National Debt a Critical Election Issue for Swing State Voters

Last Updated October 23, 2024

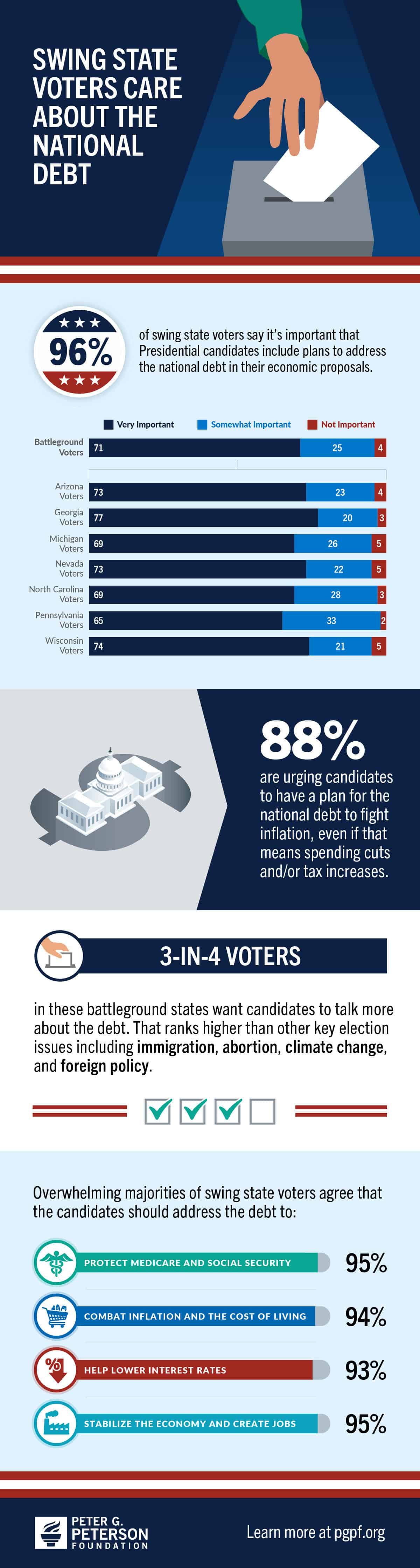

As we enter the final stretch of the 2024 election, Vice President Harris and former President Trump are tied across swing states – and new polling shows that the national debt is a critical issue for voters in these decisive states. More than 9-in-10 voters across seven key states — Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin — say it’s important for candidates to have a plan for the debt, including 95% of Harris voters, 97% of Trump voters and 95% of undecided voters.

Additionally, 3-in-4 voters in these battleground states say they want candidates to talk more about the debt and their plans to address it – outpacing the percentages of voters who say the same for other hot button election issues including immigration, abortion, climate change and foreign policy.

Thus far neither candidate has put forward a plan to address or $35 trillion national debt. A recent analysis from the Committee for a Responsible Federal Budget estimated that Harris’s campaign plan would increase the debt by $3.50 trillion through 2035, while President Trump’s plan would increase the debt by $7.50 trillion. But there’s still time for candidates to put forward plans, and there are many policy options to choose from.

Further Reading

Growing National Debt Sets Off Alarm Bells for U.S. Business Leaders

Debt rising unsustainably threatens the country’s economic future, and a number of business leaders have signaled their concern.

What Is R Versus G and Why Does It Matter for the National Debt?

The combination of higher debt levels and elevated interest rates have increased the cost of federal borrowing, prompting economists to consider the sustainability of our fiscal trajectory.

High Interest Rates Left Their Mark on the Budget

When rates increase, borrowing costs rise; unfortunately, for the fiscal bottom line, that dynamic has been playing out over the past few years.