Debt Held By Public Before Recessions

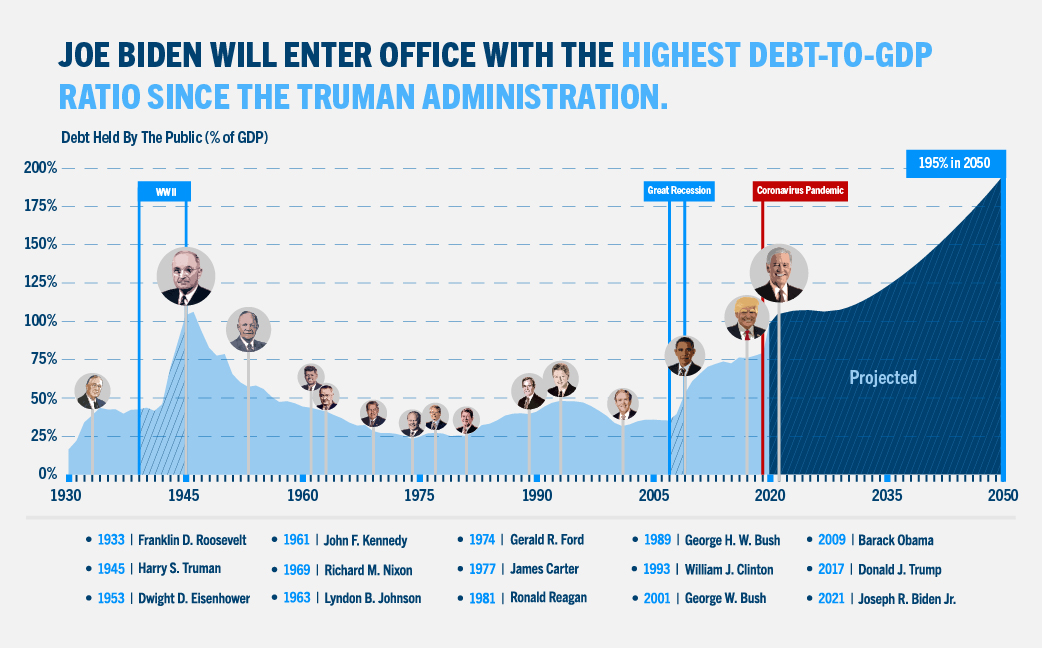

The United States was in a more precarious fiscal position in 2020 than it was at the onset of the last six recessions.

https://www.pgpf.org/chart-archive/0309_precarious_fiscal_position

The search found 406 results in 0.155 seconds.

The United States was in a more precarious fiscal position in 2020 than it was at the onset of the last six recessions.

https://www.pgpf.org/chart-archive/0309_precarious_fiscal_position

Putting our economy on a path to recovery continue to be the most pressing priorities for our nation. At the same time, our fiscal outlook has worsened considerably.

On average, Medicare benefits far exceed taxes over an individual’s lifetime.

https://www.pgpf.org/chart-archive/0197_Medicare_lifetime_benefits

Federal taxes and transfers can help reduce disparities in income.

https://www.pgpf.org/chart-archive/0233_taxes-reduce-disparities

High income individuals receive a greater portion of their income from capital gains

https://www.pgpf.org/chart-archive/0316_capital_gains_income_group

The share of total pre-tax income has sharply increased for the wealthy, but decreased for low-income households.

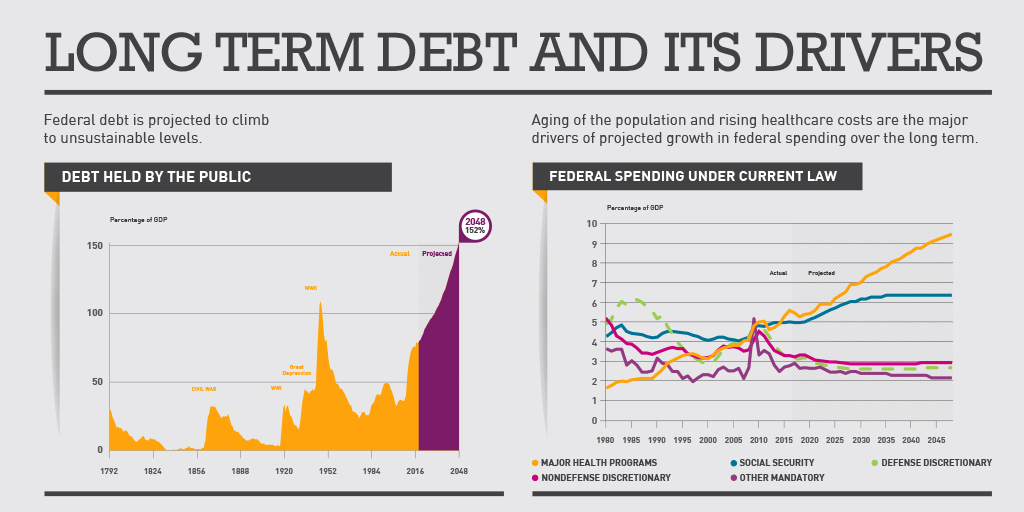

Americans want to live in a nation with widespread opportunity, a positive leadership role in the world, and a bright economic future for generations to come.

Putting our nation on a sustainable fiscal path creates a positive environment for growth, opportunity, and prosperity. Unfortunately, America is on a dangerous long-term fiscal path.

https://www.pgpf.org/infographic/infographic-why-long-term-debt-matters

Despite higher healthcare spending per capita, the U.S. generally does not have better health outcomes.

https://www.pgpf.org/chart-archive/0252_health_outcomes_spending

Healthcare expenditures in the U.S. are much higher than those of other developed countries.

https://www.pgpf.org/chart-archive/0170_international_health_spending_comparison