You are here

A Report on Fiscal Stimulus

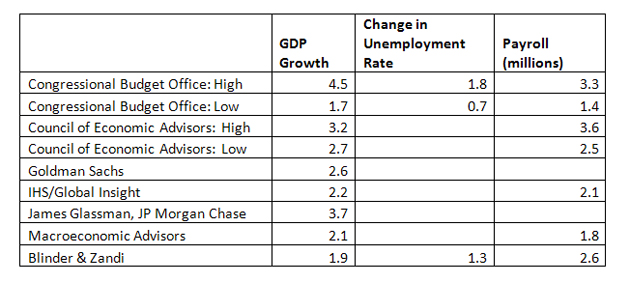

In response to the economic crisis beginning in late 2007, the federal government in the U.S. took a variety of different actions. These included fiscal stimulus, industry bailouts, and monetary actions of the Federal Reserve. One of the most controversial of these actions was the 2009 stimulus package, the American Recovery and Reinvestment Act (ARRA), a sweeping bill with an $800 billion price tag. Most of the money from this package will have been spent by the end of 2010, and so there have been a wave of reports that attempt to assess the effectiveness of the stimulus. As shown in Figure 2 below, leading models of the 2009 stimulus bill have projected a range of effects. They project an increase in GDP of between 1.7 and 4.5 percentage points, a decrease in the unemployment rate of between 0.8 and 1.9 percentage points, and an increase in payroll of between 1.4 million and 3.6 million jobs.

Results on the effectiveness of ARRA are especially important now as lawmakers and economists debate the potential merits of a second stimulus. However, despite the results of reports like the ones listed above and the economy’s successful emergence from the recession, the stimulus remains controversial. An April Pew poll found that over 60 percent of Americans do not think that the stimulus has helped the jobs situation.

Why is ARRA so controversial? There seem to be three main reasons:

- The stimulus is poorly understood

- Recovery has been sluggish

- The results of the macroeconomic models used to assess ARRA are confusing, and will always remain estimations

Understanding the Stimulus

During the 1930s, John Maynard Keynes revised the way economists viewed the behavior of economies during a downturn. Before, the theory was one of self-adjustment: when the economic cycle went down, and led to a drop in consumer demand of goods, the prices of those goods would drop correspondingly until people started buying again. In the Great Depression, however, it was clear that traditional understandings of supply and demand had broken down, and that during times like those the economy risked spiraling further and further downwards, unable to self-correct. Extra government spending or tax decreases (fiscal stimulus) could, during these times, temporarily replace private spending, and curtail the effects of a recession before it got out of control. Since the Great Depression, these ideas have been accommodated to counteract results of less extreme economic downturns. Countercyclical fiscal policies, which generally aim to stimulate consumer demand or encourage people to start spending again, also address unemployment, market illiquidity, and other negative consequences of an economic downturn.

In theory, the fiscal stimulus—whether it takes the form of tax cuts, increased aid to poverty programs, unemployment insurance, or infrastructure investments—will stimulate demand and increase consumption by adding more money into the national economy. The stimulus of 2009, however, has come under sharp criticism.

Composition

One common misunderstanding lies in the actual composition of the stimulus package passed in February of 2009. In response to the economic crisis, the U.S. government took a variety of different actions. Often, they are collectively referred to as "stimulus" or "the bailouts," but in fact the response was composed of several distinct programs. One of the most common misunderstandings lies in the muddling of these different programs.

The biggest of these distinct actions were the fiscal stimulus acts of 2008 and 2009, and the bailouts of Fannie Mae and Freddie Mac, the auto industry, and AIG. Other important actions included the bank stress tests, and the ensuing financial capital infusions of the Capital Purchase Program. The monetary actions of the Federal Reserve also served an important function, as they lowered interest rates and secured a market for mortgage-backed securities.

ARRA itself did not include any of the industry bailouts or capital infusions. The bailouts of the auto industry, AIG, and financial institutions fell under the Troubled Asset Relief Program (TARP), which was a $700 billion fund established early on in the crisis, on October 3, 2008. Nor did the stimulus include any monetary policy; those actions were undertaken by the Federal Reserve.

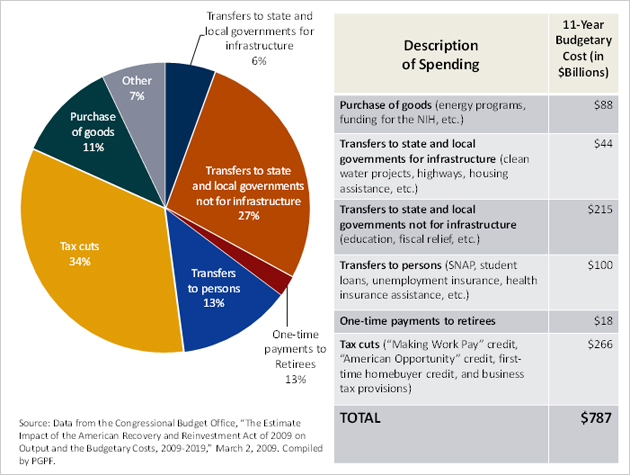

The stimulus itself was composed of $787 in direct spending programs, increased aid to poverty programs, investments in energy innovation, infrastructure development, fiscal aid to states, and tax cuts to both individuals and businesses. See Figure 3 below for more detailed information on ARRA’s composition.

Effects

Many have criticized the effectiveness of the components of the 2009 stimulus package. Some argue that it should have had more tax cuts and less spending. In any model, every dollar spent by the government is given a ratio-based number which describes its potential to contribute more (or less) than a dollar to the overall economy. The factor by which this occurs for any government spending program is called its "multiplier." Those who argue that there should have been more tax cuts, for instance, disagreed with the Administration’s assessment that spending dollars had a higher multiplier than tax-cut dollars. John Taylor, a prominent critic of the government’s response to the crisis, argues that stimulus affects consumer demand and GDP growth far less than proponents claim, and that stimulus spending might in fact have hurt the economy by contributing to growing deficits and debt.

As to its size, there are arguments both that we should have had a smaller stimulus package, and that we should have had a larger one. Many of the economists in the Administration responsible for the creation of ARRA would have used a larger stimulus, but feared that the public reaction—both domestically and internationally—would be so negative as to potentially negate the benefits of additional funds. Arguments for a smaller stimulus tend to mention the short- and long-term effects of deficit spending (i.e., crowding out of private investment, increasing interest payments, etc.).

Many of these types of arguments are, unfortunately, politically motivated, and conflate failings or success of individual programs with the stimulus bill as a whole. Economists debate the relative sizes of different multipliers, and many others appropriate those debates to call the whole stimulus an expensive failure or a sweeping success. According to an overwhelming majority of economists, it was most likely neither—though without any stimulus at all, we would clearly be worse off.

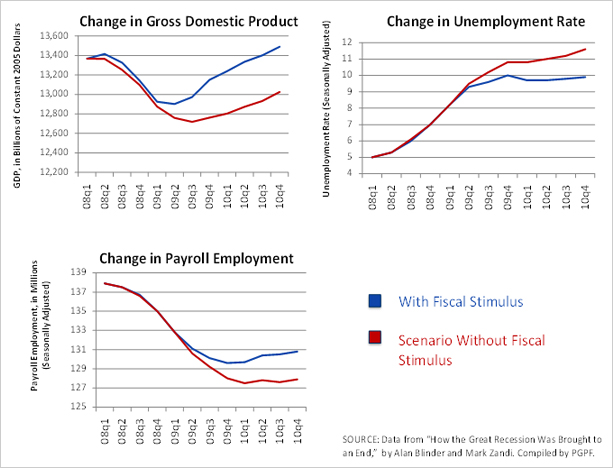

A report by Princeton University economist Alan Blinder and Moody’s analyst Mark Zandi, entitled "How the Great Recession Was Brought to an End," argued that the totality of recovery actions have played a major role in the turn-around of our economy. If the U.S. government had not taken any of the recovery measures, Zandi and Blinder contend that the growth of the U.S. gross domestic product (GDP) would be 6.5 percentage points lower, there would be 8.5 million fewer jobs, and inflation would be negative. As shown in Figure 1 below, when separating fiscal stimulus from the rest of the actions taken, the authors’ analysis shows that the fiscal stimulus alone increased the GDP growth by 2 percentage points, decreased the unemployment rate by 1.5 percentage points, and increased payroll by 2.7 million jobs (well within the range of the other leading models shown in Figure 1).

A Slow Recovery

Our current reality is worse than anyone thought it was going to be in 2009. Unemployment remains high—17 metropolitan areas recorded unemployment rates above 15 percent in July of 2010, and the national rate continues to hover just below 10 percent. People hear that the economy has emerged from recession, but they still see staggering unemployment all around them and hear increasing talk of the rising debt we are accumulating. This has led many to both distrust public officials and think that the actions taken since the economic crisis have failed.

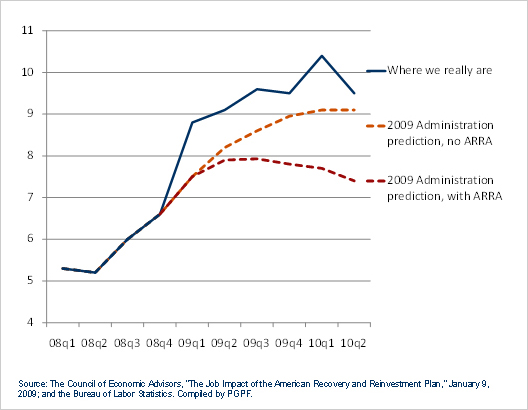

Part of this can be attributed to the gross underestimation of the economic downturn from the outset, by politicians, economists and the media. Figure 4 below compares the unemployment rates that were predicted in January of 2009 by the Administration, both with and without the stimulus, to the real unemployment rate experienced over the following year.

This chart is often used by ARRA’s critics to prove the failure of the stimulus policies. Even with the successful passage of a large stimulus plan, as this chart shows, the current unemployment rate far exceeds even the rate initially projected in the absence of fiscal stimulus. The Administration’s model was one among many that underestimated the effects of the crisis. The nonpartisan Congressional Budget Office had projected baseline (no-stimulus) unemployment levels of about 8.7 percent for 2010. The unemployment rates of over 10 percent have surprised almost everyone.

This recession is different from other recessions that exist in the collective memory (such as those of the early 80s, the early 90s, or the early 2000s), in that it was spurred by a collapse of our financial system. As Carmen Reinhardt and Kenneth Rogoff have argued that recessions that result from financial crises are longer than normal recessions, which last less than a year. So while the existence of historic precedent does not make the current slow recovery any less painful, it is important, in assessing the success of the stimulus, to consider it within its relevant economic context.

Uncertainty of Estimates

The $14 trillion American economy is complex, and the results of any models of it often necessarily entertain quite a bit of uncertainty.

Assessing the economic impact of fiscal policy is not an exact science. Doing so relies on models that must make broad assumptions about the economy, and that rely heavily on historical relationships among interacting variables. Most models (including those used by Macroeconomic Advisors and the Federal Reserve Board), for instance, assume a strong correlation between aggregate demand and economic output. These models thus will usually present ARRA spending (which focused on increasing demand) as having larger economic impacts in the short-term than will other models. Another type of model, the general equilibrium model, downplays the role of the stimulus in increasing demand, and puts a larger importance in individuals’ assessments of future fluctuations in wage rates, interest rates, and government policies. In this latter type of model, most stimulative measures do not stimulate growth, but instead crowd out productive economic activity.

Due to broad assumptions like the ones mentioned above, any assessment of fiscal policies is subject to a substantial level of uncertainty. Because there were not two Americas—one that received stimulus funds in 2009 and one that did not—we cannot know the true effect. Uncertainty levels will be even greater in the current economic climate of a country still reeling from an unprecedented crisis. In addition, changes in any of the assumptions can lead to a variety of results. This allows for a paradoxical situation in which both the proponents and opponents of fiscal stimulus can advance their arguments with the "empirical" support of advanced economic models; relatively modest adjustments can result in very different answers to the question of how the stimulus changed our economy.

Conclusion

As Blinder and Zandi mentioned in their report, the assessment of the 2009 stimulus will be particularly important in the near future as policy makers weigh the possibility of introducing a second stimulus. While the recession has technically ended, our economy is still suffering and far from completely recovered. The effects of the 2009 stimulus are now beginning to wane, and there has been increasing discussion of offering continued fiscal support until the economy is once again in a position to right itself. This is a controversial and polarizing topic. It will hardly be settled with the results of one paper, but it will be important in this discussion to avoid the conflation of short-term, crisis-related deficits with our long-term, structural budget challenges. It would be a mistake to prematurely abandon the ailing economy; but it would be equally disastrous to continue willing the challenges of our deficit spending to future generations.