Should We Lower the Medicare Eligibility Age to 60?

Last year, lawmakers in the House introduced the Improving Medicare Coverage Act in an effort to make healthcare more affordable for older Americans by lowering the age of eligibility for Medicare from 65 to 60.

Read MoreFive Charts about the Future of Social Security and Medicare

The Social Security and Medicare Trustees released their annual reports, which show that these vital programs are on an unsustainable path.

Read MoreHow Do Federal Student Loans Affect the National Debt?

Student debt held has been steadily increasing ever since the federal government switched to direct lending.

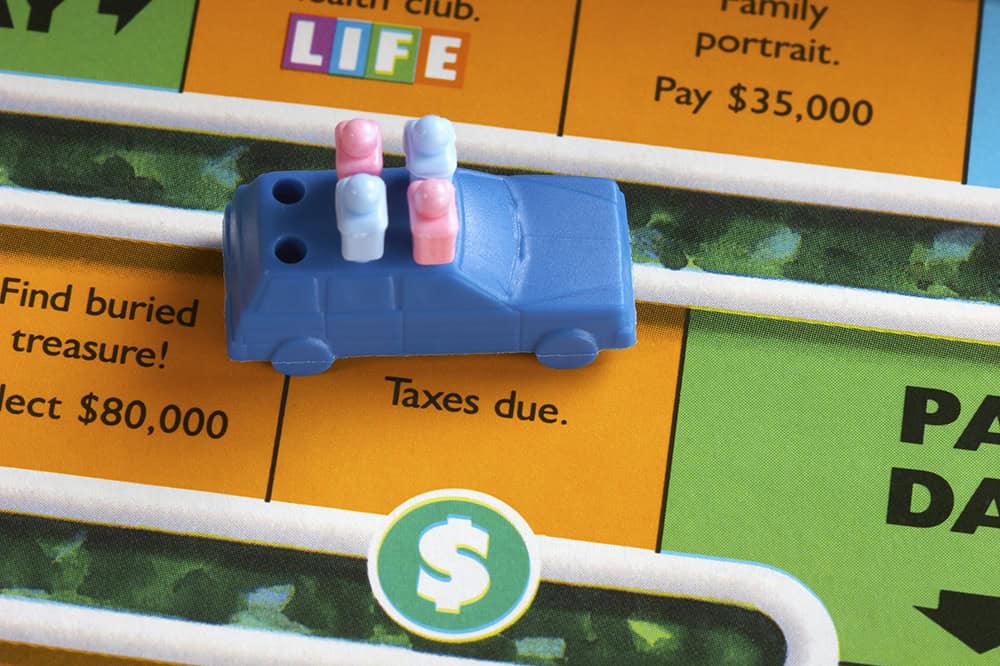

Read MoreQuiz: How Much Do You Know About the U.S. Tax System?

The lengthy and complex United States tax code can be difficult to understand. Take our quiz to see how much you really know.

Read MoreHow Have Prescription Drug Prices Changed Over Time?

In the coming years, it will be important for policymakers to look for ways to ensure that life-saving and life-improving medications are affordable and available for Americans, and at the same time, ease pressure on our unsustainable fiscal outlook.

Read MoreWho Benefits More from Tax Breaks — High or Low-Income Earners?

The benefits from tax breaks do not flow equally to households of different income levels.

Read MorePresident Biden’s Budget Reduces Deficits, but Debt Would Remain High

In an important acknowledgement of our nation’s unsustainable fiscal outlook, the President’s budget for fiscal year 2023 proposes to reduce deficits by $1 trillion over the next decade relative to current law.

Read MoreHow Are We Paying for the Federal Response to the Coronavirus?

The federal government has enacted legislation to provide relief from the COVID-19 pandemic, and the Treasury has ramped up borrowing to pay for it.

Read MoreWhat Are the Pros and Cons of Student Loan Forgiveness?

Currently, more Americans owe a greater average amount of student debt than at any time in U.S. history.

Read MoreWhat Are the Costs of Permanently Expanding the CTC and the EITC?

The American Rescue Plan included a one-year expansion of the Child Tax Credit and the Earned Income Tax Credit. What are the costs and benefits of making that permanent?

Read More