You are here

The Highway Trust Fund (HTF) was established in 1956 to provide a more dependable source of funding from the federal government for the construction of the interstate highway system. The HTF is comprised of two accounts:

- The Highway Account, which is largely devoted to construction and maintenance of highways and bridges; and

- The Mass Transit Account, which is used to make capital expenditures on buses, railways, subways, ferries, and other modes of public mass transit.

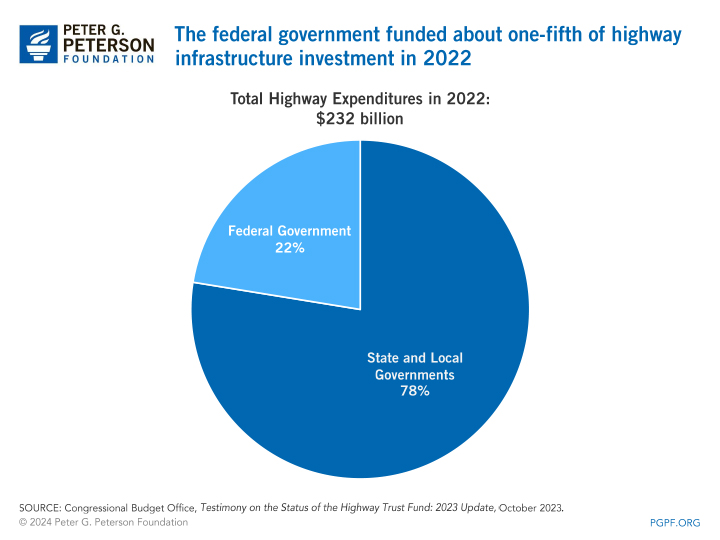

In general, state and local governments provide the majority of spending on surface transportation in the United States. For example, state and local governments funded around four-fifths ($180 billion) of total spending for highways in 2022, the latest year for which data are available. However, funding from the HTF also plays an important role in facilitating many projects. In 2022, the federal government contributed $52 billion in highway investment, 96 percent of which went towards specific capital projects, such as the Interstate Highway System.

Federal assistance comes most often in the form of grants and other direct contributions, but also in a number of financing mechanisms like tax-preferred bonds and direct federal credit programs that allow states and localities to finance projects on more favorable terms.

Where does the Highway Trust Fund get its funding?

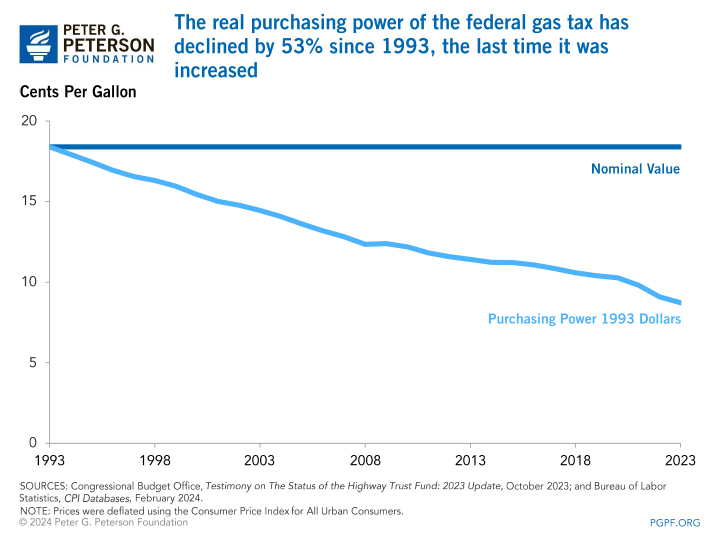

The Congressional Budget Office (CBO) reports that the Highway Trust Fund received 83 percent ($40 billion) of its revenue in 2022 from excise taxes on motor fuel, commonly known as the “gas tax.” Since 1993, fuel tax rates have been fixed at 18.4 cents per gallon for gasoline, and 24.4 cents per gallon for diesel. Taxes on tires and heavy vehicles (trucks) make up the rest of the HTF’s income. Because the federal gas tax is not pegged to inflation, the purchasing power of the revenue has eroded over time — 18.4 cents bought 53 percent less in 2023 than it did in 1993. In addition, rising construction costs and the growing needs of an aging highway system have placed a greater strain on the fund, resulting in recurring funding shortfalls in recent years. Decreasing fuel consumption as a result of both higher fuel efficiency from gasoline-powered vehicles as well as from more hybrid and electric cars on the road will ensure that those shortfalls persist if left unaddressed.

HTF funding shortfalls have generally been filled by transfers from the Treasury’s general fund; such transfers have shifted a total of $275 billion to the fund since 2008, including $118 billion authorized in the Infrastructure Investment and Jobs Act (IIJA) in 2021. Such transfers do not bring in any new federal revenues, but they allow spending from the fund to continue.

What is the outlook for the Highway Trust Fund?

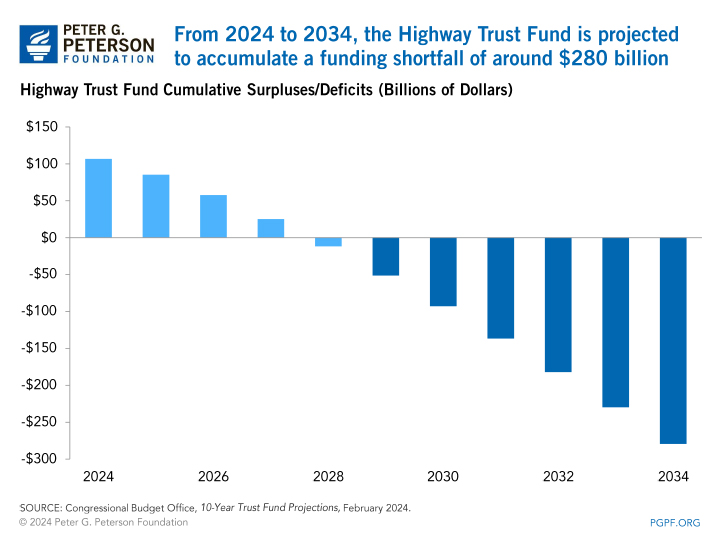

The HTF faces recurring — and increasingly large — funding shortfalls due to an imbalance between revenues and spending. The lack of agreement on a structural fix to that imbalance creates periodic funding crises that put the infrastructure system at risk. CBO projects that the Highway and Mass Transit accounts will be depleted in 2028. CBO projects that the cumulative shortfall in funding for the Highway Trust Fund will grow rapidly over the next 10 years to around $280 billion in 2034.

Why is the Highway Trust Fund important for American competitiveness?

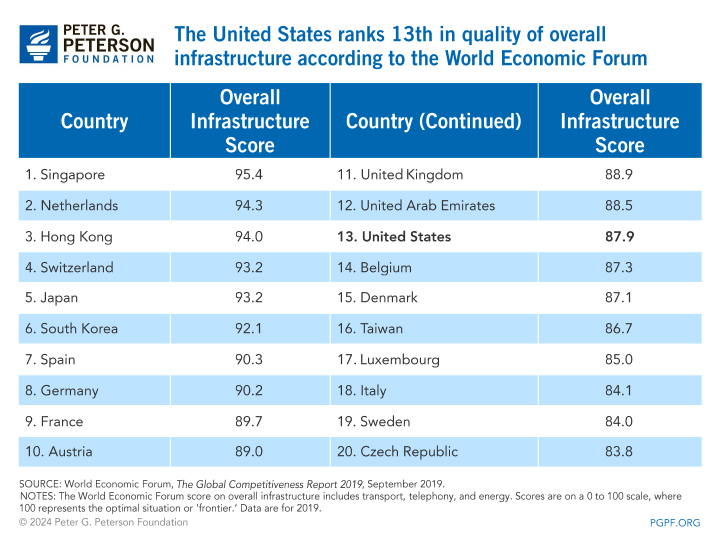

The Highway Trust Fund provides a steady source of funding for investment in and maintenance of essential infrastructure. Likewise, safe and efficient infrastructure is a significant contributor to economic growth and productivity. Yet, by many measures, the current system is not meeting the United States’ 21st century needs. According to the World Economic Forum’s 2019 report on global competitiveness, the United States ranked 17th in road quality, and 13th in overall infrastructure quality.

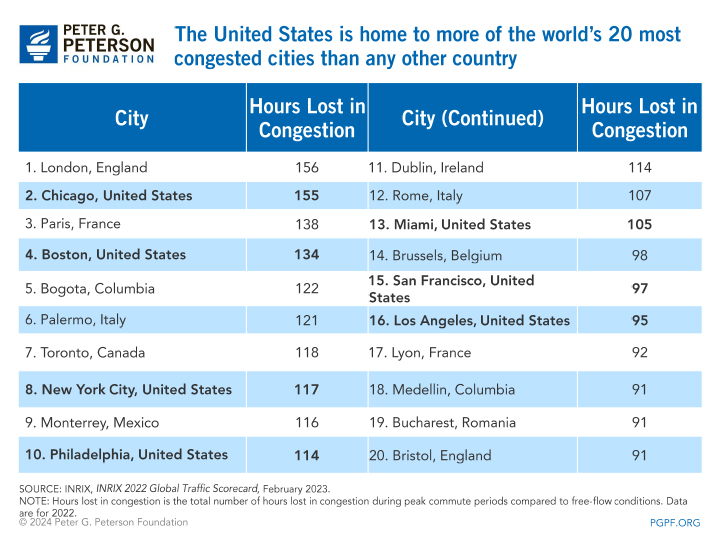

Considering the importance of infrastructure in transporting goods and people in the economy, this puts the United States at an economic disadvantage. According to a 2022 report published by INRIX, a transportation analytics firm, American drivers in 2022 lost an average of 51 hours, at a total cost of $81 billion, due to congestion. Seven out of INRIX’s 20 most congested cities were in the United States in 2022, the highest concentration for any country in the grouping.

What are some viable options to address the future of the Highway Trust Fund?

Although the need for serious, long-term changes to the funding structure of the HTF is clear, there is disagreement over the approach to do so. Some of those disagreements focus on general questions like the responsibility of the federal government for transportation funding or the proper distribution of expenditures on highways as opposed to mass transit; other disagreements center on specific policy proposals. In order to create long-term sustainability for the HTF, lawmakers must increase revenue dedicated to the fund, reduce spending, or some combination of the two. Options include:

- Raise the gas tax: Lawmakers could increase the fuel tax — for example, the current tax of 18.4 cents per gallon could be adjusted for inflation over the past 30 years, which would bring the current rates to 40 cents per gallon of gasoline and 52 cents per gallon of diesel fuel; the tax could also be pegged to future inflation. The Congressional Research Service (CRS) notes that adding just a penny to federal fuel taxes would provide the trust fund between $1.7 billion and $1.8 billion per year. However, maintaining the gas tax as the major source of revenue for the fund may not be a long-term solution. First, cars are becoming more fuel-efficient, reducing the number of gallons of fuel consumed. Also, Americans are beginning to drive slightly less; according to CRS, the growth in annual vehicle miles traveled (VMT) is expected to grow by less than 1 percent per year over the next 30 years. In addition, the increasing number of hybrid and electric cars on the road may lead to decreased demand for gasoline, and therefore reduced opportunity to collect taxes from that source; it may also disproportionately affect owners of gasoline-powered cars, particularly in rural areas where the number of miles driven is often greater and electric cars are less common. In an effort to make a tax increase more appealing, lawmakers have suggested offering a tax rebate to drivers to alleviate some of the added pressures of a new tax hike, but many rebuke that proposal as just another general fund transfer.

- Raise revenue some other way: Lawmakers could instead supplement or replace the gas tax with another revenue source. One proposed alternative is a sales tax system in which the fuel tax would be levied as a percentage of the retail price of fuel and not as a fixed amount per gallon. That way, fuel tax revenues could rise with fuel price increases independent of any fuel consumption increase. However, the inverse is also true, and any sharp decreases or price shocks could lead to substantial revenue shortfalls. Another alternative to the fuel tax is a mileage-based road user charge, which many see as a viable and eco-friendly option. Under this system, drivers would pay fees based on distance driven, regardless of their vehicle’s fuel efficiency. Some downsides to this strategy include concerns of personal privacy relating to the suggested use of GPS to track vehicle movements, costs to establish and enforce the charge, and the administrative challenge of actually billing individual drivers given the enormity of the country’s vehicle fleet.

- Reduce spending: Lawmakers could simply reduce spending so that it remains in line with the fund’s existing level of revenues. Under that approach, the HTF would only be able to expend the precise amount of its revenues, thereby eliminating the chance for deficits. However, the number of projects the federal government would be able to support could be substantially restricted, thereby placing an even greater strain on state and local governments to fund key infrastructure projects.