The President’s Budget Reduces Debt a Little, but Only if Growth Is Rosier Than Projected

Today, President Trump released the summary of his third budget, which outlines the administration’s policy proposals, budget projections, and economic forecast for the next decade. Although the budget would achieve some deficit reduction on paper under the administration’s calculations, it fails to address the key drivers of our long-term debt and relies on overly-optimistic assumptions for economic growth.

Below are five key takeaways from the president’s budget:

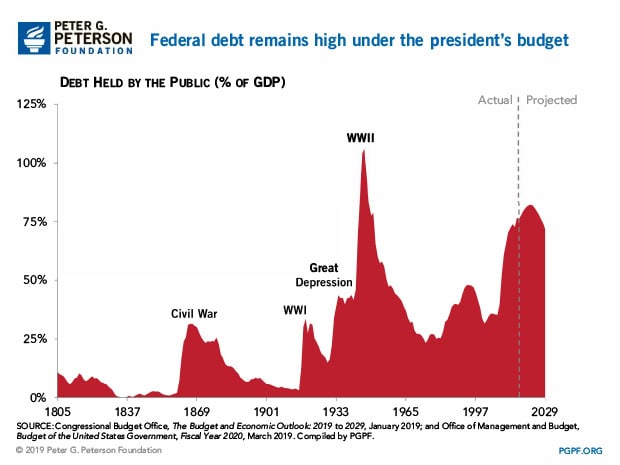

1. Debt would still be high in 10 years. Under the administration’s calculations, debt as a percentage of GDP will only decrease marginally, from 78 percent at the end of 2018 to 71 percent at the end of 2029.

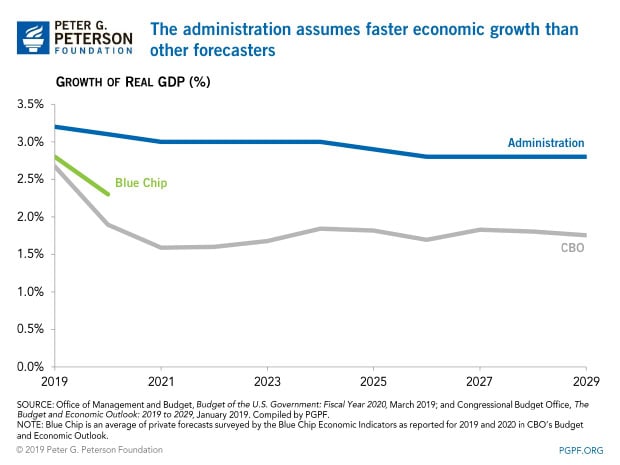

2. The president’s budget relies on overly-optimistic assumptions for growth. The president’s budget would reduce the annual deficit to 0.6 percent of GDP in 2029, compared to 5.1 percent of GDP estimated for 2019. This reduction, however, relies on an assumption that real (inflation-adjusted) gross domestic product (GDP) will average 2.9 percent growth annually over the next 10 years — significantly above other forecasts.

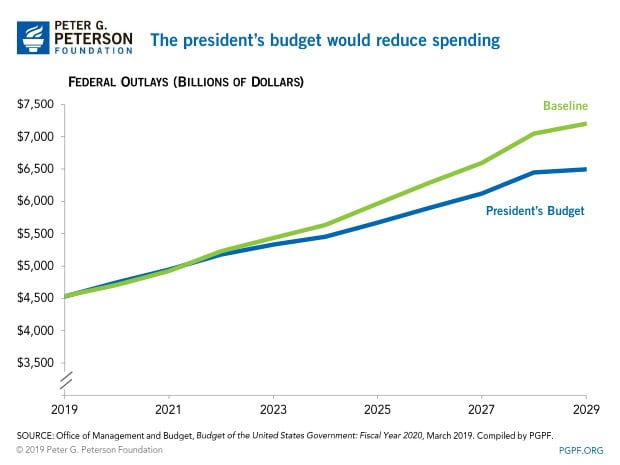

3. Spending cuts under this budget are large. Over the next 10 years, spending under the president’s budget is projected to be $2.7 trillion less than under the administration’s baseline.

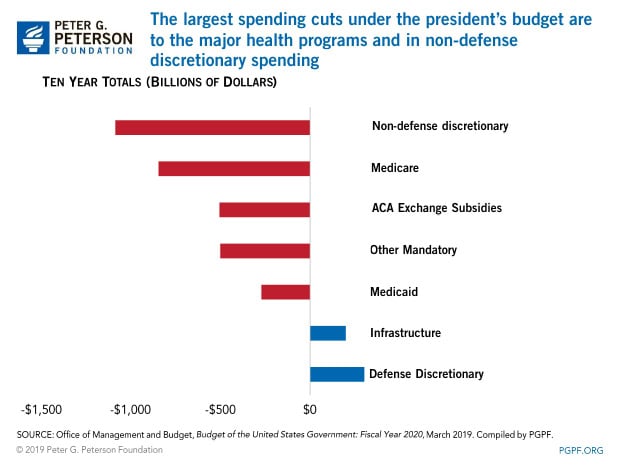

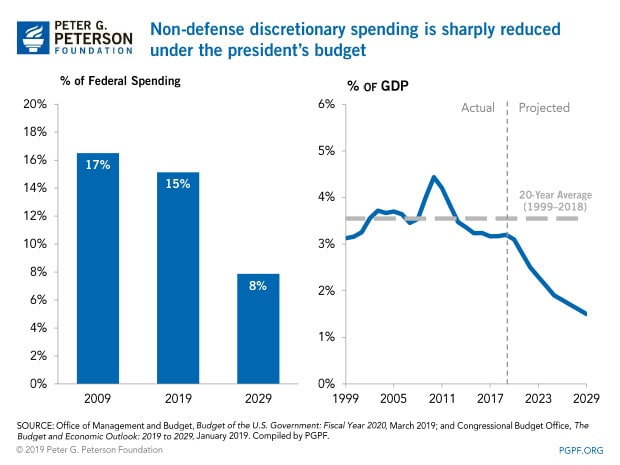

4. Most of the spending cuts under the president’s budget focus on non-defense discretionary spending and major health programs. Under the president’s budget, non-defense discretionary spending would generate the largest spending reductions. A number of healthcare programs would also be reduced. At the same time, defense spending would rise by $510 billion and funding would be provided for an infrastructure initiative. The president also proposes to extend provisions of the Tax Cuts and Jobs Act that are scheduled to expire at the end of December 2025; however, that action is not classified as a policy change by the administration.

5. The largest cuts are to nondefense discretionary spending, but that is a small portion of the budget. The president’s budget proposes reductions in non-defense discretionary spending of $1.1 trillion, or 16 percent, over the next 10 years. Nondefense discretionary spending covers a wide range of government programs, including key investments in our future such as infrastructure, education, and research & development, but currently makes up only 15 percent of the total budget; that proportion would be nearly cut in half under the president’s proposals.

The president’s budget underlines the need for further discussion about our fiscal policy. Despite optimistic economic assumptions and sharp spending cuts, debt as a percentage of GDP remains high and the structural causes of rising deficits are left unaddressed. The administration and Congress should commit themselves to effective budgeting to build a secure fiscal foundation for economic growth.

Image credit: Mark Wilson / Getty Images

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.