You are here

Tax Reform

The tax system in the United States is complex, confusing, inefficient, and, some would say, unfair. The tax code is riddled with tax expenditures, or "tax breaks," including loopholes, deductions, exemptions, credits, and preferential rates. Because such tax breaks provide financial assistance to specific activities and groups, many are actually a lot like government spending in disguise. Worse, they create market distortions that are damaging to economic growth and productivity.

Many economists believe it would help the economy to do away with some or all of those tax breaks to make the code more efficient and reduce the deficit. Tax reform done right would promote economic growth, make our fiscal outlook more sustainable, reduce the complexity and burden of compliance, and increase the system’s transparency and fairness by treating individuals and businesses in similar circumstances more equally.

Policy Options

This page outlines a number of worthwhile policy ideas that have been proposed for reforming individual and corporate income taxes, in addition to proposals for new types of tax regimes. For more background about how the U.S. tax system currently works, see our page on Revenues.

Individual Income Tax Reform

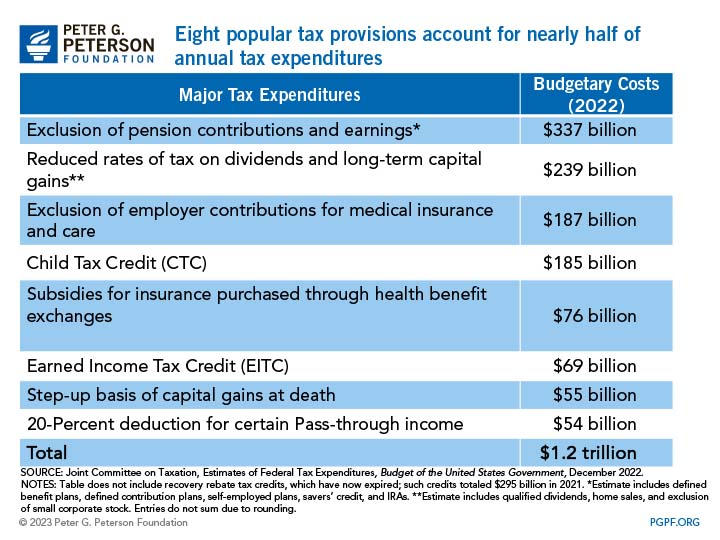

One prominent reform strategy is to eliminate most or all of the individual income and payroll tax expenditures. In the current system, two taxpayers with the same level of income could face very different tax bills because one taxpayer is able to take advantage of more tax breaks than the other. The Tax Cuts and Jobs Act eliminated certain tax expenditures, but many of the largest remain. Some of the most expensive tax expenditures are also the most popular and were designed to meet certain policy goals, including those that cover retirement plans, employer-provided health benefits, and credits for parents of dependent children. For that reason, major changes to our tax code should be phased in gradually to give people time to adjust.

Eliminating some or all individual tax expenditures could allow for a number of other changes to the tax system, while producing additional revenues to improve our long-term fiscal outlook. It could also improve the efficiency of our economy and improve taxpayers’ confidence in the fairness of the overall system.

Corporate Income Tax Reform

The Tax Cuts and Jobs Act not only reduced the top corporate income tax rate from 35 percent to 21 percent, but it also made a number of changes to the way in which the corporate income tax is administered. Corporate tax expenditures implicitly subsidize some economic activities and sectors of the economy at the expense of others and thereby distort economic decision-making. For example, businesses are taxed differently based upon how they are organized (i.e., as corporations, Subchapter S corporations, limited liability companies, partnerships, etc.). Similar to the individual tax code, many have suggested that an ideal system would do away with some or all corporate tax breaks, thereby avoiding distortions generated by special provisions and instead promoting economic growth.

Other Tax Reform Proposals

Other proposals would create new types of taxes to replace existing taxes or to supplement them. Two prominent examples include:

- Consumption taxes: One major reform would replace the current income tax system with one that taxes consumption. There are many forms that a consumption tax could take. Most proposals exempt income used for savings and investment. To protect lower-income taxpayers, some proposals would exempt income used for housing, food, medical care, and other defined purposes up to a specified level. Other proposals would tax the consumption by lower-income families at reduced rates.

- Carbon taxes: Some have suggested introducing a carbon tax to achieve two goals: raising revenues and discouraging the use of carbon-intensive energy, which would ultimately have positive environmental effects. A carbon tax could also enable the government to reduce other taxes while still generating additional revenue for deficit reduction.

|

|

Additional resources:

- Congressional Budget Office, Options for Reducing the Deficit: 2023 to 2032, December 2022

- Tax Policy Center, What Policy Reforms Could Simplify the Tax Code, May 2020

- Center for American Progress, Taking Stock of Spending Through the Tax Code, July 2019

- Brookings Institution, 6 Ways to Fix the Tax System Post-TCJA, May 2018

- Committee for a Responsible Federal Budget, How to Design Tax Reform: 8 Lessons from 1986, September 2017

- Mercatus Center, “Fixing” the Tax Code: Key Principles for Successful, Sustainable Reform, May 2016

- Peterson Foundation, “Key Principles to Achieve Tax Reform that Grows the Economy, Not the National Debt”