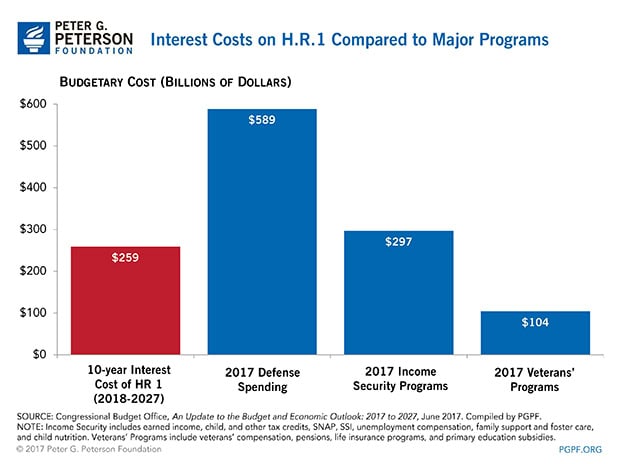

Today the House of Representatives passed the Tax Cuts and Jobs Act, which on its own would add $1.4 trillion to our national debt over the next 10 years. However, the reduction in revenues would also require additional borrowing, thereby boosting interest costs by another $259 billion. As a result, the total cost of the bill is estimated to be $1.7 trillion between 2018 and 2027.

The amount of interest on the House tax bill can be compared with existing spending in the federal budget. For example, that $259 billion is equivalent to nearly half of our annual defense spending and almost a full year of federal support for Income Security programs (which include the Supplemental Nutrition Assistance Program, Supplemental Security Income, family support, and foster care). Or, it could pay for two and a half years of programs for veterans.

Growing interest costs are rapidly becoming a significant factor in our dangerous fiscal outlook. Even without the enactment of any tax legislation, CBO projects that interest payments on the debt will more than quadruple over the next 30 years, climbing from 1.4 percent of GDP in 2017 to 6.2 percent in 2047. In less than a decade, interest costs will rise to be the third largest “program” in the federal budget, trailing only Social Security and Medicare. And by 2047, CBO projects that interest costs alone could be more than twice what the federal government has historically spent on R&D, infrastructure, and education combined.

The impact of rising interest costs on the budget should be a primary factor for lawmakers to consider as they pursue tax reform.

Image credit: Getty Images

Further Reading

How Did the One Big Beautiful Bill Act Change Tax Policy?

See how OBBBA restructured the tax landscape across four major areas: individual tax provisions, business tax provisions, energy tax credits, and health-related tax changes.

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.