Distribution of Tax Burden

All income groups pay taxes, but overall the U.S. tax system is progressive.

https://www.pgpf.org/chart-archive/0210_distribution_of_taxes

The search found 436 results in 0.19 seconds.

All income groups pay taxes, but overall the U.S. tax system is progressive.

https://www.pgpf.org/chart-archive/0210_distribution_of_taxes

Total U.S. health spending (public and private) is projected to rise to nearly one-fifth of the economy by 2025.

https://www.pgpf.org/chart-archive/0056_health-care-costs-proj

The portion of health spending paid by the government is growing.

https://www.pgpf.org/chart-archive/0090-composition-health-spending

Prescription drug costs have increased significantly over the past several decades.

https://www.pgpf.org/chart-archive/0319-prescription-drug-costs

Government health insurance is paying for a larger share of prescription drug expenditures.

https://www.pgpf.org/chart-archive/0320-prescription-drug-costs-composition

Federal budget deficits are projected to be high despite low unemployment.

https://www.pgpf.org/chart-archive/0306-high-deficits-low-unemployment

Over one-third of American children are covered by Medicaid or the Children's Health Insurance Program (CHIP).

https://www.pgpf.org/chart-archive/0097_children_medicaid_chip

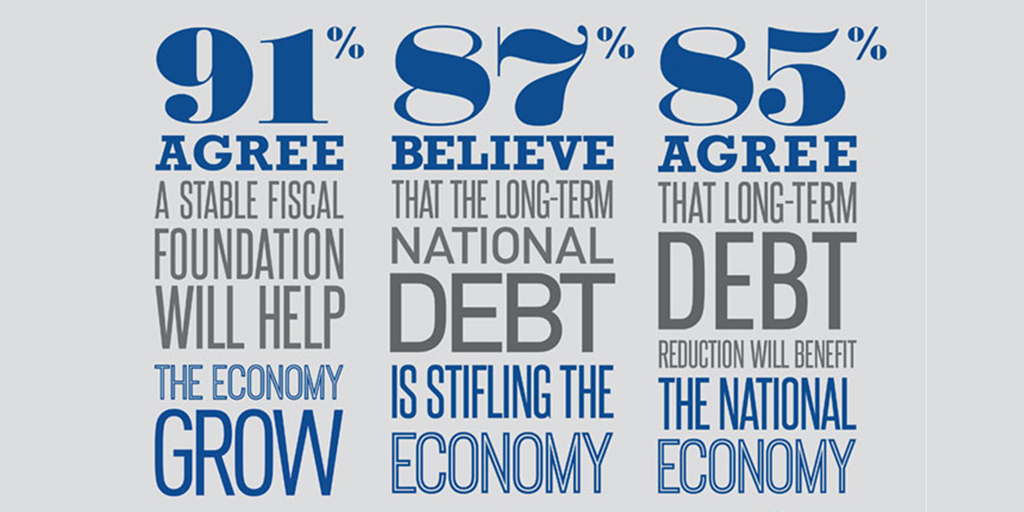

Americans draw clear connections between our nation’s fiscal health and economic strength.

https://www.pgpf.org/infographic/infographic-fiscal-health-leads-to-economic-strength

The United States ranks 13th in quality of overall infrastructure according to the World Economic Forum.

https://www.pgpf.org/chart-archive/0215_infrastructure-ranking-by-country-world-economic-forum

The fraction of children who earn more than their parents has decreased over time.