You are here

Recent Economic Projections Show Higher Short-term Interest Rates than Previously Expected

The Congressional Budget Office (CBO) now expects short-term interest rates over the next two years to be higher than previously anticipated, according to new data released on July 26. The agency also anticipates that economic growth will be slower over the next few quarters. The forecasts for other major economic indicators, such as unemployment and inflation, were similar to the projections released in February 2023.

Changes to Interest Rate Projections

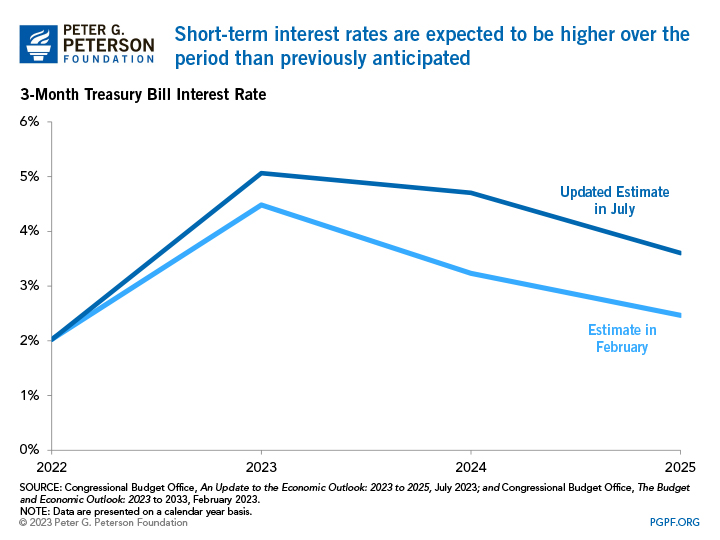

Earlier this year, CBO estimated that interest rates on 3-month Treasury bills would rise another half point through the first half of 2023 to around 4.7 percent and then begin to decline. They projected that the 3-month rate would fall to 2.3 percent by the end of 2025.

However, the Federal Reserve has increased the target Federal Funds rate by more than CBO anticipated in order to address inflationary pressures during the first half of this year. Because of those actions, CBO now expects that 3-month interest rates will peak at around 5.3 percent this year and only fall to 3.2 percent by the end of 2025, which would be nearly a full percentage point above the projection in February. Despite the upward revisions to short-term rates, CBO anticipates that 10-year Treasury rates will be generally similar to their earlier projections.

Changes to Economic Growth Projections

In its previous forecast, CBO projected that real (inflation-adjusted) gross domestic product (GDP) would grow by 0.1 percent from the fourth quarter of 2022 to the fourth quarter of 2023. That forecast assumed that the economy would quickly rebound, though, to 2.5 percent during late 2024 and early 2025 before reaching 2.6 percent by the end of 2025.

In CBO’s updated projections, growth in the fourth quarter of 2023 would rise by 0.9 percent relative to the year before. However, CBO now anticipates that economic growth will only climb slowly over the next several quarters and end up slightly lower — at 2.4 percent — by the end of 2025.

How Changes in Interest Rates and GDP Influence the Federal Budget

Fiscal health and economic strength are closely related, and CBO’s revised economic projections draw attention to the fiscal challenge in the United States.

As interest rates rise, so does government spending. Higher interest rates make it more expensive for the government to borrow money to fund its obligations. That leads to accumulation of more debt and the potential for crowding out investment in other government priorities to pay increasing interest costs. Unfortunately, interest is already the fastest-growing area of the government budget, and increases in interest rates only intensify that trend.

When expectations for GDP growth decrease, so do anticipated government revenues. CBO’s forecast for lower economic growth over the next couple of years means that revenues are likely to be lower than CBO previously projected as well.

CBO already projects that deficits will exceed $1.5 trillion this year and beyond. Higher interest rates and lower economic growth imply that deficits could be even larger than that. It is essential that policymakers prioritize solutions to solve the fiscal challenge and establish a sustainable path for the United States.

Related: Higher Interest Rates Will Raise Interests Costs on the National Debt

Image credit: Photo by Anna Moneymaker / Getty Images