Without further action from policymakers, several federal programs that were enacted to mitigate the economic damage from the coronavirus (COVID-19) pandemic will expire by the end of the year. Those programs have been playing a crucial role in supporting the economy, individuals, and businesses during the pandemic.

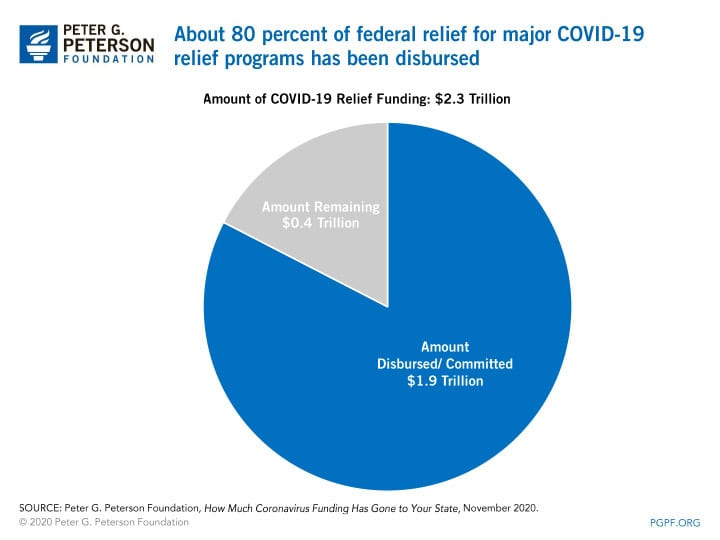

Policymakers have provided about $2.3 trillion in federal funding for the largest COVID-19 relief programs (not including indirect aid such as tax deferrals, certain credit programs, and backing for lending facilities run by the Federal Reserve). As of November 17, about $1.9 trillion of that funding had already been disbursed.

Below is an overview of some of the programs that face impending deadlines or are set to expire soon.

Economic Impact Payments

Applications close after Nov. 21

Over the past several months, the Internal Revenue Service (IRS) has sent $269 billion in economic impact payments (also referred to as stimulus payments) to 153 million Americans; the payments typically total $1,200 for individuals and $2,400 for married couples, plus $500 for each qualified child. However, many Americans who do not normally file a tax return but are still eligible for the payment have yet to receive one. The IRS is urging such individuals to register online by November 21 so they can receive their Economic Impact Payment this year. The Congressional Budget Office estimates that the program will eventually cost a total of $281 billion.

Economic Injury Disaster Loans

Applications close after Dec. 21

Eligible small businesses and qualified agricultural businesses that were affected by the COVID-19 pandemic can apply for low-interest loans administered by the Small Business Administration. While the money must be paid back in full, payments can be delayed for one year. Applicants have until December 21 to apply for such loans. Funding for other small business programs have either expired, such as with the Paycheck Protection Program, or have been fully exhausted, such as with the Economic Injury Disaster Loan Advances.

Coronavirus Relief Fund

Benefits expire after Dec. 30

This funding to state and local governments has partially alleviated the budgetary challenges they face due to the pandemic. While those governments have already used most of those funds, they have until December 30 to spend any remaining allocations.

Extension of Unemployment Benefits

Benefits expire after Dec. 31

Policymakers extended unemployment benefits primarily through three major programs. The largest of those programs, the Federal Pandemic Unemployment Compensation Program, increased benefits by $600 per week and expired on July 31. The remaining programs are set to expire on December 31:

- Expansion of Unemployment Benefits by 13 Weeks. This program, referred to as the Pandemic Emergency Unemployment Compensation program, extends unemployment aid to those who have exhausted their regular unemployment benefits.

- Expansion of Unemployment Eligibility. By expanding eligibility for unemployment to people who are not usually qualified, such as self-employed workers and people without sufficient work history, the Pandemic Unemployment Assistance program provides benefits to more Americans for up to 39 weeks.

Unless further action is taken, an estimated 12 million Americans will lose federal unemployment benefits when those programs expire.

Federal Reserve Lending Facilities

Benefits expire after Dec. 31

To help support the economy, the Federal Reserve (with Treasury backing to cover potential losses) established a number of lending facilities to provide loans, credit, and liquidity to various parts of the economy. Many of those facilities, including the Main Street Lending Program — which facilitates lending to small- and mid-sized business — are set to expire on December 31. The Department of the Treasury recently asked the Federal Reserve to allow some of those programs to expire and return any unspent funds.

Tax Credits and Deferrals

Benefits expire after Dec. 31

Policymakers also enacted a number of temporary tax benefits to help organizations and their employees:

- Employee Retention Credit. To incentivize businesses to keep employees on their payroll, this credit is available to qualified employers who were affected by the pandemic and is equivalent to 50 percent of qualified wages paid by employers from March 13 through December 31 (up to a maximum of $5,000 per employee).

- Deferring Payment of Payroll Taxes. Employers are able to delay payment of their payroll taxes from March 27 through December 31 of this year; half of that deferred amount would be due by December 31, 2021 and the remaining half would be due by December 31, 2022.

- Other tax benefits, such as loosening limits on businesses losses, expire at the end of December.

Other Coronavirus Relief Programs

Benefits expire after Dec. 31

A variety of other benefits — such as the requirement to provide emergency paid leave benefits and the national eviction moratorium — also expire at the end of this year.

Image credit: Photo by John Sommers II/Getty Images

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.