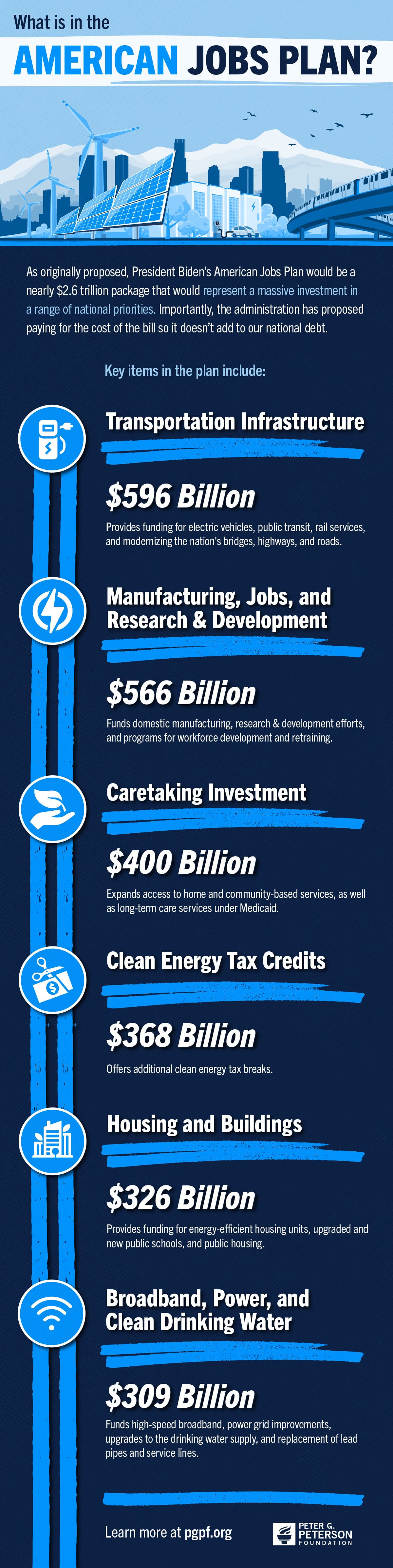

In May, the Administration released details for the proposed American Jobs Plan. It would be a massive investment in a range of national priorities including transportation, climate change, caregiving, and housing.

The Biden administration has proposed offsetting the spending in the $2.6 trillion package through changes to the corporate tax code, including an increase in the corporate tax rate.

The proposed spending in the American Jobs Plan covers a 10-year window and is broken down in the following ways.

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.