On November 19, 2021 the House passed the Build Back Better Act, a wide-ranging bill that aims to accomplish numerous priorities of the Biden Administration. According to a CRFB analysis of calculations from the Congressional Budget Office and the Joint Committee on Taxation, the legislation would raise the deficit over the next 10 years by $160 billion. While the new spending is mostly offset by other savings, the bill also includes a number of budget timing gimmicks which could hide its true cost.

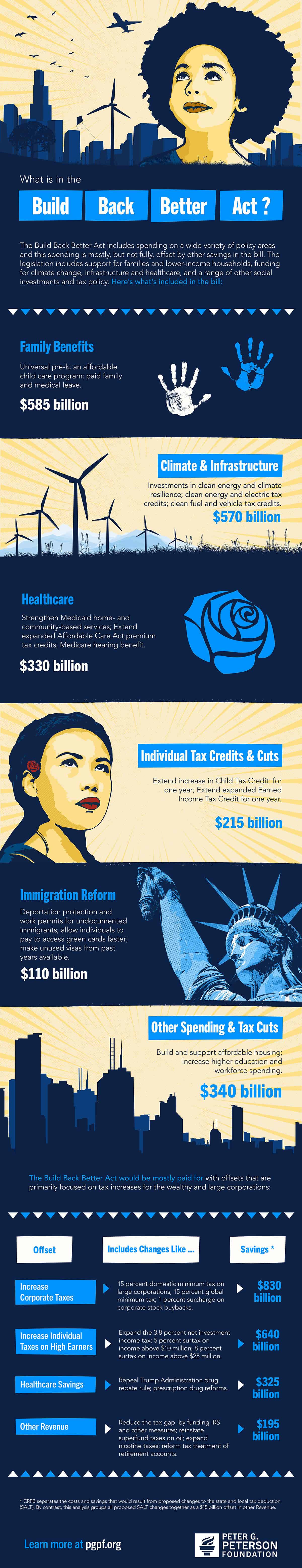

The proposed spending, tax cuts, and offsets are broken down in the following ways.

Further Reading

Here’s How No Tax on Overtime Would Affect Federal Revenues and Tax Fairness

Excluding overtime pay from federal taxes would meaningfully worsen the fiscal outlook, while most of the tax benefits would go to the top 20% of taxpayers.

No Taxes on Tips Would Drive Deficits Higher

Eliminating taxes on tips would increase deficits by at least $100 billion over 10 years. It could also could turn out to be a bad deal for many workers.

Full Array of Republican Tax Cuts Could Add $9 Trillion to the National Debt

Fully extending the TCJA would cost approximately $5.0 trillion, while other elements of the Republican tax agenda also have large price tags over ten years.