On November 19, 2021 the House passed the Build Back Better Act, a wide-ranging bill that aims to accomplish numerous priorities of the Biden Administration. According to a CRFB analysis of calculations from the Congressional Budget Office and the Joint Committee on Taxation, the legislation would raise the deficit over the next 10 years by $160 billion. While the new spending is mostly offset by other savings, the bill also includes a number of budget timing gimmicks which could hide its true cost.

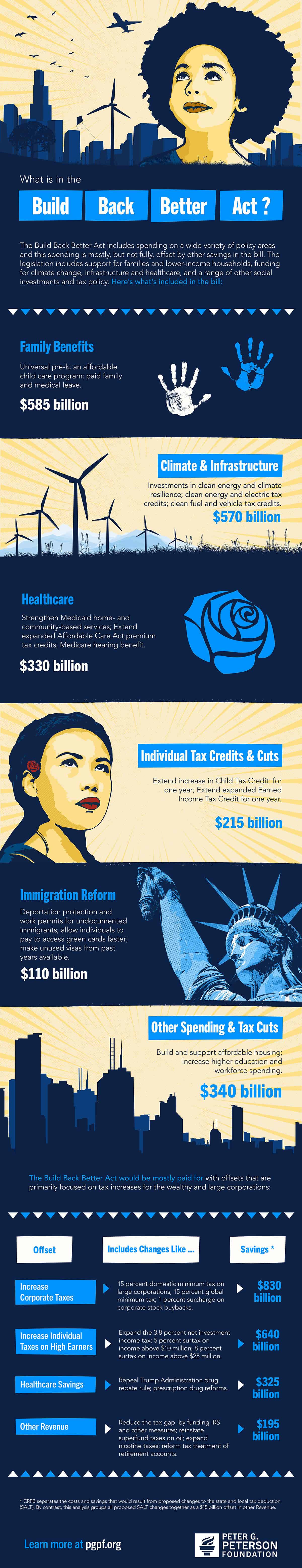

The proposed spending, tax cuts, and offsets are broken down in the following ways.

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.