Poll: Voters Say that Tax Reform Shouldn’t Grow the Debt

Last Updated December 1, 2017

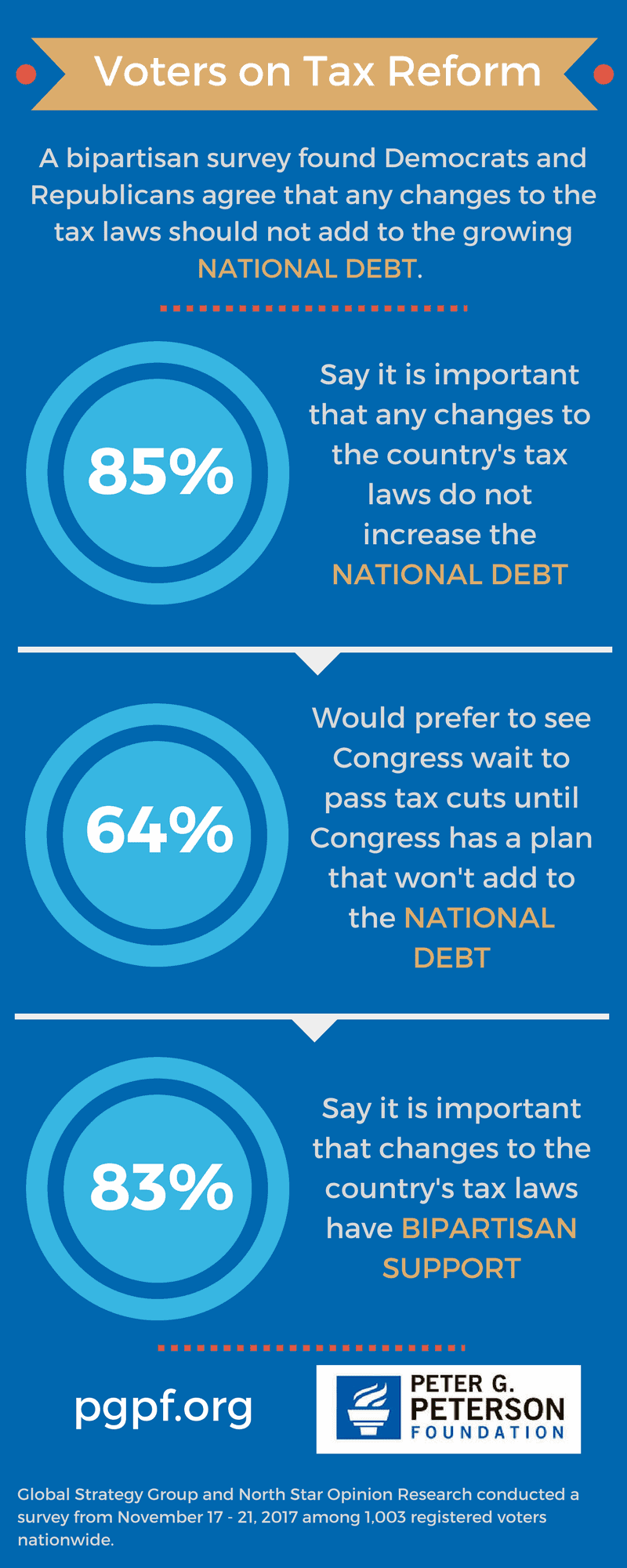

An overwhelming majority of Americans (85%) agree that any changes to the tax laws should not add to the growing national debt, according to a new survey from a bipartisan team of pollsters. And, in a time where there are many deep political divisions, there is no gap between the number of Democrats (86%) and Republicans (85%) who feel this way.

Furthermore, voters would prefer to see Congress “wait to pass tax cuts until Congress has a plan that won’t add to the national debt” (64%) rather than “use the opportunity to cut taxes now, even if the tax cuts add to the national debt (28%).”

Independent analyses agree unanimously that either bill would add significantly to the growing national debt. The interest costs alone on that additional debt ($259 billion) would total approximately half of our annual defense spending.

Earlier this year, the national debt passed the $20 trillion mark, and America’s debt-to-GDP ratio is the highest it has been since World War II. On our current path, we will spend $6 trillion on interest alone over the next decade, and interest will become the third largest federal “program.”

“This is a generational opportunity to enact tax reform to both improve our fiscal outlook and enable sustained economic growth,” Michael A. Peterson, President and CEO of the Peter G. Peterson Foundation, said in a recent statement. “To do so, reforms must foster simplicity, fairness and growth, while also being fiscally responsible.”

Image credit: Getty Images

Further Reading

News from the Quarterly Treasury Refunding Statement

As borrowing has risen, the Treasury has generally been increasing the proportion of bills (maturity of one year or less) in its portfolio of marketable securities.

The Next Fiscal Cliff: Big Tax Decisions to Make in 2025

Some TCJA provisions were made temporary to limit the negative fiscal impact of the 2017 bill. It sets up a significant decision point for policymakers next year.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.