New CBO Report: Pandemic Accelerates Existing Fiscal Challenges

Last Updated September 22, 2020

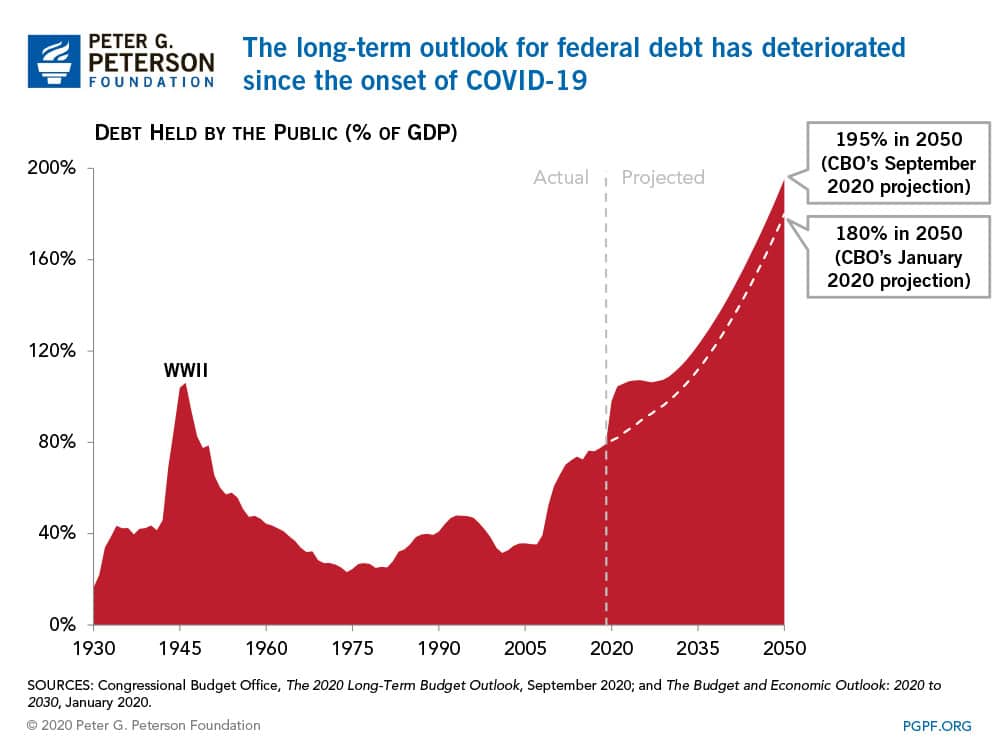

Yesterday, the Congressional Budget Office (CBO) released updated long-term budget projections that show the path of federal revenues, spending, and debt through 2050. Those projections offer a look at the nation’s fiscal outlook for the decades ahead, incorporating the effects of the coronavirus (COVID-19) pandemic on federal finances. Overall, the report shows that the pandemic accelerated an already unsustainable fiscal trajectory because of its devastating effect on the economy and the necessary legislative response. Here are five key takeaways from CBO’s latest projections.

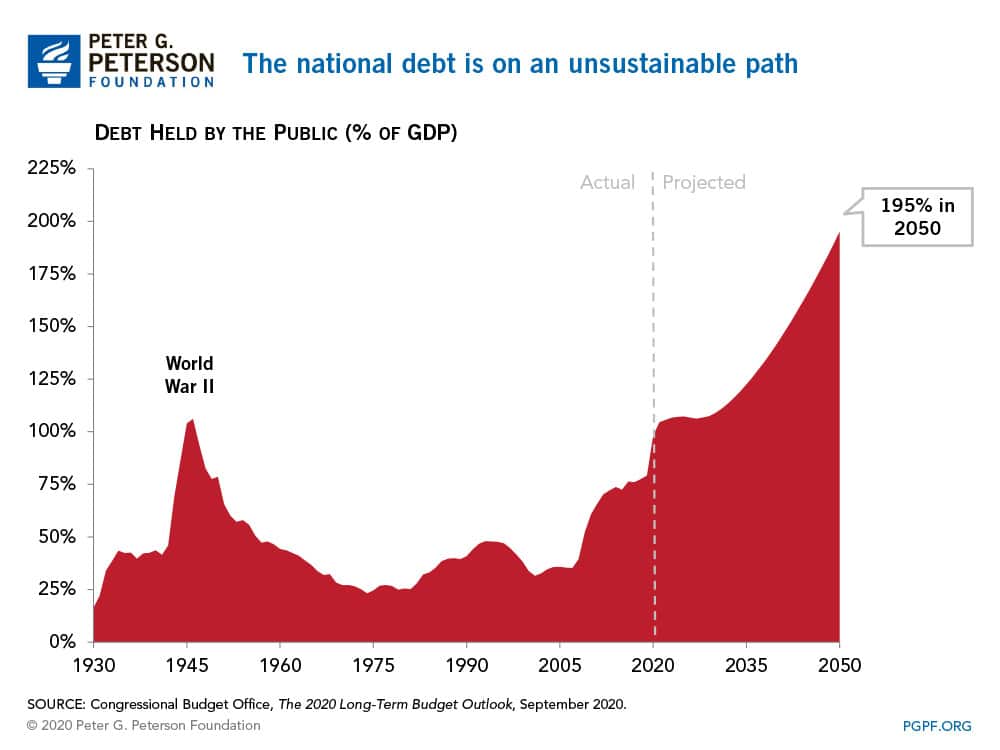

1. CBO projects that debt will reach nearly twice the size of the economy by 2050. Debt is expected to rise rapidly throughout the 30-year period covered in the report, nearing the size of the U.S. economy by the end of this year and breaking the all-time record high debt-to-GDP ratio of 106 percent in 1946.

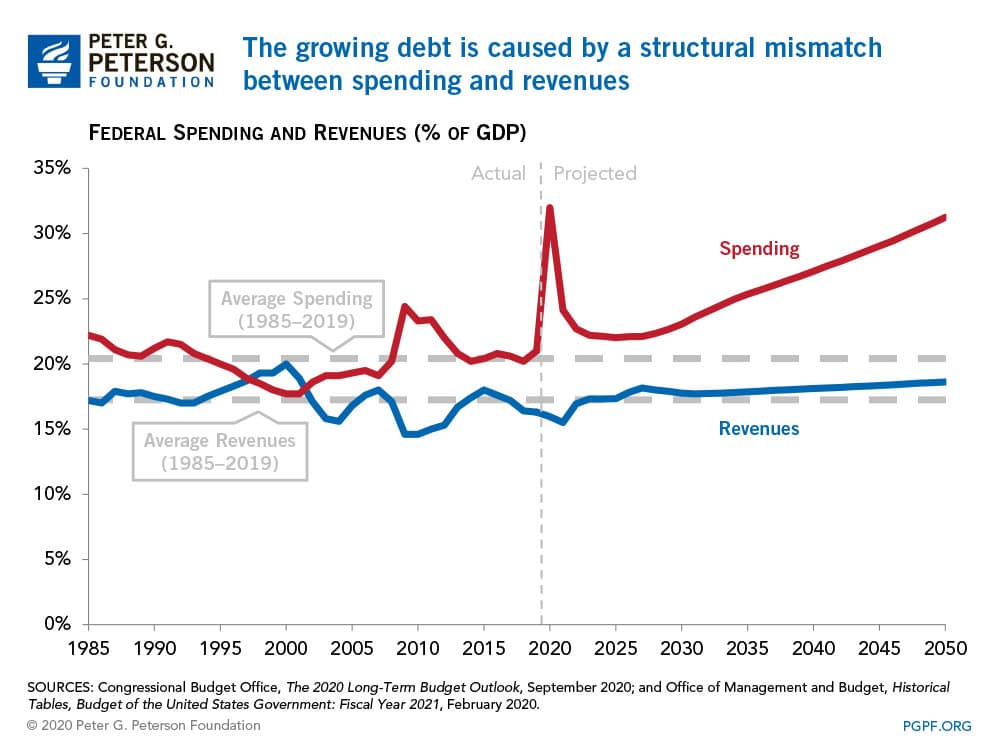

2. There is a fundamental mismatch between spending and revenues. Spending will fall from 32 percent of GDP this year to 24 percent of GDP in 2021, CBO projects, reflecting the waning of the programs enacted thus far in response to the COVID-19 pandemic. However, structural factors will cause spending to rise from that level over the next 30 years, reaching 31 percent of GDP in 2050. While revenues rise slightly over the next 30 years relative to the size of the economy, CBO does not project them to keep pace with spending.

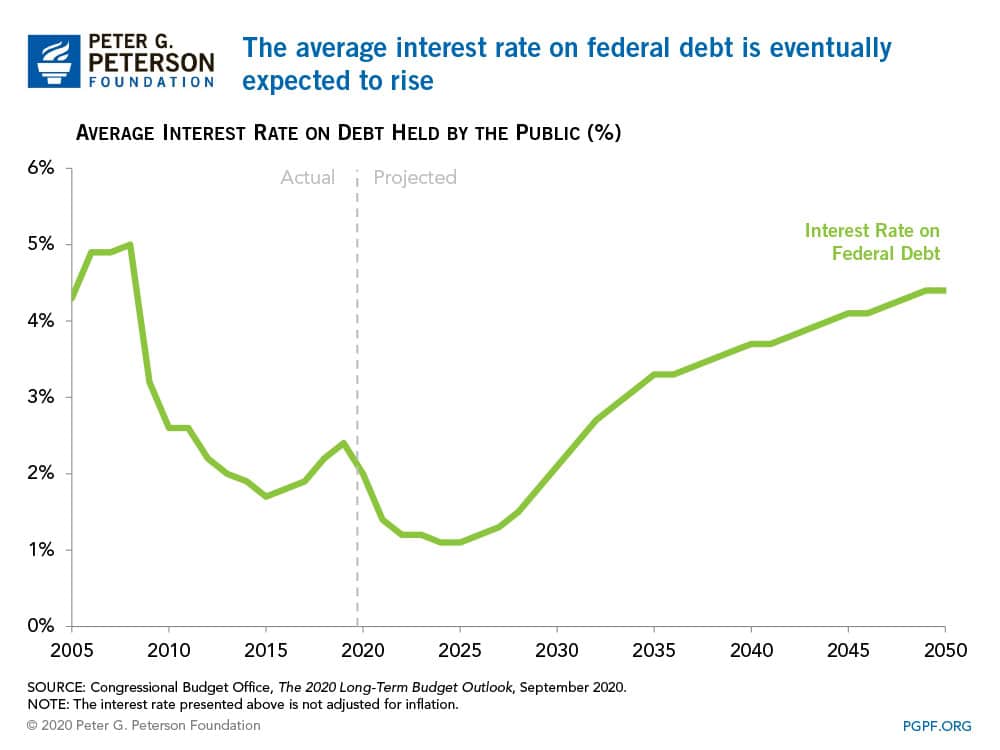

3. The latest projections of debt are based on the assumption that interest rates will rise later in this decade. This year, the average interest rate on debt is 2.0 percent; CBO projects that the average will remain below that level until the end of the decade, but will eventually rise higher. By 2050, they report an average rate of 4.4 percent.

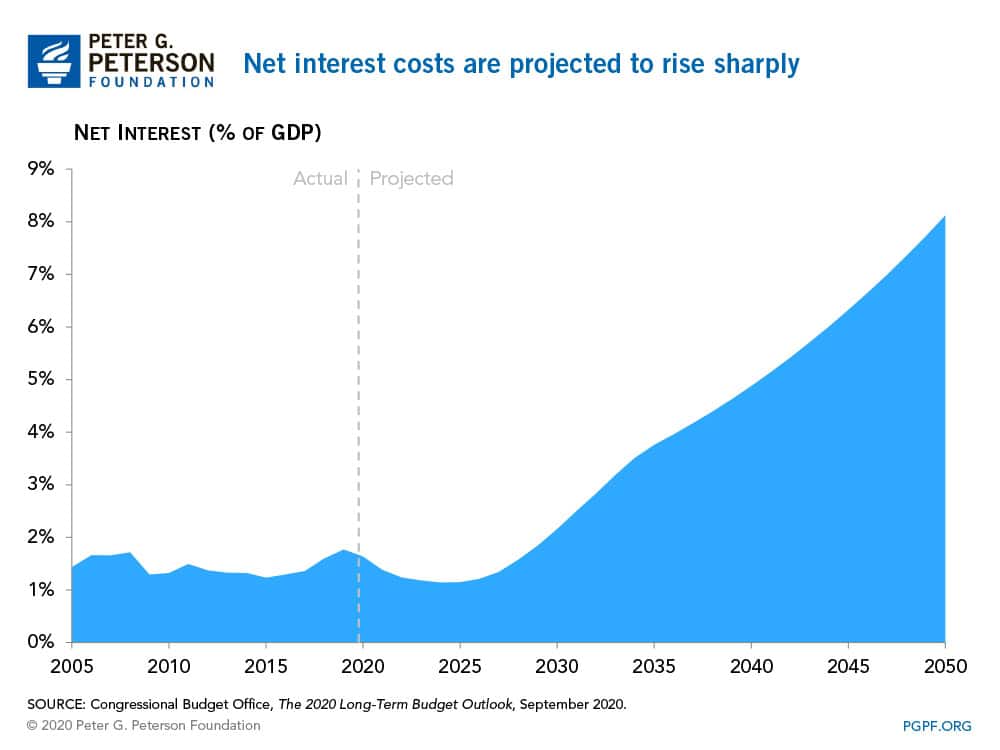

4. Growth in the debt and rising interest rates will push interest costs up substantially over the 30-year horizon. CBO projects that interest costs will rise dramatically from 1.6 percent of GDP in 2020 to 8.1 percent in 2050.

5. The long-term fiscal outlook has deteriorated as a result of the economic downturn and the legislative response to it. In January 2020, CBO projected that debt would reach 180 percent of GDP by 2050; the latest projection shows a debt-to-GDP ratio of 195 percent of GDP.

As the COVID-19 pandemic continues to unfold, significant health and economic issues will persist. However, after those hurdles have been cleared, attention will need to shift back to addressing the alarming long-term budget outlook that is outlined in this new CBO report.

Image credit: Getty Images

Further Reading

Growing National Debt Sets Off Alarm Bells for U.S. Business Leaders

Debt rising unsustainably threatens the country’s economic future, and a number of business leaders have signaled their concern.

What Is R Versus G and Why Does It Matter for the National Debt?

The combination of higher debt levels and elevated interest rates have increased the cost of federal borrowing, prompting economists to consider the sustainability of our fiscal trajectory.

High Interest Rates Left Their Mark on the Budget

When rates increase, borrowing costs rise; unfortunately, for the fiscal bottom line, that dynamic has been playing out over the past few years.