Some Tax Provisions Are Expiring in 2025 — Here’s What Experts Think About Them

The TCJA lowered taxes for millions of households and made filing simpler for many — all while making the country’s fiscal outlook worse.

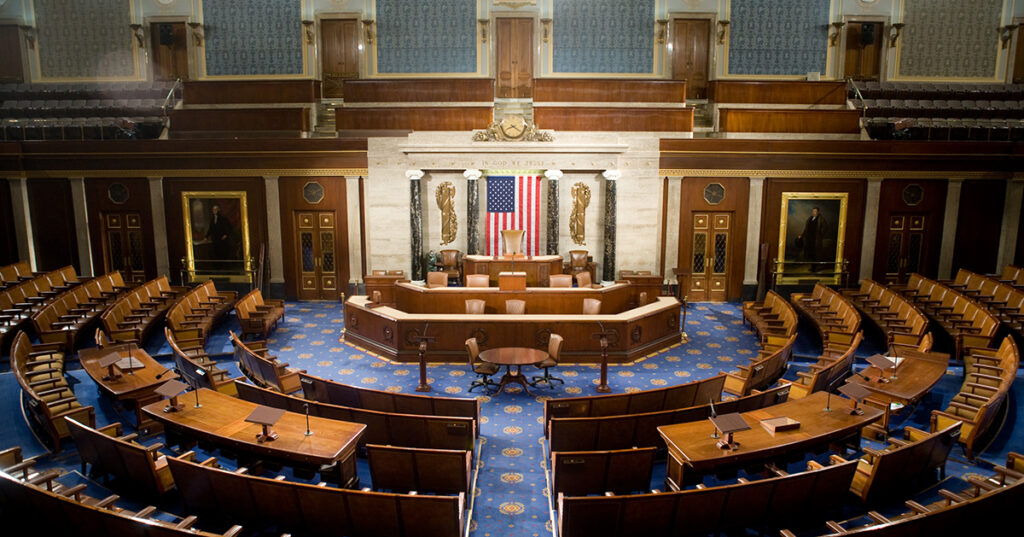

Read MoreA Brief History of U.S. Government Shutdowns

Because government shutdowns are unique to the U.S., it is helpful to understand their history, why they occur here, and how peer countries avoid them.

Read MoreHow Much Would It Cost to Make the TCJA Permanent?

Most of the individual tax provisions and a handful of business provisions in the TCJA are scheduled to expire in the next few years.

Read MoreHow Did the TCJA Affect Corporate Tax Revenues?

For the first few years after TCJA’s enactment, revenues from corporate taxes dropped sharply, but they returned to pre-TCJA levels starting in 2021.

Read MorePresident’s Budget Would Reduce Deficits by Raising Taxes on the Wealthy and Corporations

While this budget would be a step in the right direction, it does not adequately address the underlying structural imbalance that defines our fiscal outlook.

Read MoreLessons Learned: Setting a Bipartisan Fiscal Commission Up for Success

A group of respected policy experts share their views on how a bipartisan fiscal commission could help break the cycle of governing by crisis.

Read MoreHow Would the Tax Relief for American Families and Workers Act Change Federal Tax Law?

The Tax Relief for American Families and Workers Act is estimated to cost about $400 million over 10 years.

Read MoreGrowing Momentum for a Fiscal Commission in Congress

A fiscal commission would provide the space and structure for lawmakers to comprehensively review the entire budget and improve the fiscal path of the U.S.

Read MoreMoody’s Lowers U.S. Credit Rating to Negative, Citing Large Federal Deficits

On November 10, 2023, Moody’s Investors Service lowered its outlook on the United States’ credit rating from “stable” to “negative.”

Read MoreWould Increased Funding for the IRS Narrow the Tax Gap?

Nearly half a trillion dollars in taxes go uncollected every year. Can increased funding for the IRS bring in more federal revenues?

Read More