On March 27, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the third phase of legislation designed to lessen the economic impact of the COVID-19 pandemic.

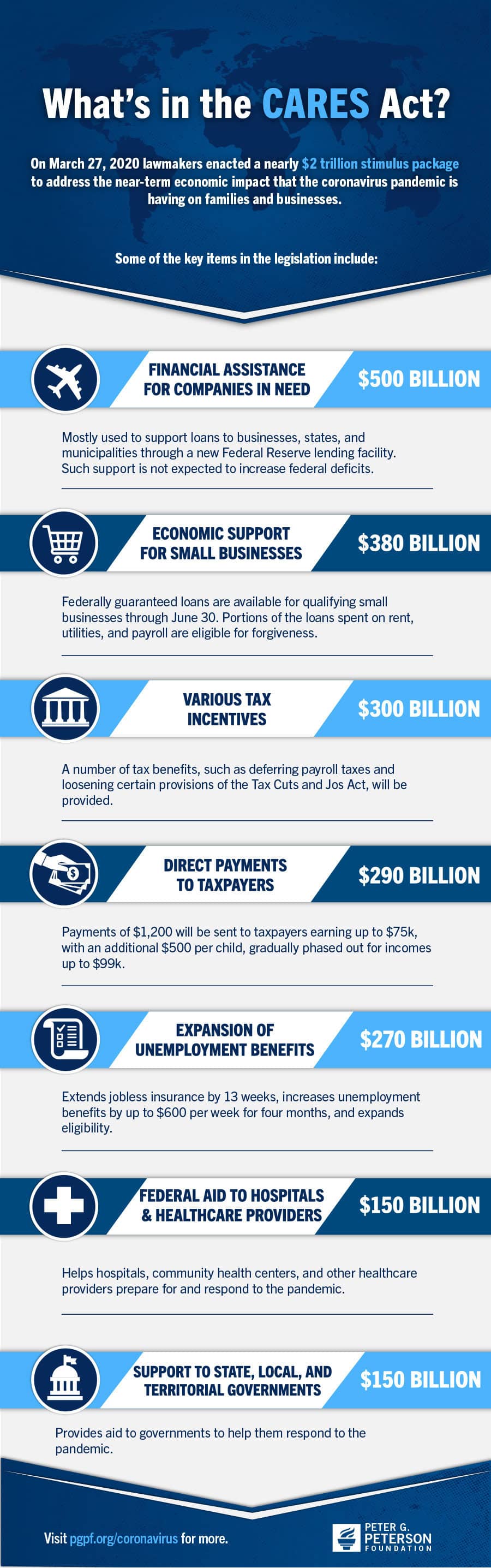

The largest emergency response bill in history, the CARES Act allocates nearly $2 trillion in emergency funding to provide relief to households, small and large businesses, states and municipalities, and healthcare providers, among others. Many commentators have noted that the CARES Act is better characterized as a relief bill, which addresses the more immediate fallout, than a stimulus plan, which would restore regular economic activity and is expected to roll out in subsequent phases.

This infographic breaks down the CARES Act to explain some key funding items in the legislation.

Further Reading

Lifting the Debt Ceiling Has Been Paired with Budget Reform in the Past

Earlier this year, the United States once again hit its debt ceiling, which is currently capped at $31.4 trillion.

Even with Economic Growth Factored in, OBBBA Would Increase Deficits

The small, positive fiscal impact from slightly higher economic growth is projected to be more than offset by increased federal interest costs.

House Reconciliation Bill Would Add Trillions to the National Debt

The bill would increase debt by $3.0 trillion over the next 10 years, driving it from nearly 100 percent of GDP now to 124 percent of GDP by 2034.