Today, President Biden signed the Infrastructure Investment and Jobs Act, bipartisan legislation that provides new federal investment for infrastructure over the next five years. The legislation also includes various provisions that lawmakers claim will fully pay for the additional spending, but a cost estimate from the Congressional Budget Office (CBO) indicates that those pay-fors will not offset the full cost of the bill.

What Are the Budgetary Offsets Proposed in the Infrastructure Package?

CBO expects the bipartisan package to increase discretionary spending by $415 billion and mandatory spending by $10 billion. Offsetting provisions are projected to reduce outlays by about $120 billion and increase revenues by about $50 billion.

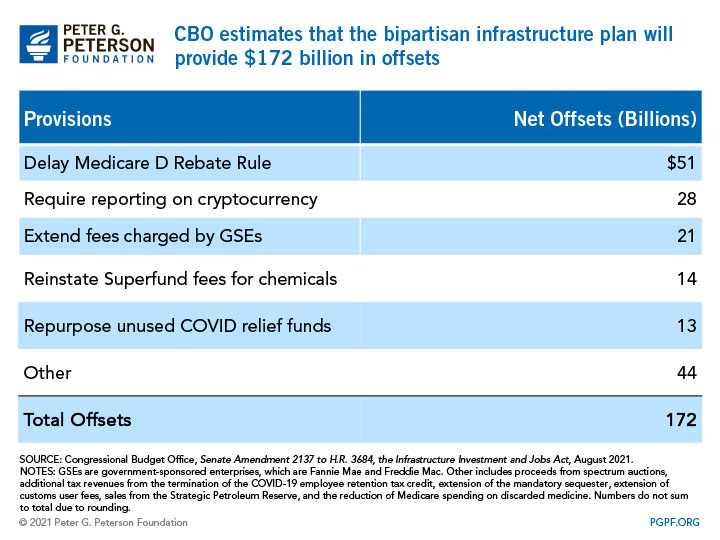

The largest offsets in the package are:

- A delay in the Medicare Part D rebate rule. The rule, which aims to regulate the price of drugs by banning certain rebates, was projected to increase federal spending on Medicare. CBO estimates that delaying the rule’s implementation from 2023 to 2026 would save future costs.

- Heightened tax enforcement of cryptocurrencies. The provision would increase revenues by requiring information reporting on digital assets like cryptocurrencies.

- An extension of higher fees charged by Fannie Mae and Freddie Mac. The provision would extend the higher guarantee fees that the government-backed mortgage companies charge to lenders, a policy that was set to expire later this year.

- Reinstatement of Superfund fees for chemicals. The provision would bring back taxes charged on certain chemicals, which used to help pay for Superfund pollution cleanups.

- Rescission of unspent COVID-19 funds. The provision would repurpose a small amount of the funds that were enacted in relation to the pandemic.

In total, CBO expects those provisions to provide $172 billion to offset the cost of the legislation.

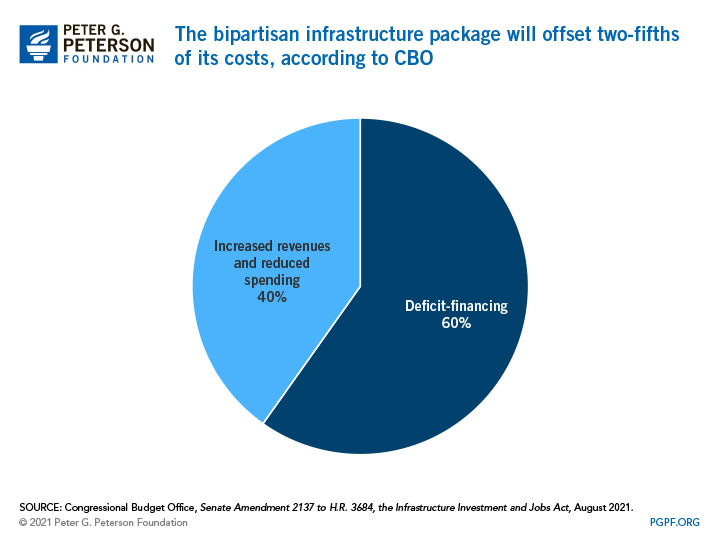

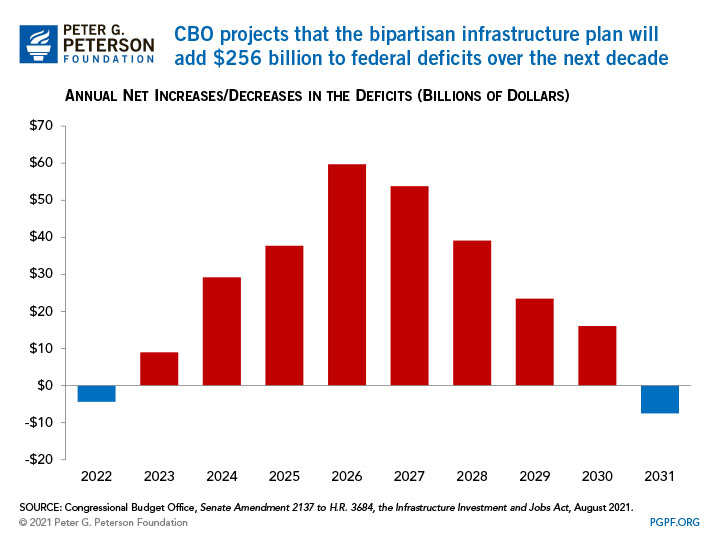

According to CBO, the legislation’s pay-fors will offset only about 40 percent of the total cost; the legislation will therefore increase federal deficits by $256 billion over the next decade.

CBO did not estimate the potential macroeconomic effects of the legislation, which lawmakers claim would include productivity and tax revenue increases to help pay for the additional spending. Lawmakers also claimed savings from lower-than-expected spending for unemployment compensation and other COVID-related relief that CBO had already accounted for in its baseline.

Conclusion

Despite lawmakers’ claims, analysts anticipate that a large portion of the spending in the infrastructure package will be deficit financed. While it is commendable that lawmakers at least partially offset this new spending, which represents investments in America’s future, the bill falls short of being fully fiscally responsible.

Image credit: Photo by Mark Wilson / Getty Images

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.