Delta Variant Slows Economy, But Output Still Better Than Pre-Pandemic Levels

Last Updated November 1, 2021

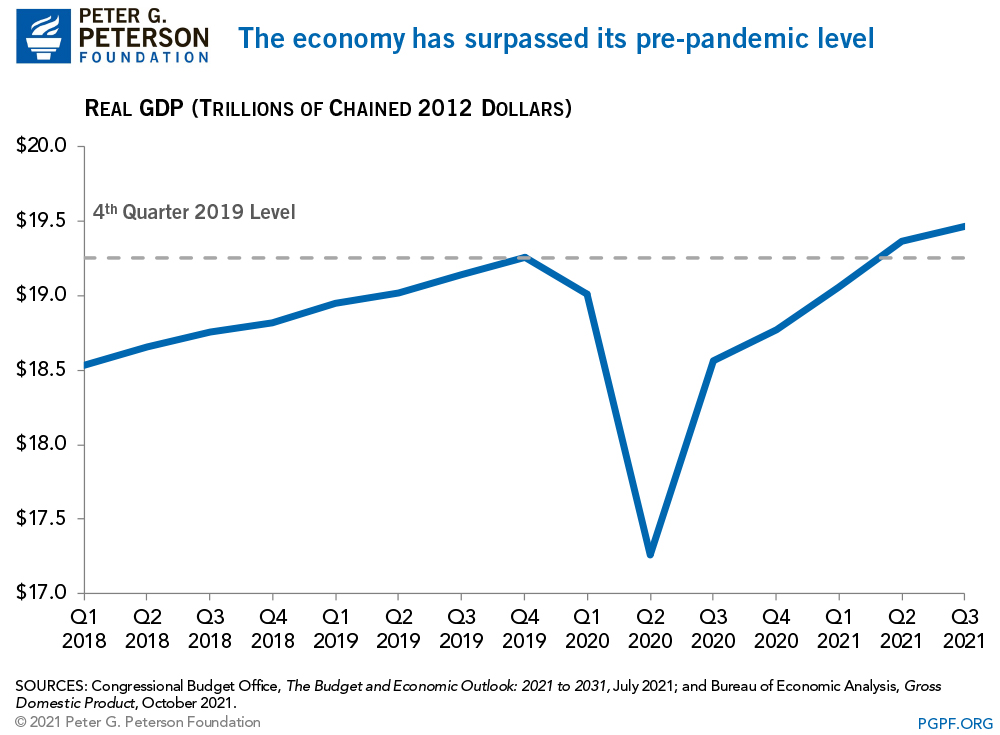

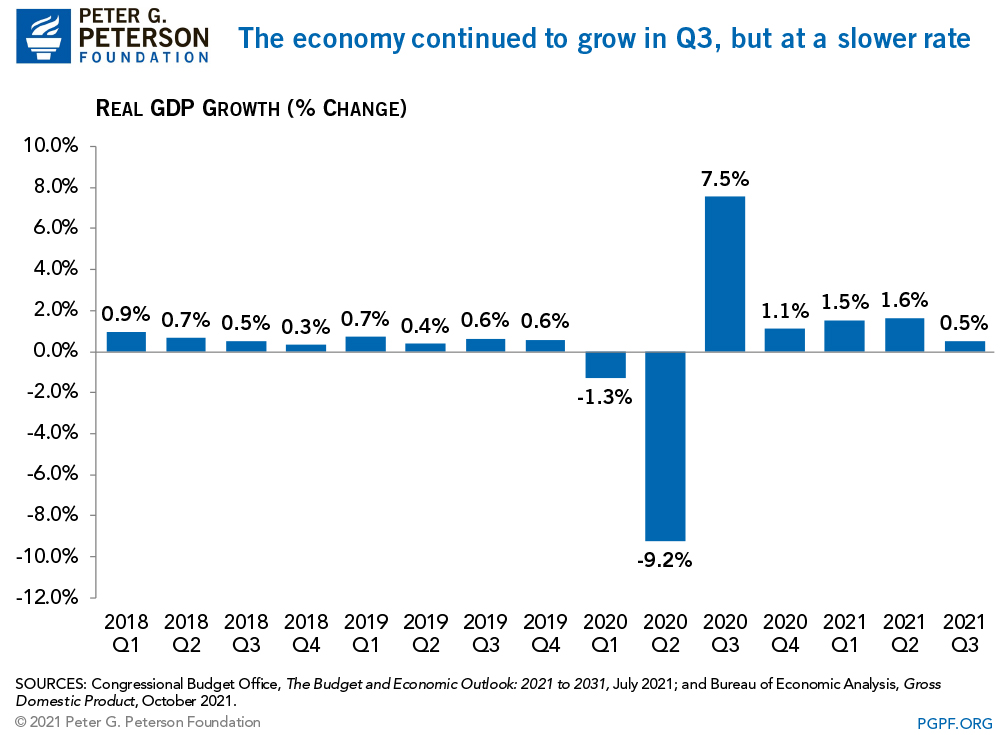

The economy continued to grow in the third quarter of 2021, but at a slightly slower pace than previous quarters due to the delta variant of COVID-19. New data from the Bureau of Economic Analysis (BEA) show that Q3 was the economy’s lowest-performing quarter of the year, yet gross domestic product (GDP) is still higher than it was before the pandemic.

Real (inflation-adjusted) GDP grew by an annual rate of 2.0 percent in the third quarter of 2021, according to the BEA. Looking at the quarter in isolation (without annualizing the growth), the economy grew by 0.5 percent, which was approximately the same as the growth rate in the fourth quarter of 2019 — the last quarter before the pandemic started.

The growth of GDP in the third quarter was driven by an increase in private investment (11.7 percent higher than the previous quarter) that mostly resulted from growth in intellectual property products. Personal consumption was also up by 1.6 percent last quarter; that growth reflects an increase of 7.9 percent in spending on services such as transportation and healthcare but a decrease of 9.2 percent in purchases of goods.

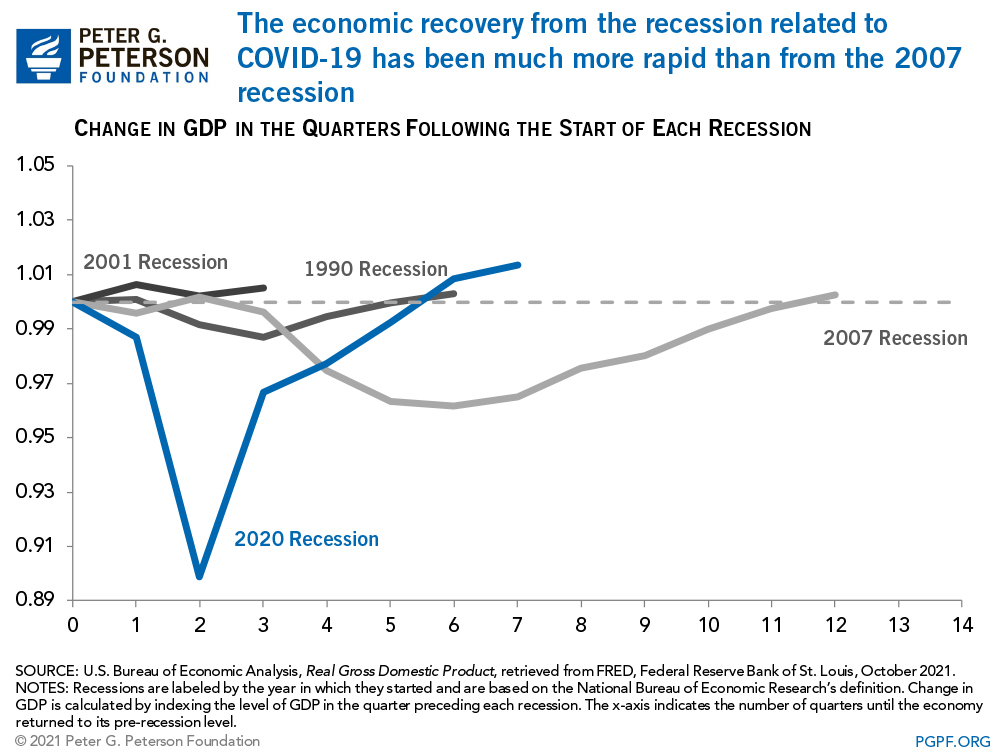

Though the delta variant has slowed growth over the last three months, overall our recovery in the past year is cause for optimism, as the rebound in economic output has been much quicker than witnessed in the last recession. New COVID-19 cases are now falling and consumer confidence is increasing, which leaves economists feeling optimistic about the state of the economy for the end of the year. The labor market is also recovering, though there are ongoing concerns that the recovery is not equally distributed, particularly for Black, Hispanic, and Asian workers.

As we continue to emerge from the pandemic, and as policymakers turn their eyes towards longer-term issues, they should keep in mind that our nation has a significant, existing fiscal imbalance that predates the pandemic, and strengthening our fiscal outlook for the years ahead is a necessary element of positioning America for its next chapter.

Image Credit: Spencer Platt/Getty Images

Further Reading

National Debt Puts Upward Pressure on Inflation and Interest Rates

America’s unsustainable fiscal outlook can have “significant consequences for price stability, interest rates, and overall economic performance,” according to a new report.

Why Is the Federal Deficit High If Unemployment Is Low?

The U.S. is experiencing an unusual and concerning phenomenon — the annual deficit is high even though the unemployment rate is low.

What Is Inflation and Why Does It Matter?

Here’s an overview of inflation, why it matters, and how it’s managed.