See How the Coronavirus Has Impacted 10-Year Projections for GDP and More

Last Updated July 7, 2020

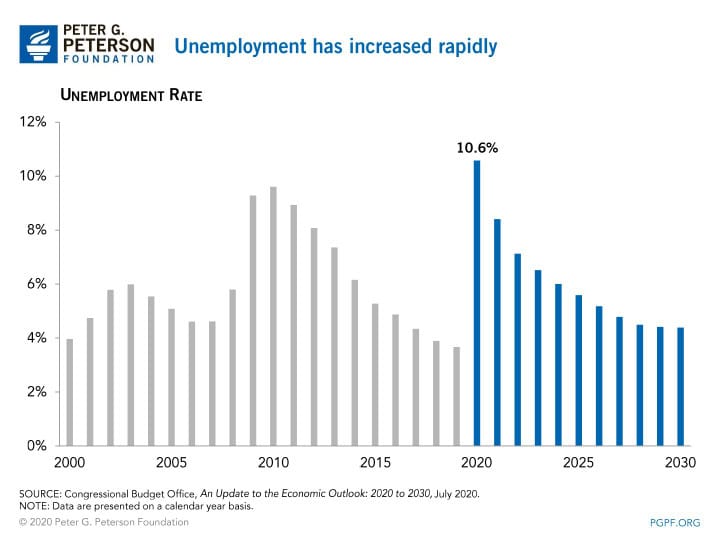

It’s going to take at least a decade for the labor market to recover from the coronavirus (COVID-19) pandemic, according to the latest data from the Congressional Budget Office (CBO).

CBO’s updated assessment of America’s economic outlook for 2020 to 2030 takes into account the effects of the pandemic and underscores the severe economic damage it has caused. CBO anticipates that the unemployment rate will remain above its pre-pandemic level through 2030.

In CBO’s estimation, the unemployment rate will reach 14.1 percent in the third quarter of 2020 before decreasing steadily through 2028. Towards the end of the projection, unemployment is expected to stabilize at 4.4 percent, or 0.7 percentage points above the rate in 2019.

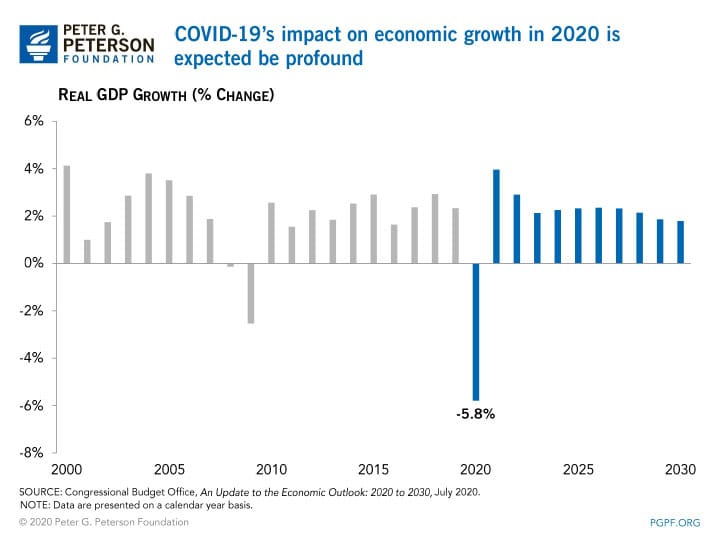

Economic growth is projected to bounce back more quickly. CBO expects that after a significant contraction in the beginning of 2020, gross domestic product (GDP) will strengthen later in the year and continue to exhibit strong growth through 2021. Real GDP (which is adjusted for inflation) is projected to contract by 5.8 percent for the full year in 2020 and increase by 4.0 percent in 2021. From 2023 to 2030, CBO projects that the economy will recover further and see sustained but lower growth, averaging 2.1 percent annually.

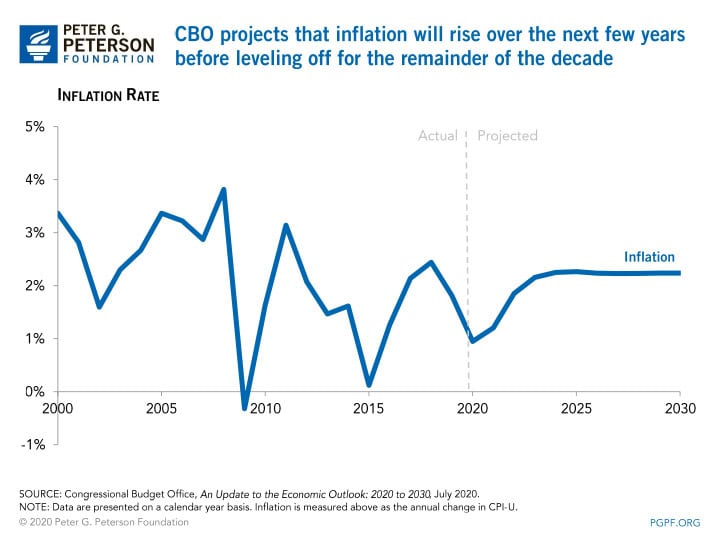

Inflation, as measured by the consumer price index for all urban consumers, is expected to increase gradually from 0.9 percent in 2020 to 2.3 percent in 2025. For the remainder of the projection period, it will remain at 2.2 percent. CBO expects the Federal Reserve to keep its target rate stable throughout the period.

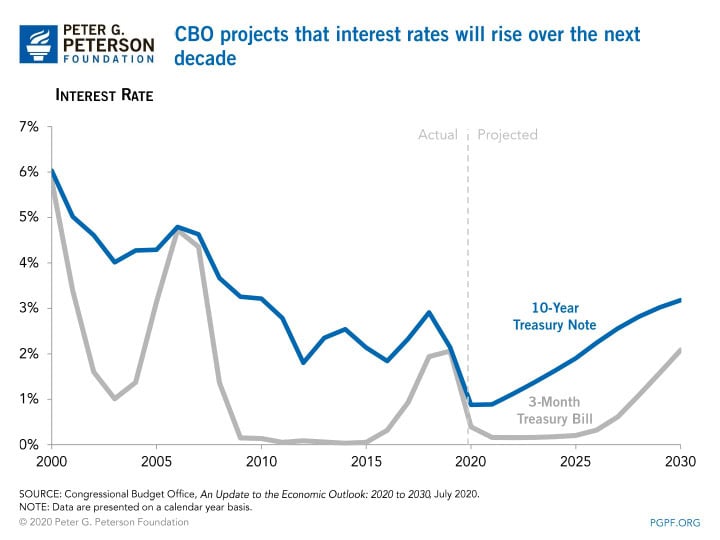

Interest rates, which prior to the pandemic had been in decline, are anticipated to remain low in 2020 and 2021. Thereafter, CBO projects that long-term rates will steadily increase while short-term rates remain near zero through 2026. By 2030, short-term rates will rise to 2.1 percent.

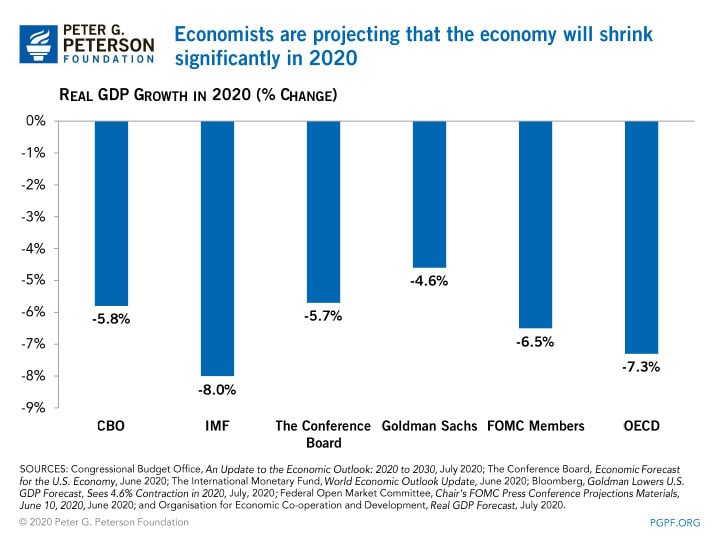

This economic forecast reflects CBO’s first complete set of projections since the pandemic, taking into account many scenarios related to various waves of the disease, social distancing measures, and how effective monetary and fiscal policy measures will be. CBO’s projections are in the middle of the distribution of possible outcomes, but the agency cautions that they remain subject to an unusually high degree of uncertainty. Nevertheless, other forecasters are projecting similarly strong economic contractions in the near term.

Those forecasts underscore the seriousness of the pandemic and the uncertain road to recovery. As an eventual economic recovery takes shape, policymakers should consider how to bolster the economy and create a strong fiscal foundation for sustained economic growth.

Image credit: Photo by Spencer Platt/Getty Images

Further Reading

National Debt Puts Upward Pressure on Inflation and Interest Rates

America’s unsustainable fiscal outlook can have “significant consequences for price stability, interest rates, and overall economic performance,” according to a new report.

Why Is the Federal Deficit High If Unemployment Is Low?

The U.S. is experiencing an unusual and concerning phenomenon — the annual deficit is high even though the unemployment rate is low.

What Is Inflation and Why Does It Matter?

Here’s an overview of inflation, why it matters, and how it’s managed.