The Highway Trust Fund Explained

The funding structure of the Highway Trust Fund requires serious, long-term changes, but how to approach reform remains a topic of debate.

Read MoreWhat Is the Earned Income Tax Credit?

The earned income tax credit (EITC) is a measure administered through the tax code to address poverty.

Read MoreDebt vs. Deficits: What’s the Difference?

The words debt and deficit come up frequently in debates about policy decisions. The two concepts are similar, but are often confused.

Read MoreWhat Is the SALT Cap?

The deduction of state and local tax payments from federal income taxes has been a subject of debate among economists and policymakers over the past few years — with significant implications for our budget and fiscal outlook.

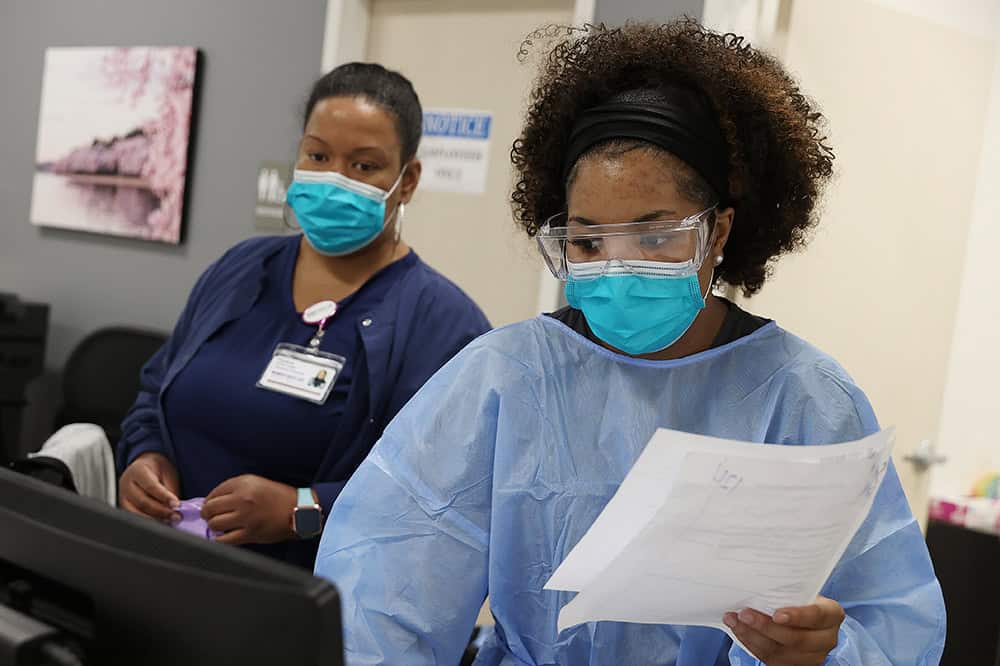

Read MoreWhy Are Americans Paying More for Healthcare?

High healthcare spending is not necessarily a bad thing, especially if it leads to better health outcomes. However, that is not the case in the United States.

Read MoreShould We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

Read MoreWould Increased Funding for the IRS Narrow the Tax Gap?

Nearly half a trillion dollars in taxes go uncollected every year. Can increased funding for the IRS bring in more federal revenues?

Read MoreHow Does Inflation Affect the Federal Budget?

Rising inflation usually prompts higher interest rates, which in turn boost interest paid on the federal debt and thereby increase annual deficits.

Read MoreWhy the American Healthcare System Underperforms

Healthcare in the United States is very expensive — but we don’t get what we pay for.

Read MoreWhat Is Fiscal Policy? Interactive Teaching Tools

Many Americans, young and old, may be confused by the complex set of issues that comprise how the government raises revenues and allocates them.

Read More