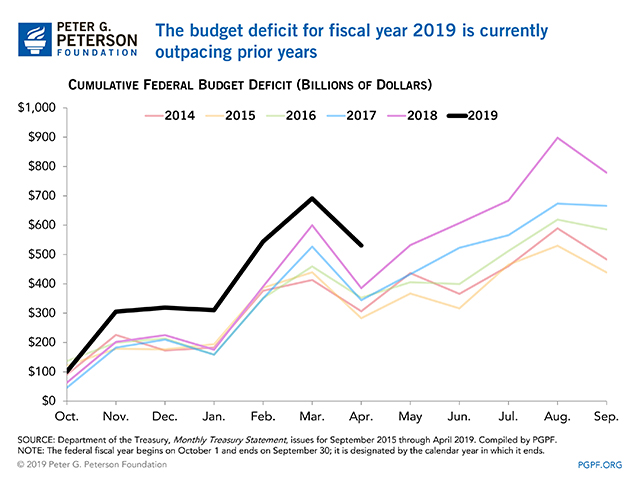

Cumulative Federal Deficit

- Cumulative FY19 Deficit through April 2019: $531 billion

- Cumulative Budget Deficit over Same Period in FY18: $385 billion

The cumulative deficit through the first seven months of FY19 was $145 billion larger than it was through the first seven months of FY18. However, because October 1, 2017 fell on a weekend, $44 billion of payments were shifted forward to September 2017, which reduced the deficit recorded for FY18. If not for that shift the deficit for the first seven months of FY18 would have been $429 billion and the deficit for the first seven months of FY19 would have increased by $102 billion.

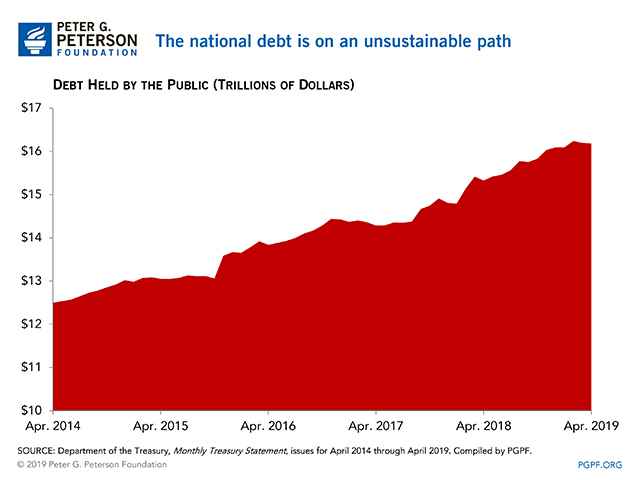

National Debt

- Debt Held by the Public through April 2019: $16.2 trillion

- Debt Held by the Public through April 2018: $15.3 trillion

While the deficit varies from month-to-month, and may even decline some months — for example, in April when taxpayers are submitting their personal income taxes — debt and deficits are on an unsustainable upward trajectory. The CBO projects that national debt could rise to about 150 percent of gross domestic product by 2048. That level of debt would far exceed the 50-year historical average of approximately 40% of GDP.

Why are such high-levels of debt so concerning? There are many reasons that Americans should be concerned about the rising national debt — particularly if you are concerned about economic growth, investments in our nation’s future, and preservation of our social safety net.