You are here

Why Is the Federal Deficit High if Unemployment Is Low?

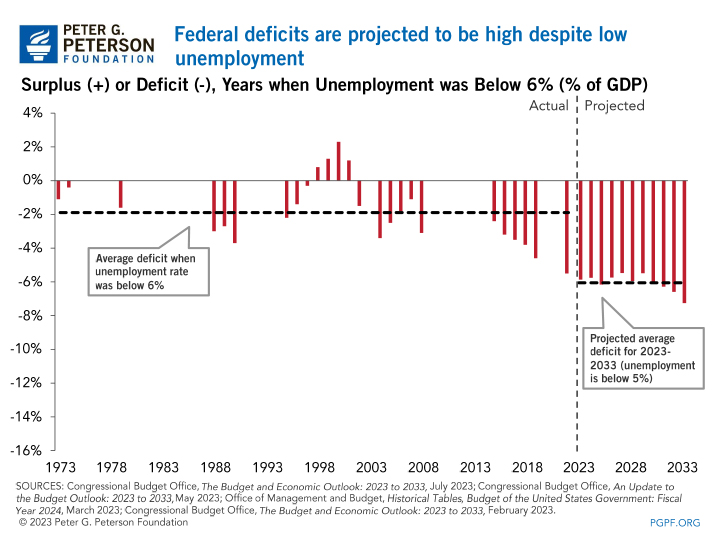

Currently, the United States is experiencing an unusual and concerning phenomenon — the annual deficit is high even though the unemployment rate is low.

A low unemployment rate usually signals a healthy economy, contributing to conditions that encourage lower deficits. When the unemployment rate is low, the federal government’s balance sheet benefits in two ways. First, more people are working so the federal government spends less money on relief programs known as automatic stabilizers, such as unemployment insurance, Medicaid, and Supplemental Nutrition Assistance Program. Second, the federal government collects more money from taxes due to higher payrolls. Lower spending on automatic stabilizers paired with higher revenues as more people are employed should generate lower deficits.

That relationship is not in effect today. In 2023, the unemployment rate averaged 3.6 percent, well below its 50-year average of 6.2 percent. However, the deficit last year was 6.3 percent of gross domestic product (GDP), significantly above its 50-year average of 3.7 percent. The average deficit when the unemployment rate was low (defined as below 6 percent) between 1970 and 2022 was 1.9 percent of GDP.

The high deficit in 2023, which is anticipated to grow in upcoming years, results in part from a structural imbalance between spending and revenues; that imbalance is driven by demographic factors, rising healthcare costs, higher interest rates on the growing debt, and insufficient revenues to cover promises that have been made. In addition, factors such as delayed payments from areas affected by natural disasters have reduced revenues. Furthermore, spending for programs such as deposit insurance was significantly higher in 2023, and proceeds from auctions of the electromagnetic spectrum did not occur last year (but brought in around $100 billion the year before).

Observers of the fiscal situation have highlighted the dangerous anomaly of running high federal deficits during a period of low unemployment. For example, referring to the $2 trillion deficit in fiscal year 2023, the Economist noted that “At a time of low unemployment, such borrowing is jaw-droppingly reckless.”

Ben Ritz, director of the Progressive Policy Institute’s Center for Funding America’s Future, writes, “The real federal budget deficit more than doubled in just the last year, from $933 billion to $2 trillion. Such a borrowing binge might be justified to combat an economic emergency like the COVID pandemic or the 2008 financial crisis. But our economy has experienced the most sustained period of low unemployment since the 1950s.”

In an opinion piece in Bloomberg, Matthew Yglesias states that reducing high federal deficits was in the political discussion a decade ago even though it was not urgent because, among other economic characteristics, the unemployment rate was high. Now, however, the unemployment rate is low yet there is no serious political discussion about cutting the deficit.

Jason Furman was quoted in the Washington Post as noting that “To see [high deficits] in an economy with low unemployment is truly stunning. There’s never been anything like it. A good and strong economy, with no new emergency spending — and yet a deficit like this. The fact that it is so big in one year makes you think it must be some weird freakish thing going on.”

As the old saying goes, the time to save for a rainy day is when the sun is shining. The fact that the deficit is growing at a time when it usually would recede should be a troubling warning sign to policymakers. Here is clear evidence that we need to take action on the structural imbalance built into our budget.

Related: Debt vs. Deficits: What's the Difference?

Image credit: Photo by Emily Elconin/Getty Images