What Is Stepped-Up Basis on Capital Gains and How Does It Affect the Federal Budget?

Stepped-up basis is a provision in tax law that applies to the taxation of capital gains at death. The provision allows assets to be revalued when they are inherited, resulting in preferential tax treatment to the tune of billions of dollars in forgone tax revenues every year. Here, we explain how stepped-up basis works, what it means for the federal budget, and describe some proposed reforms to the taxation of capital gains at death.

What Is the Step-Up in Basis and Who Would Be Affected by This Change?

Stepped-up basis allows the tax basis of an asset (the cost of the asset ascribed to the taxpayer) to be adjusted to reflect its value at the time that the owner passes away, rather than the value when it was originally purchased. Increasing the basis of an asset reduces the portion of it that is subject to the capital gains tax, thereby lowering taxes on the asset for the inheritor.

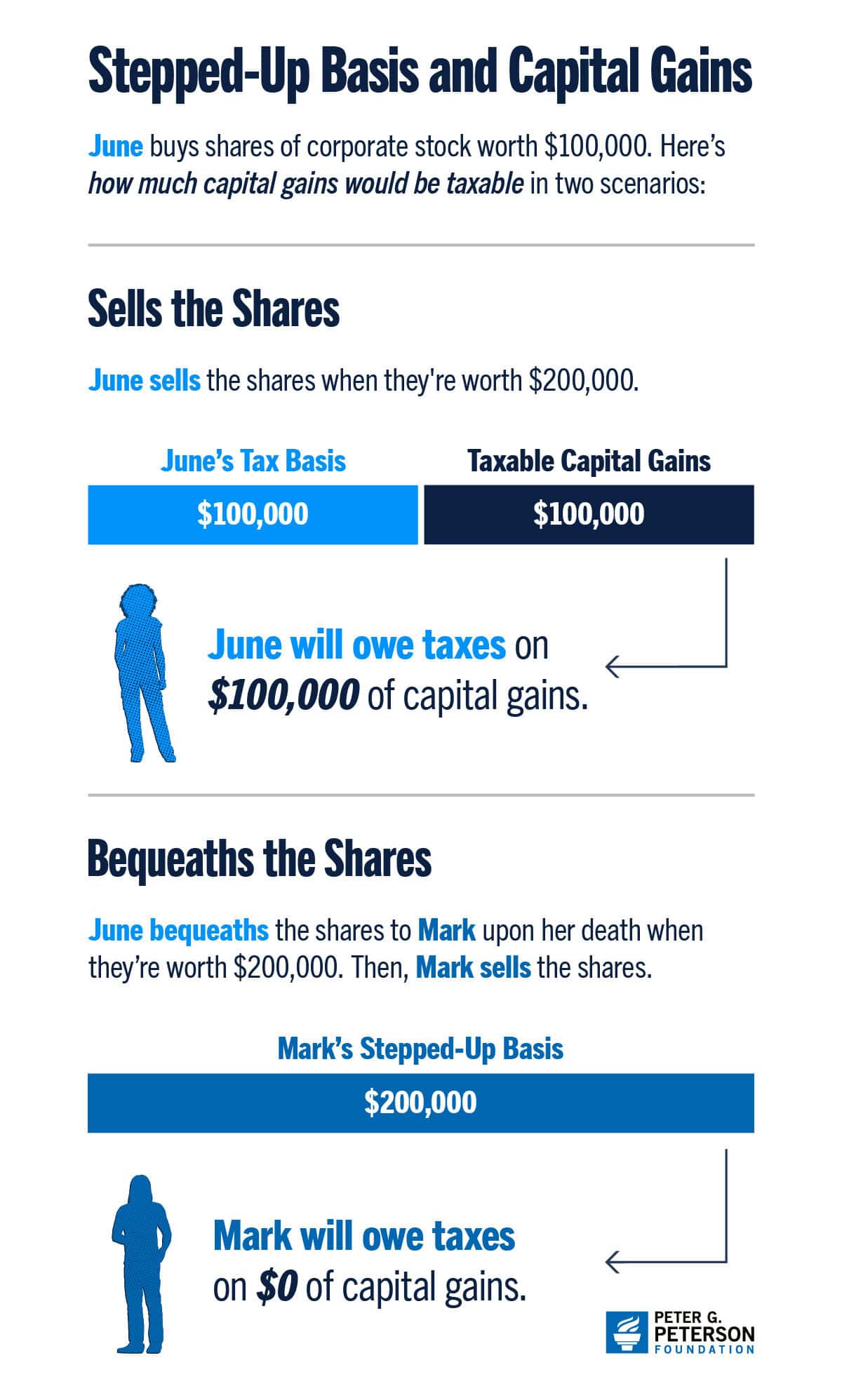

Capital gains are considered “realized” — and thereby subject to taxation — when an asset is sold for a profit. For example, if shares of corporate stock were purchased for $100,000 and sold later for $200,000, the $100,000 of profit would be considered a capital gain and would be subject to the capital gains tax. However, if the owner of the asset were to pass away and bequeath it to someone else, the tax basis of the asset would be adjusted to reflect the asset’s value at the time of the decedent’s death. So, if the asset that was purchased for $100,000 and is now worth $200,000 was bequeathed rather than sold, the recipient of the asset would receive a new tax basis of $200,000. If they later sold the asset for the same amount, no taxable capital gains would exist and, therefore, no taxes would be owed. In the example, stepped-up basis effectively erases $100,000 of taxable gains.

Stepped-Up Basis and Federal Revenues

Stepped-up basis is one of the largest federal tax expenditures. According to the Joint Committee on Taxation, it will account for $58 billion in forgone revenues for the federal government in 2024. That is equal to about a quarter of all revenues from taxes on capital gains.

The Debate about the Future of Stepped-Up Basis

Opponents of stepped-up basis argue that the provision is a tax sheltering strategy that primarily benefits wealthy taxpayers and that it is an unfair loophole in the tax system, as it serves to shield some capital gains from ever being taxed. In 2019 (the latest year for which data is available), 56 percent of the benefits — or $22 billion — went to the top 20 percent of decedents’ estates, with $7 billion of that amount going to the top 1 percent, according to the Congressional Budget Office. Furthermore, stepped-up basis creates an incentive and a pathway to continue to pass assets from one generation to the next within the same family, contributing to the concentration of wealth.

Others argue that eliminating stepped-up basis would result in a form of double taxation that would arise from the combination of the estate tax and the capital gains tax. However, only decedents with estates greater than $13,610,000 will be required to file an estate tax return in 2024, so very few estates face taxation. Concerns about measuring basis have also been raised. Taxpayers are responsible for keeping track of basis, but some may not have done so if they expected their heirs to benefit from stepped-up basis. Further, those responsible for paying taxes after death did not actually own the asset and might not have adequate documentation to establish basis.

Proposals to Reform the Taxation of Capital Gains at Death

Proposals to reform stepped-up basis generally fall into two categories:

- Carryover Basis: Rather than receiving a stepped-up basis set to the current market value of an asset at the time of death, the inherited asset would retain the basis from the decedent. When a transferred asset retains its basis from the prior owner, it is called “carryover basis.” In the example above, Mark would inherit June’s shares worth $200,000 with her $100,000 basis. If he later sold the shares for $200,000, Mark would have $100,000 of taxable capital gains. The tax basis for gifted assets is currently determined on a carryover basis, where the recipient retains the donor’s basis.

- Treat Death as a Realization Event: Currently, capital gains are only considered realized when sold. Such proposals would reclassify capital asset transfers at death as realization events for decedents; thereby making capital gains taxable at death. In the example above, June would be taxed the same if she sold or bequeathed the shares. The Biden Administration included a similar provision in its budget proposal for fiscal year 2025.

Conclusion

Stepped-up basis accounts for billions in forgone revenues each year, with most of the tax benefits going to the highest-income households. Over time, the value of assets that have received a stepped-up basis will continue to grow, restraining the potential tax base and contributing to the imbalance between spending and revenues. In 2025, lawmakers will have the opportunity to consider reforms to the taxation of estates — including capital gains at death — as certain estate tax provisions of the Tax Cuts and Jobs Act are set to expire at the end of that year. As they consider reforms, lawmakers should look at both the revenue and spending sides of the budget and work together to find solutions that chart a more sustainable fiscal path.

Photo by Spencer Platt/Getty Images

Further Reading

Understanding the New Senior Deduction in the One Big Beautiful Bill Act

The senior deduction adds complexity to the tax code, and fewer than half of seniors will benefit from it.

What Are Estate and Gift Taxes and How Do They Work?

Estate and gift taxes produce relatively lower revenue compared to other sources, but they generate a significant amount of attention, and even controversy.

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.