The projections of spending, revenues, debt, and deficits in the Budget and Economic Outlook issued by the Congressional Budget Office (CBO) are based on the assumption that current laws will generally remain the same. That requirement is specified by law and enables CBO to provide a benchmark — also known as the baseline — that lawmakers can use to assess the budgetary effects of policy decisions.

However, oftentimes policies in place are scheduled to expire, even though many observers expect that they will continue in some form. For example, in recent years, a number of tax policies have been enacted with expiration dates; those policies could be extended or modified in the future if new legislation were enacted. Similarly, spending policies may also contain provisions that are likely to be changed in the future. To account for the continuation of such current policies, CBO also prepares what is known as an alternative fiscal scenario (AFS), which can be helpful for lawmakers and the general public in understanding a range of potential outcomes.

In CBO’s current AFS, there are two sets of effects that differ from their baseline estimates:

- Tax Policy. Under current law, the lower individual income tax rates enacted in the Tax Cuts and Jobs Act in December 2017 would rise in January 2026. An alternative scenario would make permanent the rates currently in effect and extend other expiring revenue provisions.

- Discretionary spending. For the past four fiscal years (2015–2018), outlays for appropriated spending (also known as discretionary spending) have averaged 6.3 percent of gross domestic product (GDP). In CBO’s baseline, such spending would remain at that level for a few years, but eventually drop to 5.6 percent of GDP by 2029, which would be the lowest proportion recorded since 1962 (the first year in which data for the category was recorded). An alternative scenario would project discretionary spending to remain at 6.3 percent of GDP.

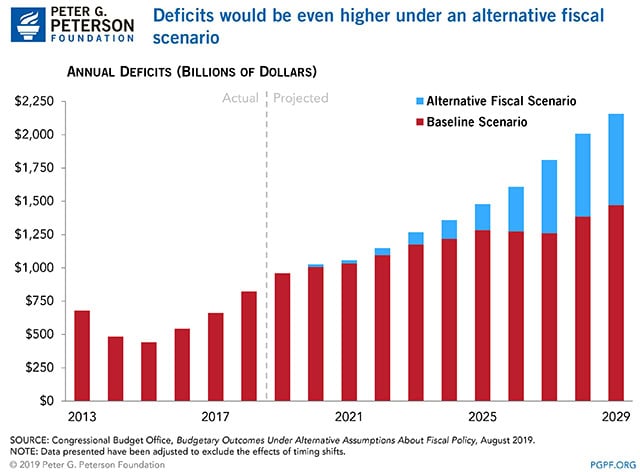

In CBO’s most recent projections, issued in August 2019, the agency estimated that the deficit for this year will be $960 billion, and that the cumulative deficit over the following 10 years would total $12.2 trillion. As a result of mounting deficits, the national debt would rise from 78 percent of GDP in 2018 to 95 percent of GDP by 2029.

Under an AFS, things would look even worse. Under such a scenario, deficits would total $14.9 trillion over the next decade — $2.7 trillion higher than projected in CBO’s baseline. And debt as a percentage of GDP would reach 104 percent of GDP by 2029 — nearly as much as its peak right after World War II. An AFS was also constructed for CBO’s long-term estimates and indicated that the difference between the baseline and the alternative scenario continues to grow over time.

We don’t know how lawmakers will address fiscal policy in the future. As such policy changes are considered, the alternative fiscal scenario helps illuminate some options and outcomes that are in play.

Image credit: Wil Etheredge/Getty Images

Further Reading

How Much Can the Administration Really Save by Cutting Down on Improper Payments?

Cutting down on improper payments could increase program efficiency, bolster Americans’ confidence in their government, and safeguard taxpayer dollars.

How Do Quantitative Easing and Tightening Affect the Federal Budget?

The Federal Reserve plays an important role in stabilizing the country’s economy.

Can a Rescissions Package Help Lawmakers Formalize DOGE Cuts?

Rescission packages can serve as a tool for the President and Congress to manage and control government spending through a formal statutory process.