Breaking Down the $48 Billion of Airline Industry Payroll Support in Coronavirus Relief Legislation

Last Updated February 3, 2021

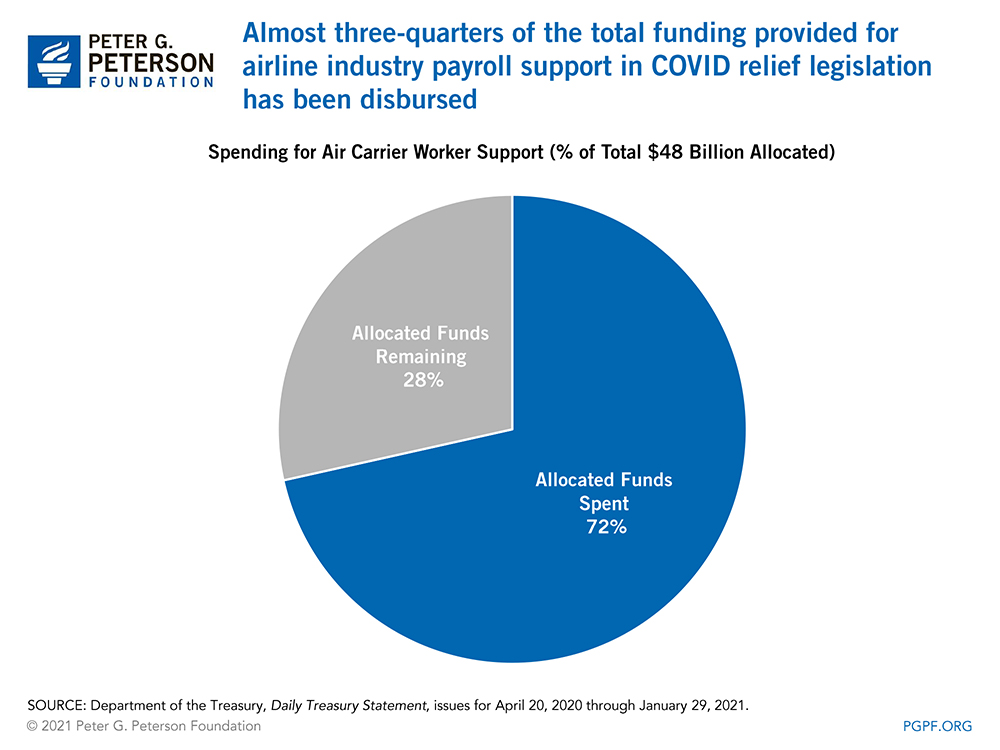

On March 27, 2020, the president signed into law the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the third phase of legislation designed to lessen the economic impact of the COVID-19 pandemic. One important component of the CARES Act was the Payroll Support Program (PSP1), which provided up to $32 billion in federal aid to maintain employment in the airline industry by providing funds to cover employee wages, salaries, and benefits. On December 27, 2020, policymakers enacted the 2021 Consolidated Appropriations Act, which provided an additional $16 billion in federal financial assistance to air carriers through the Payroll Support Program Extension (PSP2). Between both pieces of legislation, the total amount of funding has been allocated in the following ways:

- $40 billion to passenger air carriers

- $4 billion to cargo air carriers

- $4 billion to certain contractors providing services to air carriers

Upon successful application for the PSP2, an employer can receive assistance equal to the full amount paid to its employees between October 1, 2019 and March 31, 2020. In exchange, the airlines must avoid layoffs and furloughs through the end of March 2021.

As of January 29, 2021, the Department of the Treasury has disbursed over $34 billion of the total $48 billion allocated to air carriers through the PSP1 and PSP2.

Image credit: Photo by Rob Carr/Getty Images

Further Reading

Here’s How No Tax on Overtime Would Affect Federal Revenues and Tax Fairness

Excluding overtime pay from federal taxes would meaningfully worsen the fiscal outlook, while most of the tax benefits would go to the top 20% of taxpayers.

No Taxes on Tips Would Drive Deficits Higher

Eliminating taxes on tips would increase deficits by at least $100 billion over 10 years. It could also could turn out to be a bad deal for many workers.

Full Array of Republican Tax Cuts Could Add $9 Trillion to the National Debt

Fully extending the TCJA would cost approximately $5.0 trillion, while other elements of the Republican tax agenda also have large price tags over ten years.