You are here

Trustees: Funding Challenges Threaten Medicare’s Future

Medicare is an essential program that currently provides healthcare benefits to 60 million Americans. The program is on unsustainable financial footing, which threatens its ability to provide services in the future, according to the most recent annual report from the Medicare Trustees.

Medicare has a fundamental imbalance between spending and revenues, driven by America’s aging population and rising healthcare costs. In coming years, as revenues flowing into the program are insufficient to finance promised benefits, health programs critical to millions of Americans could be affected.

In their report, the Trustees find that:

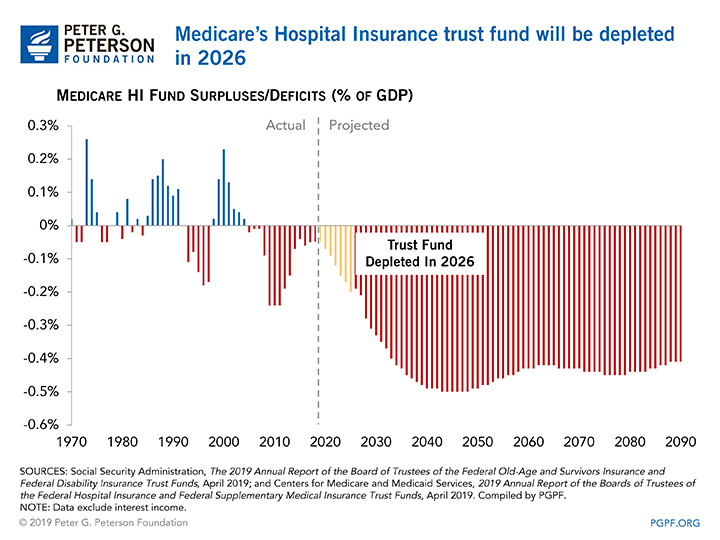

- The Medicare Hospital Insurance (HI) trust fund will be depleted in 2026, the same timeframe cited in last year’s report.

- In 2026, Medicare would have to cut payments to providers by 11 percent, which could negatively affect 73 million beneficiaries.

The Trustees urge policymakers to act quickly to keep Medicare solvent for beneficiaries over the long term:

“The financial projections in this report indicate a need for substantial changes to address Medicare’s financial challenges. The sooner solutions are enacted, the more flexible and gradual they can be … The Trustees recommend that Congress and the executive branch work closely together with a sense of urgency to address those challenges.”

Key Drivers of Insolvency

The key drivers of the financial instability of Medicare are fundamental and predictable factors — in particular, the rising number of people over age 65 and per capita spending on healthcare that is increasing faster than the growth rate of the economy.

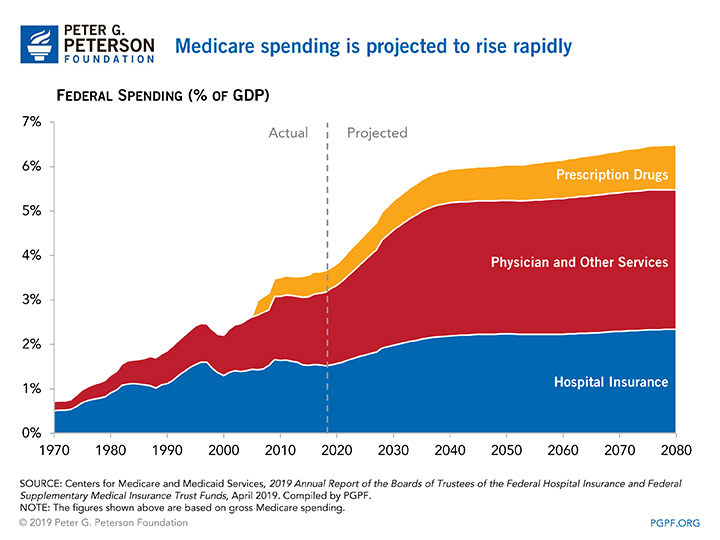

Rapidly Rising Spending: Medicare spending equaled 2.9 percent of gross domestic product (GDP) in 2018, but is expected to rise to 5.5 percent of GDP by 2043 — a 90 percent increase. Those amounts include spending on hospital coverage, medical services, and prescription drugs.

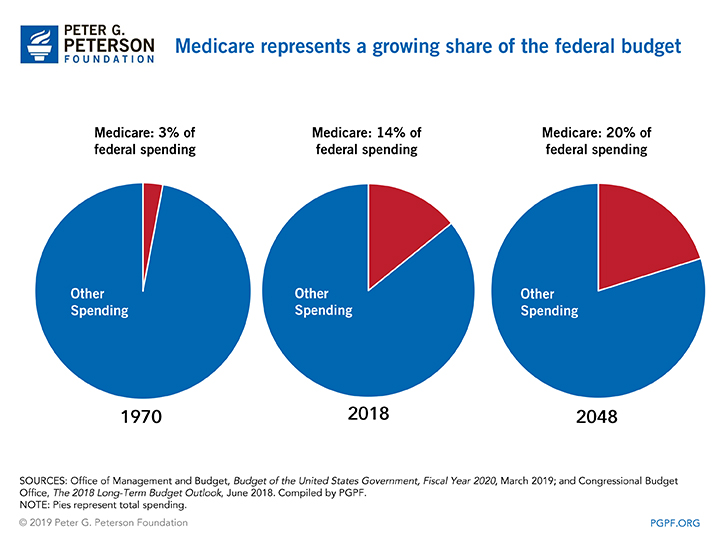

Because of the rapid growth in spending, Medicare will represent an increasing proportion of the federal budget going forward. The program will account for 20 percent of federal spending by 2048, up from just three percent in 1970.

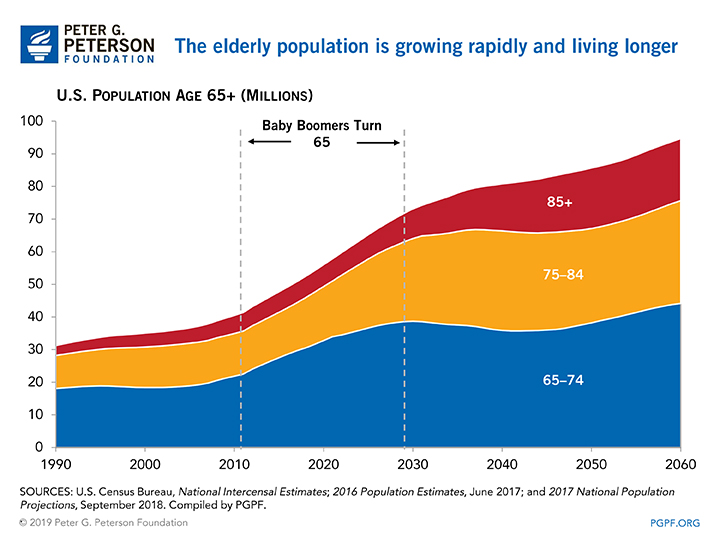

Demographics: With more Americans reaching retirement age — and living longer in retirement — the aging of the population is a major contributor to Medicare’s financial challenges. In 1990, there were 32 million people age 65 and older. Today, there are 52 million people, a 60 percent increase. And by 2048, the Trustees project that the number of Americans age 65 and over will increase by another 60 percent to 83 million people.

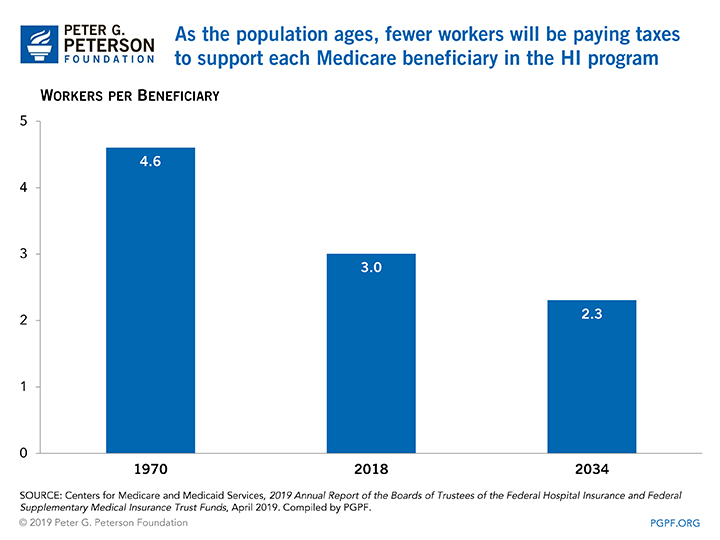

Another illustration of Medicare’s demographic challenge is the declining ratio of workers to beneficiaries. In 1970, there were 4.6 workers contributing payroll taxes for every individual receiving benefits. That ratio decreased to 3.0 workers for every beneficiary in 2018, and is projected to fall to 2.3 workers for every beneficiary in just 15 years. Those ratios have a significant impact on the solvency of the program.

What does this mean for Medicare beneficiaries?

The Trustees warn that Medicare’s unsustainable future threatens benefits that millions of Americans — including retirees and people with disabilities — are counting on under the program.

Medicare’s largest component — known as Part A — covers inpatient hospital visits and care at skilled nursing facilities. It is funded via the HI trust fund, which will be depleted in 2026 according to projections by the Trustees. Without action, that will result in an 11 percent cut in payments to providers under HI in just seven years, affecting 73 million enrollees.

The HI trust fund’s challenges are exacerbated over the long run, putting the vulnerable populations that rely on Medicare at risk of losing the critical healthcare services provided by the program. Although both income and expenditures were near 3.4 percent of taxable payroll in 2018, spending is projected to rise to 4.7 percent by 2035, while income would grow to only 3.7 percent, which leaves a significant deficit of one percentage point of taxable payroll. The annual deficit would remain around one percent of taxable payroll for much of the 75-year projection period, which would deplete the trust fund in just seven years.

The Trustees also report on the status of the Supplementary Medical Insurance (SMI) trust fund, which finances Medicare Part B and Part D, and includes coverage for medical services (including outpatient hospital treatment, ambulance services, and medical equipment) and prescription drugs. The SMI trust fund covers about one-quarter of its costs through premiums charged to beneficiaries. By design, transfers from the general fund of the U.S. Treasury cover the rest of its costs. As a result, the SMI trust fund is not threatened with depletion. However, programs funded through the SMI fund are still the source of fiscal challenges and budgetary pressure. As the Trustees point out, SMI expenditures are expected to grow significantly throughout the projection period.

Read more about the Medicare program and how it works.

Solutions

Long-term demographic trends are clear and their fiscal consequences are well known.

The good news is that many policy solutions are available to address this predictable challenge and improve the financial outlook of Medicare. The Congressional Budget Office published a compendium of options to reduce the deficit, including several that would address the Medicare program. In addition, the Medicare Payment Advisory Commission identified areas in which eliminating or reducing unnecessary payments and subsidies could reduce costs without significantly harming access or quality.

The 2019 Trustees report has made it clear that Medicare continues to face an uncertain financial future. Medicare is an essential program that is relied upon by millions of older Americans. Policymakers should work with urgency to improve Medicare’s outlook because the sooner action is taken, the more gradual and fair the solutions can be.