President’s Budget Relies on Optimistic Economic Projections and Unlikely Spending Cuts

The president’s budget misses an opportunity to address the structural causes of our debt and relies instead on overly optimistic economic assumptions.

Read MoreThe President’s Budget Reduces Debt a Little, but Only if Growth Is Rosier Than Projected

The budget would achieve some deficit reduction on paper under the administration’s calculations, but it fails to address the key drivers of our debt.

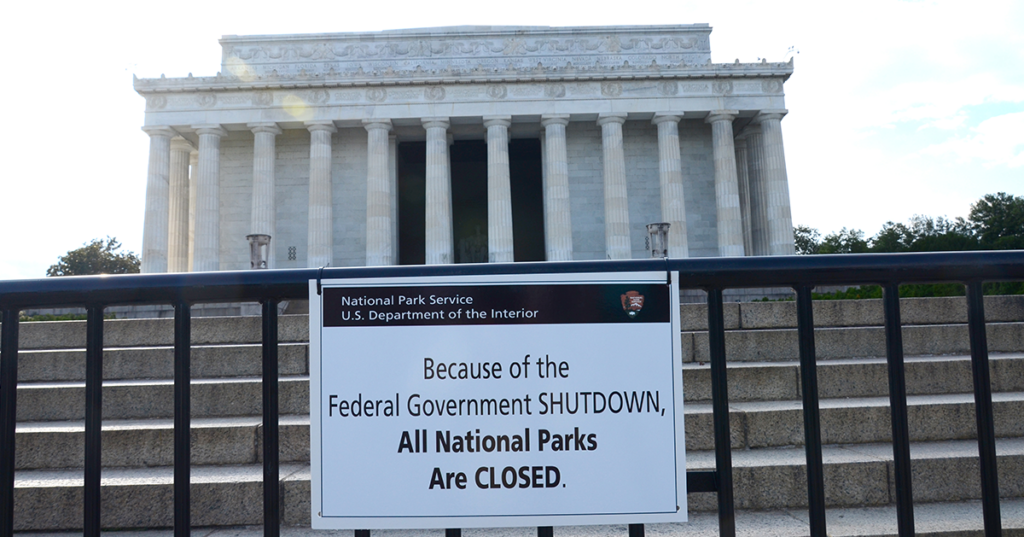

Read MoreHere Are Some Ways the Shutdown Is Hurting Americans and the Economy

Since the shutdown began, about 800,000 federal employees have been furloughed or are working without pay.

Read MoreThe House Is Returning to PAYGO

Budget process rules like PAYGO help ensure that fiscal considerations are an important part of policymaking.

Read MoreBudget Basics: Balanced Budget Amendment — Pros and Cons

What is a balanced budget amendment to the Constitution, and how would it work in practice?

Read MoreFive Things That We Have Learned Since the Tax Cuts Were Enacted

Last year’s tax cuts have had significant implications for the federal budget, our economy, and every family and business in the country.

Read MoreIt’s Rare for Revenue Growth to Be This Weak

Revenues in 2018 didn’t even keep up with inflation, much less growth in nominal gross domestic product.

Read MoreCorporate Tax Receipts Took an Unprecedented Drop This Year

Corporate tax receipts dropped by 31% in 2018 — an unprecedented decline during a time of economic growth. What’s responsible for the plunge?

Read MoreHow Will the Rising Cost of Prescription Drugs Affect Medicare?

Rising costs of prescription drugs and their effect on Medicare could have serious consequences on our healthcare system and our nation’s fiscal well-being.

Read MoreLast Year’s Tax Law Did Not Simplify the System — It Added More Tax Breaks

Last year’s tax legislation was a key opportunity to simplify the tax code, but the TCJA actually increased the number of tax breaks.

Read More