What to Know About the New Monthly Child Tax Credit Payments

Last Updated July 16, 2021

The Internal Revenue Service began its first monthly cash payments yesterday as part of the temporary revisions to the Child Tax Credit (CTC) provided in the American Rescue Plan (ARP). About 36 million households who have children age 17 or younger are in line to receive the monthly payments, which will be sent through December of this year to those who opt to receive them.

The CTC, which was created in 1997, is a part of the tax code designed to address the cost of raising children. The ARP modified the credit for 2021 to:

- Extend the credit to 17-year-old children

- Adjust the income limits for eligibility

- Make the credit fully refundable (taxpayer eligible for full credit regardless of income)

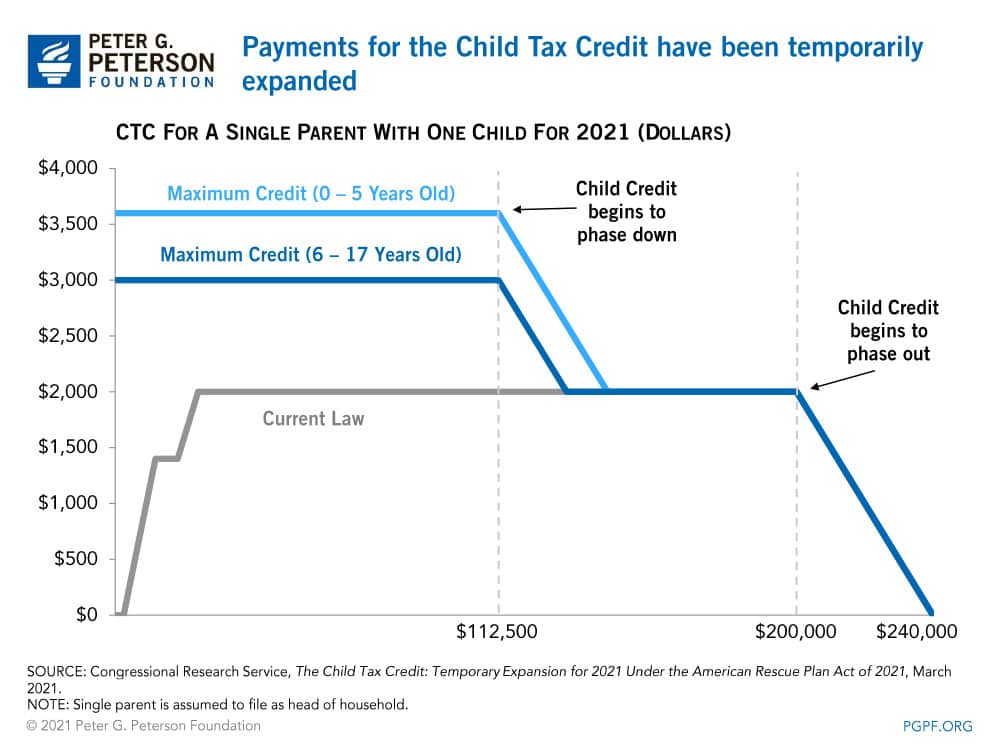

- Increase the credit amount from $2,000 to $3,600 per child age 5 and under and $3,000 per child between ages 6 and 17.

A key provision of the ARP advances half of the expected credit for 2021 in periodic payments, which have now begun. The advancement will be based on taxpayers’ 2020 income tax data, or if unavailable, 2019 income tax data. Taxpayers will claim the remaining half of the total credit for 2021 when filing their final tax returns next year.

Under the ARP’s revised income eligibility, the full credit amount in 2021 is available to those with children under 18 years old and incomes below $112,500 for single taxpayers filing as head of household ($150,000 for married couples). It begins to phase down for those with incomes above that level until the credit equals $2,000 per child. The CTC remains at $2,000 per child until a taxpayer’s income exceeds the current-law maximum of $200,000 ($400,000 for married couples), at which point it is progressively reduced until it reaches zero for those with incomes of $240,000.

Under permanent law (other than for 2021), taxpayers with children ages 16 and under were eligible to receive a credit equal to a percentage of their earnings, up to a maximum amount of $2,000 per qualifying child. The credit began to phase out at $200,000 for single taxpayers filing as head of households and $400,000 for married couples.

The CTC is a significant tool for reducing child poverty and among the largest tax expenditures in the budget — it was the fourth largest in 2019 and totaled $118 billion that year. The temporary changes enacted through the ARP are projected to cost $105 billion in 2021 and 2022.

Photo by Jemal Countess/Stringer/Getty Images

Further Reading

Here’s How No Tax on Overtime Would Affect Federal Revenues and Tax Fairness

Excluding overtime pay from federal taxes would meaningfully worsen the fiscal outlook, while most of the tax benefits would go to the top 20% of taxpayers.

A Bipartisan Roadmap for Social Security Reform

Lawmakers are running out of time before automatic reductions to benefits are activated; the Brookings Institution plan is a valuable contribution to the policy discussion.

No Taxes on Tips Would Drive Deficits Higher

Eliminating taxes on tips would increase deficits by at least $100 billion over 10 years. It could also could turn out to be a bad deal for many workers.