Fiscal policy refers to the decisions made about government tax and spending. But many Americans may be confused by the complex set of issues that comprise how the government raises revenues and allocates them.

What is fiscal policy? And what does it mean for you? Below are interactive tools from the nonpartisan Peterson Foundation as well as other respected policy organizations that can help you answer these questions and make complex fiscal policies more accessible, understandable, and relevant to your daily life.

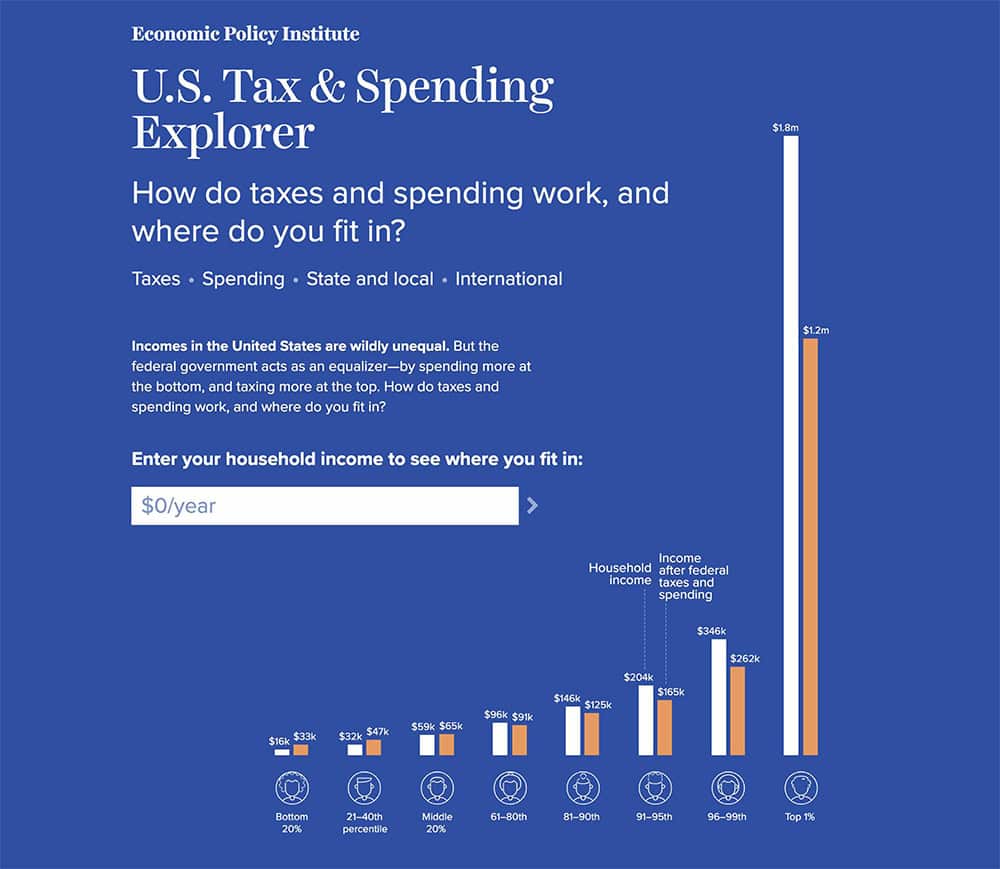

1. Several tools exist to help users understand the various components of the federal budget. The Economic Policy Institute has developed an interactive tool that leads viewers through the key elements of the federal budget while showing them how households with their level of income compare to others. Similarly, the United States Treasury has created an in-depth interactive explorer that allows users to take a deep dive into how spending is allocated by program or by agency. Viewers can also test their knowledge of the federal budget and the U.S. tax system with the Foundation’s own quizzes.

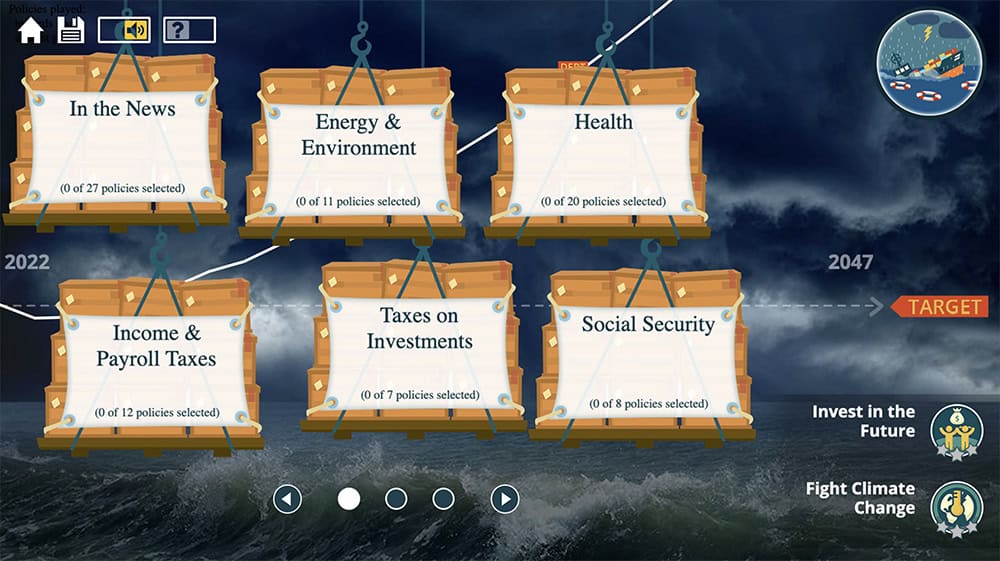

2. The Fiscal Ship, developed by the Hutchins Center at the Brookings Institution and the Wilson Center, makes the federal budget more accessible and engaging by challenging players to put the budget — the ship, as it were — on a sustainable course. Brookings has developed a teaching tool for using the game in classrooms, and the Council for Economic Education has developed a module for using the Fiscal Ship in the context of analyzing political platforms.

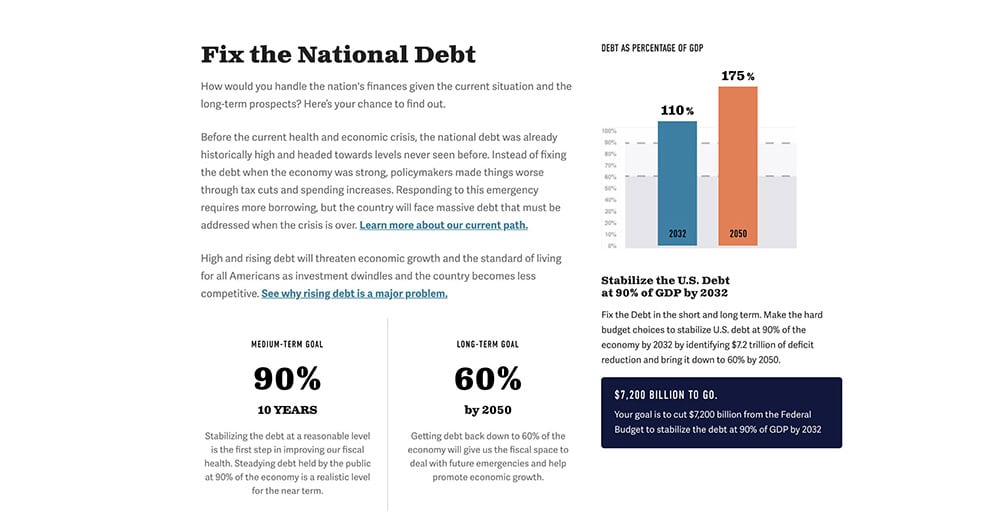

3. The Committee for a Responsible Federal Budget (CRFB) and the Bipartisan Policy Center have also developed tools that illustrate the tough budget trade-offs that policy makers are faced with. Both the Debt Fixer and Balancing Act allow users to make adjustments to the Federal Budget and see the potential impact of their changes.

4. The Understanding Fiscal Responsibility curriculum helps high school students to think critically about public policy issues including Social Security, Medicare, national defense, and the federal debt. First developed by Teachers College, Columbia University, and now disseminated by the Council for Economic Education, the curriculum includes professional development tools for teachers as well as group activities and interactives to engage students in discussions and help them articulate their own views.

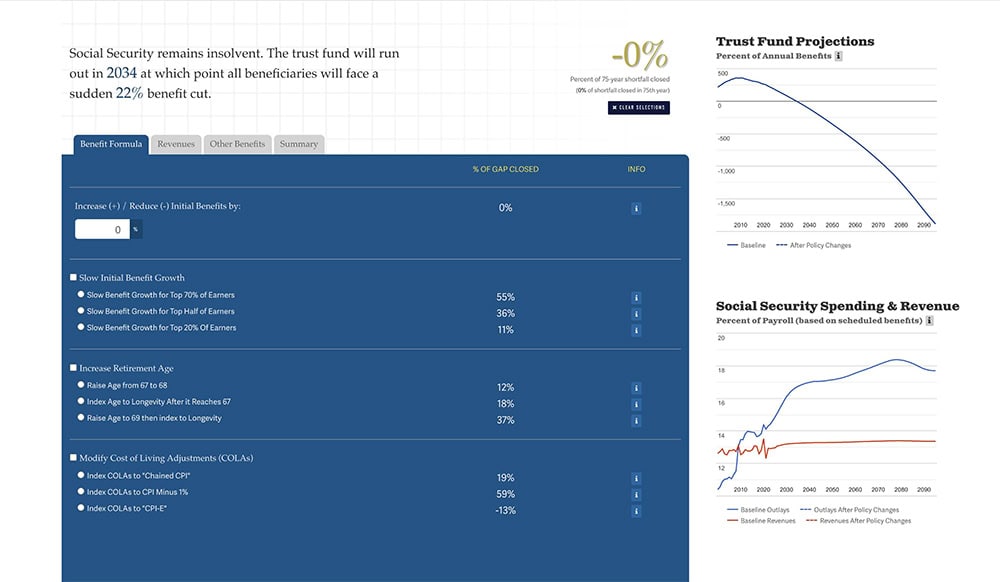

5. Social Security’s finances are not on solid footing. The Reformer, from CRFB, allows users to select policies to make Social Security more financially stable by modifying benefits and changing taxation rates.

Photo by Getty Images

Further Reading

What Is R Versus G and Why Does It Matter for the National Debt?

The combination of higher debt levels and elevated interest rates have increased the cost of federal borrowing, prompting economists to consider the sustainability of our fiscal trajectory.

High Interest Rates Left Their Mark on the Budget

When rates increase, borrowing costs rise; unfortunately, for the fiscal bottom line, that dynamic has been playing out over the past few years.

Debt vs. Deficits: What’s the Difference?

The words debt and deficit come up frequently in debates about policy decisions. The two concepts are similar, but are often confused.