You are here

Financial Condition of Social Security

OVERVIEW

The Social Security Trustees recently issued the 2011 financial report for the single largest federal program. Once again, the report warns that Social Security is in a weakened financial position in the short run and in an unsustainable condition in the long run. The Trustees report highlights the need for reforms of the program’s finances.

• In the short term: Social Security is now operating with a permanent, annual cash flow deficit. This means that benefits cost more each year than the payroll taxes collected each year to pay for them.

• In the medium term: Within seven years, the Trustees estimate that Social Security will not be able to pay full disability benefits scheduled under current law. The Disability Insurance program will begin running permanent cash deficits. Its trust fund will be exhausted in 2018.

• In the long term: Absent reform, Social Security will only be able to pay approximately 77 percent of scheduled benefits under current law after 2036. After this date, the program will only have the legal authority to pay benefits equal to the amount of revenue generated by the payroll tax and the taxation of some benefits.

While the Trustees report focuses on the financial condition of Social Security as a single isolated program, the financial condition of Social Security has important implications for the overall federal budget. As a federal program, Social Security cannot be any stronger financially than the overall federal government, and long-term financial problems in Social Security will have a negative impact on the federal budget as a whole. As the program’s financial condition continues to deteriorate, providing full benefits will lead to higher deficits and require increased federal borrowing from the public, absent reforms in benefits, taxes or both.

THE IMPORTANCE OF SOCIAL SECURITY BENEFITS

In 2010 Social Security provided cash benefits to almost 54 million Americans. According to data gathered by the Social Security Trustees, Social Security benefits are a key source of income for many of the nation’s elderly. In 2008 Social Security benefits accounted for 100 percent of the annual income of about 5.6 million older Americans, or about 22 percent of the population of older Americans receiving Social Security benefits. The same study found that Social Security benefits account for 100 percent of annual income for about 27 percent of beneficiaries who live beyond 80. Social Security is obviously important for the financial security of a large number of America’s elderly, but Social Security is not just a retirement program. According to the Trustees, about 30 percent of beneficiaries were receiving disability or survivorship benefits. Considering the importance of Social Security benefits to so many Americans, it is critically important that reforms to the program balance long-term solvency with the need to provide income security for the most vulnerable beneficiaries.

SOCIAL SECURITY’S UNSUSTAINABLE FISCAL OUTLOOK

Box 1: The Open Group Unfunded Obligation:

The Trustees also report that Social Security is facing an open group unfunded obligation of $6.5 trillion. The open group unfunded obligation is the size of the total, accumulated shortfall expressed in present value terms. (Present value expresses a stream of future receipts or payments into an equivalent lump-sum amount received or paid today). The unfunded group obligation can be thought of as a measure of the total liabilities of the program in the long term. The liability measure includes all non-interest income and program costs over the next 75 years less the current value of the trust fund assuming current levels of taxation and the scheduled benefit level under current law. The current estimate of the open-group liability is about a trillion dollars higher than last year’s number. About $400 billion of this increase stems from the passage of another year. The open group unfunded liability is calculated using the 75-year projection period. Using this method, the net costs increase each year, as an additional year of large cash flow shortfalls is included in the liability calculation. The rest of the increase is caused by revisions to long-term assumptions about life expectancy and economic growth.

The Social Security Trustees’ report includes several measures to evaluate Social Security’s financial health. All of these indicate that over the long term, the cost of Social Security’s benefits will be greater than the resources available to finance them. As the financial condition of Social Security deteriorates, the pressure that this program will place on the rest of the budget will grow. To sustain the program for future retirees and to relieve mounting pressure on the budget as a whole, reforms will be needed.

This negative financial outlook for the Social Security program stems from the aging of the population. This results from increasing longevity, stable fertility rates, and the retirement of large numbers of the baby boomers. The Trustees Report projects that the number of workers per beneficiary will decline from a current ratio of about 3 workers per beneficiary to 2.1 by 2035.

Measuring Social Security’s Financial Condition and the Federal Budget

Social Security provides benefits to retired and disabled workers, as well as their spouses and survivors. It is largely funded by payroll taxes on current workers, but some higher-income beneficiaries also pay income taxes on their benefits. Two government accounts—the Federal Old Age and Survivors Insurance (OASI) program and the Federal Disability Insurance (DI) program, keep track of the program revenues and expenses. The Trustees Reports analyze the condition of these trust fund accounts.

Reforms enacted in 1983 increased worker contributions and gradually raised the full retirement age. As a result of those changes, Social Security has generated substantial surpluses. As a result, by the end of 2010, trust fund balances had grown to approximately $2.6 trillion.

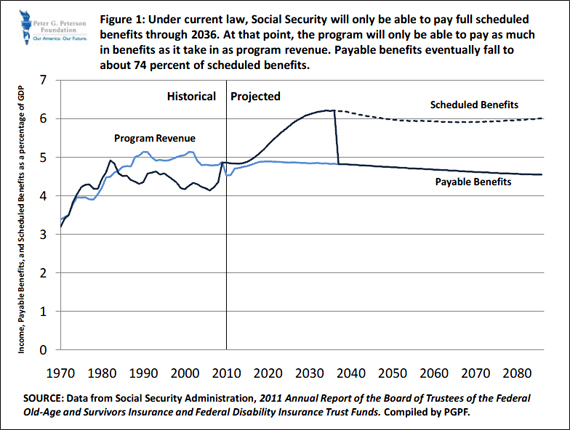

The accumulated balances in the trust fund accounts represent future legal authority for benefits. According to the 2011 Report, the program has sufficient resources to pay for scheduled benefits until 2036, when the funds will be exhausted. Absent a change in current law, once all available resources are exhausted Social Security will only be able to cover 77 cents of every dollar of scheduled benefits (see Figure 1). This will deteriorate to about 74 cents per scheduled dollar of benefits by the end of the 75-year projection period.

CASH SURPLUSES AND DEFICITS

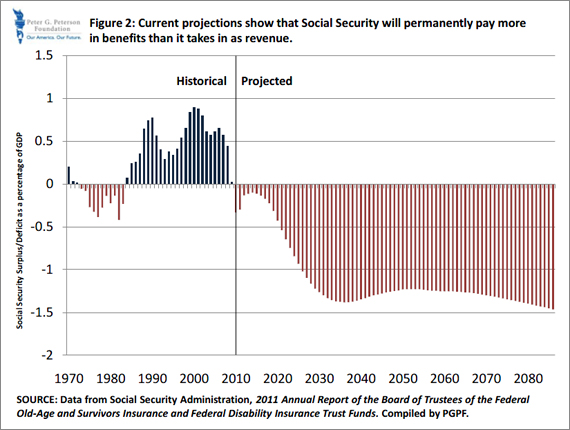

In addition to measures of long-range trust fund solvency, the Trustees report also provides projections of Social Security’s cash transactions. From 1983 to 2009, Social Security ran cash surpluses. Those surpluses probably reduced the federal government’s overall budget deficits and the amount it had to borrow from the public, though it is not possible to know definitively what would have happed to the federal budget if Social Security had not run surpluses. The government could have borrowed more from the public, spent less for other programs, or increased taxes.

In previous projections, the program was expected to briefly return to cash flow surpluses between 2012 and 2015 before running permanent cash flow deficits. This is no longer the case. As Social Security’s cash flow turns negative, overall budget deficits and Treasury borrowing from the public could increase, which, in turn, could increase pressure on policy makers to reduce spending in other programs or to raise taxes to continue paying full scheduled benefits.

The latest projections from the Trustees show that the combined trust funds will run permanent cash deficits. The fact that Social Security begins operating with a permanent cash flow deficit partially reflects the current poor condition of the economy and expectations of a slower economic recovery, but the long term imbalance in the program is a result of the declining ratio of workers to beneficiaries and the growth in future benefits (see Figure 2).

CONCLUSION

Social Security is in an unsustainable financial position in the medium and long term. In the short term, Social Security is operating with a now permanent cash flow deficit. Without reform, Social Security will place an increasing strain on the federal budget as a whole as benefit costs will add to federal deficits and public borrowing. Waiting too long to reform Social Security could prompt sharp changes in promised benefits or unexpected increases in tax burdens and could create significant hardship for our most vulnerable families. Financial preparation for retirement is a long-term activity. Social Security reforms need to begin soon to make changes more gradual and to allow people time to adjust their saving and retirement plans.

i Social Security Administration, The 2011 Annual Report of the Board of Trustees of the Federal Old Age and Survivor4s Insurance and Federal Disability Insurance Trust Fund, May 13, 2011.

ii According to the Congressional Budget Office, trust funds maintained by the Federal government are an “accounting mechanism” used to link earmarked revenues to specific programs.

iii Social Security Administration. “Income of the Population 55 or Older: Importance of Social Security Relative to Total Income.” 2008. Available at <http://www.ssa.gov/policy/docs/statcomps/income_pop55/2006/sect09.html>

Download PDF Version