The International Monetary Fund (IMF) recently released the fall edition of its 2018 World Economic Outlook, a periodic report examining the global economy. Although the report forecasts continued growth for at least the next year, broader trends indicate that many economies, both advanced and developing, can expect a slowdown in the not-so-distant future.

Specifically, the report notes that “U.S. growth will decline as fiscal stimulus begins to unwind in 2020, at a time when the monetary tightening cycle is expected to be at its peak.” In other words, the boost to economic growth in the U.S. from the tax cuts and increased spending enacted over the past year is anticipated to diminish over the next year or so — while at the same time interest rates will be rising.

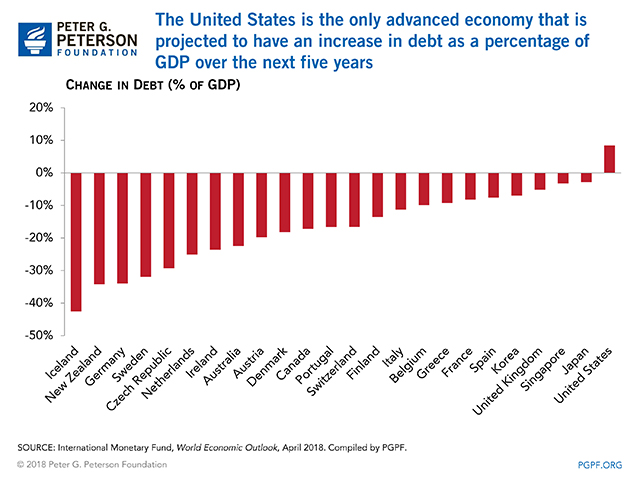

As we near this dangerous confluence of events, the United States unfortunately stands alone as the only country among advanced economies that is projected to have an increase in debt as a percentage of GDP over the next five years.

In its report, the IMF provides several observations about the current budget and economic situation in the United States:

- “In the United States, the tax overhaul and higher spending will widen the fiscal deficit, which was already set to deteriorate over the long term because of aging-related spending. Against the backdrop of record low unemployment rates, the deficit expansion is providing a short-term boost to activity in the United States and many of its trading partners, but at the cost of elevated risks to the U.S. and global economies. The larger deficit not only will leave fewer budget resources to invest in supply-side reforms, but will add to an already-unsustainable public debt and contribute to a rise in global imbalances.”

- “Some policy measures that are supporting short-term activity in some economies (such as larger U.S. fiscal deficits) are not sustainable — and hence come at the cost of lower future growth because they will need to be reversed.”

- “With the U.S. economy already operating above potential, expansionary fiscal policy could lead to an inflation surprise, which may trigger a faster-than-currently anticipated rise in U.S. interest rates, a tightening of global financial conditions, and further U.S. dollar appreciation, with potentially negative spillovers for the global economy.”

- “The U.S. economy, which is already operating beyond full employment, should implement a medium-term plan to reverse the rising ratio of public debt, accompanied by fiscal measures to gradually boost domestic capacity. This would help ensure more sustainable growth dynamics as well as contain external imbalances.”

- “Countries with stronger fiscal positions entering the financial crisis suffered smaller losses, suggesting that greater room for policy maneuver may have helped defend against harm. . . . Moreover, some of the crisis management tools deployed in 2008–09 are no longer available (the Federal Reserve’s bailouts of individual institutions, for example), suggesting financial rescues in the future may not be able to follow the same playbook.”

Fiscal policy in the United States, the report concludes, “should aim to rebuild buffers for the next downturn, and the composition of public spending and revenues should be designed to bolster potential output and inclusiveness.”

Image credit:Getty Images

Further Reading

House Reconciliation Bill Would Add Trillions to the National Debt

The bill would increase debt by $3.0 trillion over the next 10 years, driving it from nearly 100 percent of GDP now to 124 percent of GDP by 2034.

House Reconciliation Bill Would Increase the National Debt by More Than Any Other Recent Legislation

The House recently passed the largest reconciliation bill ever. CBO estimates it would add $2.4 trillion (excluding interest) to the national debt over 10 years.

United States Is Borrowing at a Higher Rate than the Global Average, Warns IMF

New IMF reports serve as a warning to all countries that global fiscal and economic conditions are veering into dangerous territory.