These Tax Expenditures Cost Billions More Than Anticipated — Here’s Why

Last Updated May 29, 2024

Tax expenditures are costly for the federal government — to the tune of $1.8 trillion in 2023 — but they can be effective vehicles for lawmakers to achieve policy goals. That could explain why lawmakers created or modified 62 tax expenditures in fiscal year 2023, according to the Joint Committee on Taxation (JCT). Over the past few years, the cost of some relatively new tax expenditures has grown considerably beyond their original estimates: energy tax provisions of the Inflation Reduction Act are projected to cost twice as much as originally expected, while a COVID-related relief measure for businesses could grow to three times its original estimate. Those growing price tags demonstrate that the ultimate cost of a new tax break can be difficult to anticipate, and lawmakers should consider the deficit effects as well as the policy goals of such provisions.

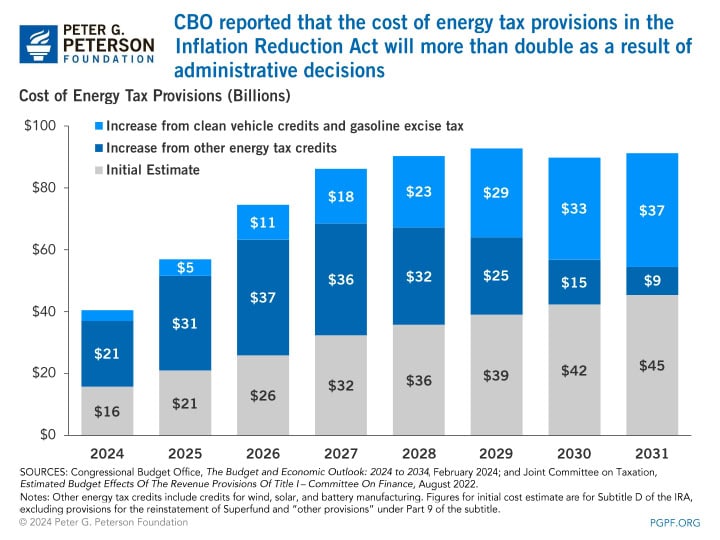

Energy Tax Provisions of the Inflation Reduction Act

The Inflation Reduction Act (IRA) included provisions that created tax credits for electric vehicles and clean energy production. JCT originally estimated that those provisions would cost $258 billion from 2024 through 2031. However, because of a series of administrative decisions from the Internal Revenue Service (IRS) and the Environmental Protection Agency as well as greater than expected investments in manufacturing and energy production, JCT now estimates the cost of those provisions to be much greater. Administrative decisions in particular drove up the estimated cost of clean vehicle credits, which is a group of nonrefundable tax credits that can be claimed for up to $7,500 for personal vehicles and $40,000 for commercial vehicles. The IRS issued guidance that credits claimed by businesses are not subject to the same restrictions applied to individuals and that businesses can claim credits for commercial vehicles leased to consumers. Those decisions led to greater uptake of the credit than originally anticipated. In February 2024, the Congressional Budget Office reported that the projected cost of the energy tax provisions of the IRA will amount to $622 billion from 2024 through 2031, nearly 2.5 times the original estimate.

Employee Retention Credit

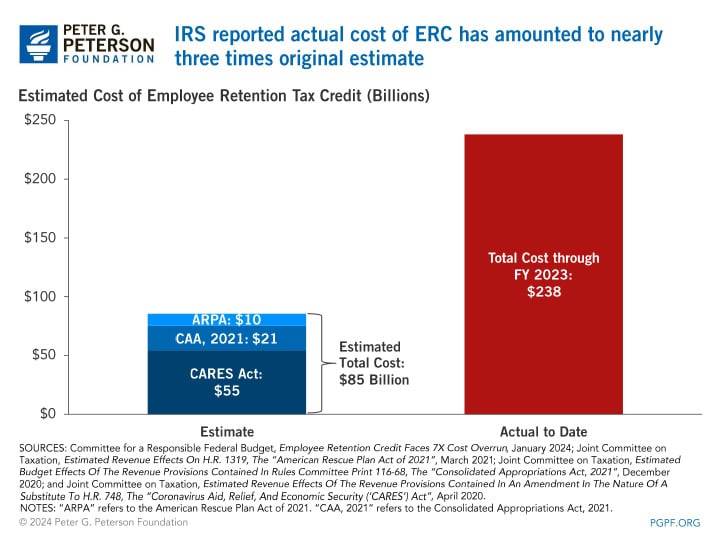

Enacted as part of the federal government’s COVID-19 relief packages, the employee retention credit (ERC) is a refundable tax credit available to businesses to help offset the cost of wages paid through the pandemic. The ERC was established and expanded through a series of laws enacted in 2020 and 2021. At the time of enactment, JCT estimated that the cumulative cost of the ERC would total $85 billion, all of which would occur from 2020 through 2022. However, businesses claiming the ERC exceeded expectations, and — with more claims than anticipated plus an extended window to file claims — the cost of the tax credit has surpassed the original estimate. Economist Donald Schneider estimated that the ERC has already cost $238 billion through December 2023, but the total cost of the credit is expected to continue to rise as the IRS processes claims. On September 14, 2023, the IRS announced a moratorium on processing new ERC claims, but it will still process claims submitted before that date.

Part of the unexpected cost of the credit resulted from fraudulent claims. An alert from the Financial Crimes Enforcement Network reported that the ERC has become a popular target for such fraud, with individuals and businesses claiming the credit using fabricated, dormant, or ineligible entities. They also warned of third-party promotors — known as “ERC mills” — that use “aggressive marketing tactics” to convince businesses to file ERC claims and charge large, upfront fees for preparation services. For a limited time, the IRS allowed businesses that received improper ERC payments to voluntarily repay 80 percent of their ERC refund without interest or penalty. Similarly, businesses that had unprocessed claims or had not cashed ERC returns could withdraw claims and return checks without penalty. That program ended on March 22, 2024. In an effort to control the cost of the credit, lawmakers included a provision in a proposed tax bill to retroactively bring forward the deadline to file a claim from April 15, 2025 to January 31, 2024. They also proposed enhancing penalties for fraud related to the credit. Those reforms to the ERC are projected to reduce payments by $79 billion from 2024 to 2033, if enacted.

Fiscal Responsibility and the Uncertainty of Tax Expenditures

While they can be useful tools for lawmakers to achieve policy outcomes, tax expenditures can cost the federal government more than lawmakers intend because of unanticipated taxpayer behavior and administrative decisions. That potential growth can jeopardize deficit reduction in legislation that includes tax expenditures. For example, the Inflation Reduction Act was projected to reduce deficits by $238 billion from 2022 to 2031, but the inflated cost of its energy related tax provisions has eliminated that reduction. As important fiscal decisions arise over the next few years — including the expiration of certain provisions of the Tax Cuts and Jobs Act and discretionary spending caps at the end of 2025 — lawmakers should take a holistic view of the fiscal outlook, including reform of tax expenditures.

Related: 6 Key Charts on Tax Breaks

Image credit: Justin Sullivan/Getty Images

Further Reading

Infographic: How the U.S. Tax System Works

One issue that most lawmakers and voters agree on is that our tax system needs reform.

No Taxes on Tips Would Drive Deficits Higher

Eliminating taxes on tips would increase deficits by at least $100 billion over 10 years. It could also could turn out to be a bad deal for many workers.

Should the U.S. Change the Corporate Tax Rate in 2025?

Here’s why lawmakers lowered the corporate tax rate in 2017, how the lower rate impacted the U.S., and how the rate might be reformed in 2025.