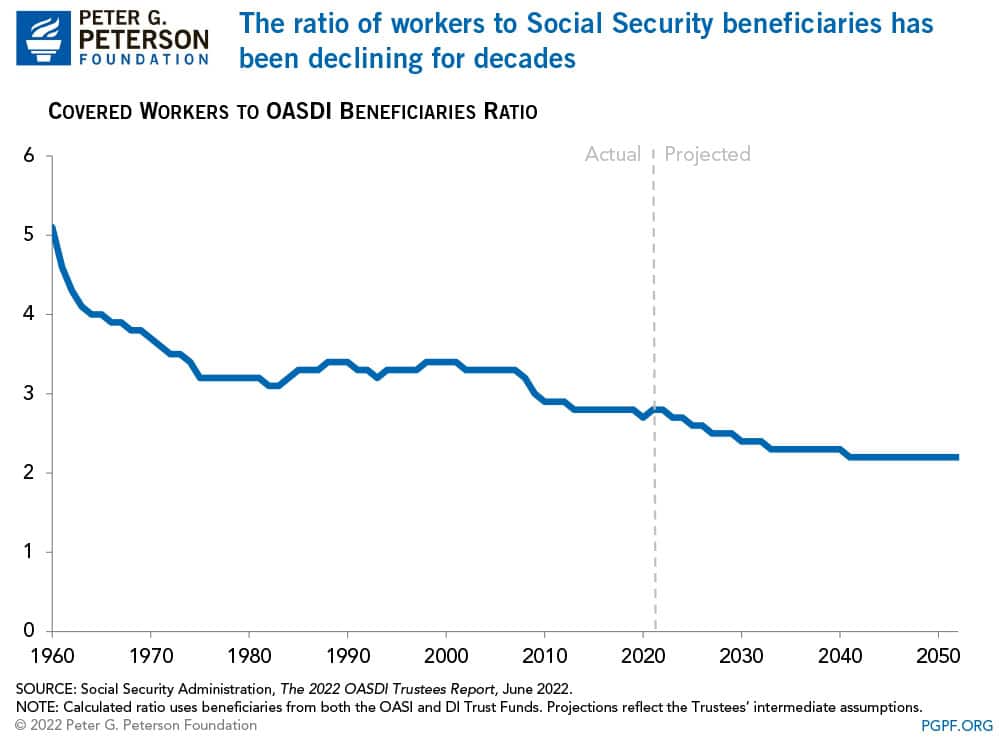

The Ratio of Workers to Social Security Beneficiaries Is at a Low and Projected to Decline Further

Social Security has been a cornerstone of economic security for almost 90 years, but the program is on unsound footing. Social Security’s combined trust funds are projected to be depleted by 2035 — just 13 years from now. A major contributor to the unsustainability of the current Social Security program is that the number of workers contributing to the program is growing more slowly than the number of beneficiaries receiving monthly payments. In 1960, there were 5.1 workers per beneficiary; that ratio has dropped to 2.8 today.

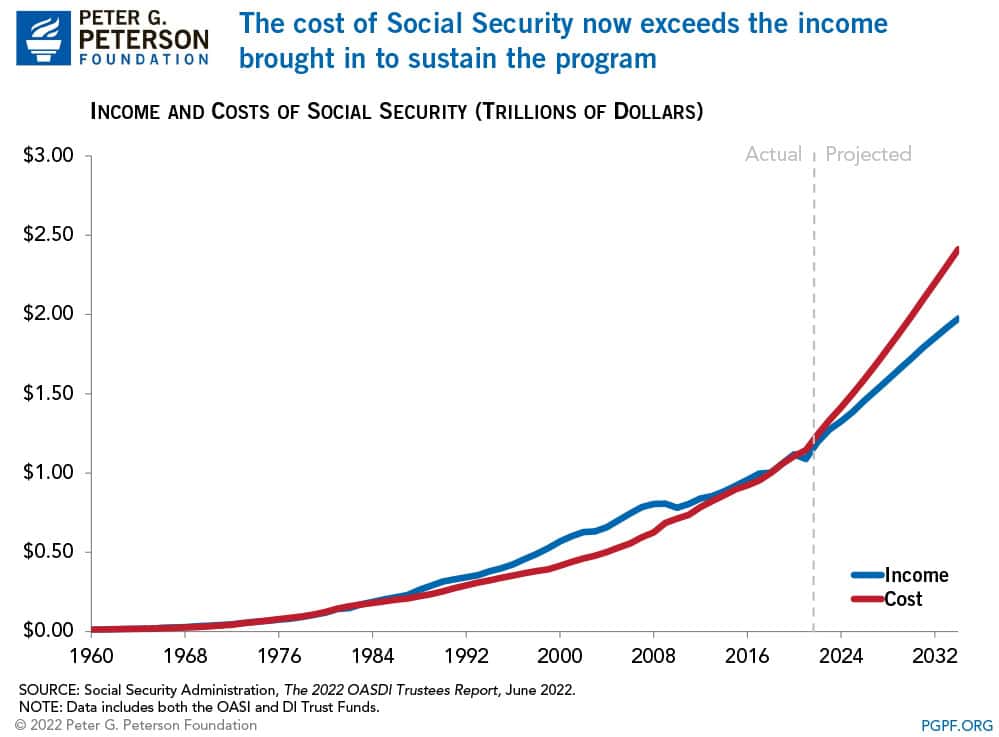

The declining ratio of workers to beneficiaries creates financial difficulties for Social Security. In 1960, the Social Security program had revenues of $12 billion and outlays just shy of $12 billion. However, by 2021, the smaller ratio led to outlays ($1,145 billion) exceeding revenues ($1,088 billion). As it stands now, the gap between outlays and income will continue to grow. By 2034, the last year before funds are expected to become depleted, the Social Security Trustees expect that costs will exceed income by $437 billion. When the trust funds are depleted, benefits will be limited by the income assigned to the program and absent changes to law, benefits would be reduced by 20 percent.

Why Is the Ratio Declining?

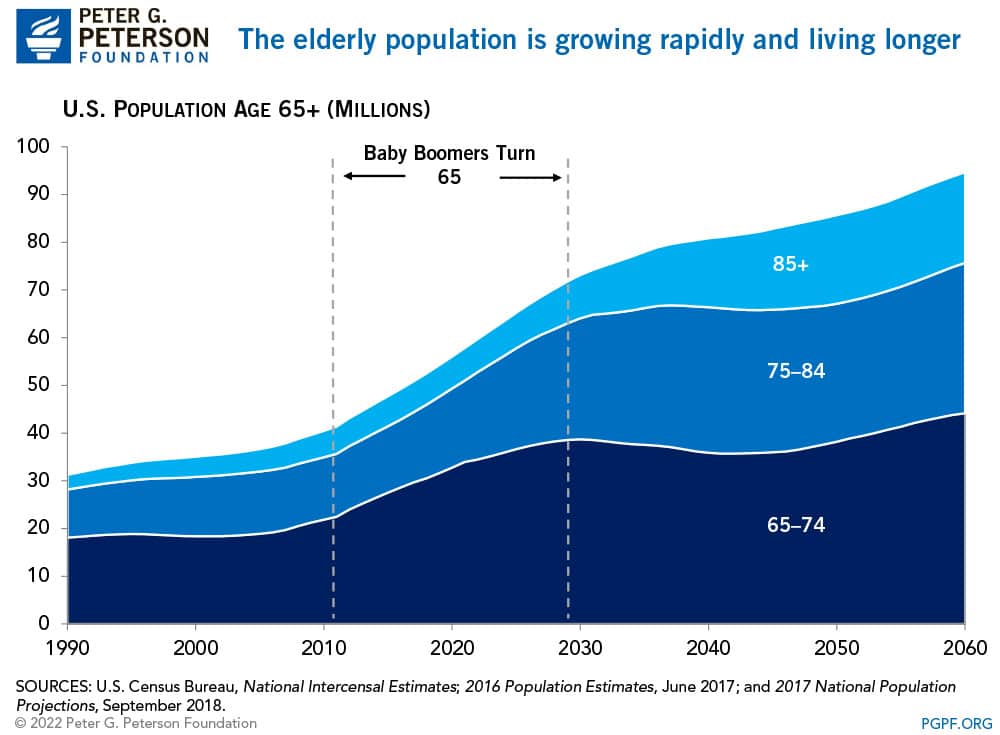

There are a few reasons why the ratio of workers to beneficiaries has been declining — most notably changes in fertility, immigration, and age of the population. Around the end of the baby boom in 1960, the average number of children born to a woman was 3.6; by 2020, that number had declined to 1.6. The decline in fertility rate means that the working generation is getting smaller relative to the generation receiving benefits. Immigration also plays a role in the population landscape because immigrants tend to be younger, have higher fertility rates, and participate in the workforce. However, the rate of immigration to the United States has been declining in recent years. Simultaneously, more Americans are getting older and living longer. In 1960, an individual who reached age 65 was expected to live to 80; today that person is expected to live to 85.

How Can Social Security Be Sustained?

There are some variations as to what researchers believe the minimum ratio of workers to beneficiaries should be — ranging from 2.8 to 3.3 — but all analyses warn that its current decline signals an unstable source of funding for Social Security. While it is more difficult to change the components of the ratio itself, the program could be reformed to ensure a sustainable future.

The good news is that there are many available solutions to ensure Social Security’s solvency: raising the retirement age, decreasing the program’s benefits, or increasing revenues dedicated to the program; pursuing all in combination would likely provide the most lasting and least painful adjustment for the future. For example, the Congressional Budget Office (CBO) estimates that if the federal retirement age was raised to 70, it would decrease federal outlays by $72 billion over the next several years (and by growing amounts thereafter). An example of a way to reduce benefits would be to link payments to average prices rather than lifetime earnings — CBO estimates that change would reduce outlays by $69 billion over a 10-year period. Lawmakers could also raise the tax rate or adjust the cap on income subject to payroll taxes. For instance, the current maximum taxable amount is $147,000, but CBO estimates that subjecting earnings above $250,000 to the payroll tax would raise more than $1 trillion in revenues over a 10-year period.

Social Security is the largest single line item in the budget and a key driver of the national debt; it is also an essential component of our economy and society. Regardless of what policies lawmakers choose, if reforms are not enacted soon, recipients could see a large decrease in their benefits. Because millions of people depend on Social Security, lawmakers need to ensure that benefit payments are adequate for individual financial security, but also sustainable to ensure the program’s solvency.

Image credit: Don Mason / Getty Images

Further Reading

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.

Budget Basics: Unemployment Insurance Explained

The Unemployment Insurance program is a key counter-cyclical tool to help stabilize the economy and speed recovery during downturns or crises.

Can We Raise the Retirement Age and Protect Vulnerable Workers?

Some policy options aim to protect economically vulnerable workers or those who are unable to delay retirement because they work in physically demanding occupations.