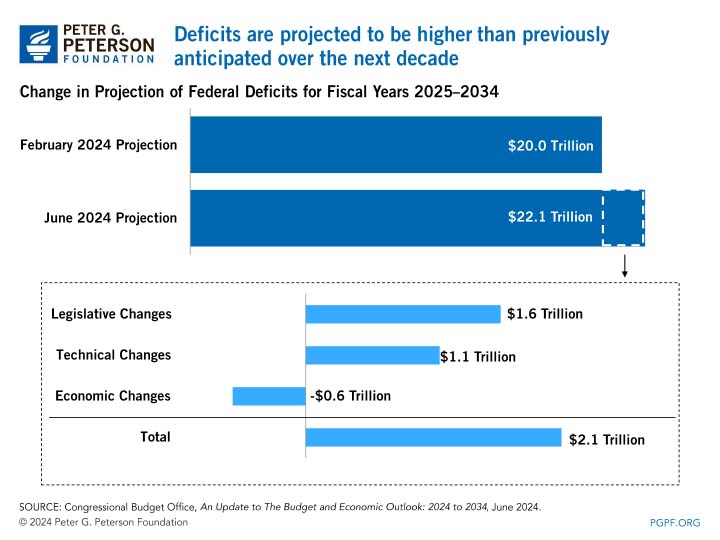

Two weeks ago, the Congressional Budget Office (CBO) updated its budget and economic projections, which now show that federal deficits are projected to be $2.1 trillion higher over the next decade than the agency projected just a few months ago. The increased cumulative deficit is primarily due to legislative and technical changes.

Legislative Changes

Legislative changes result from laws enacted since CBO released its February baseline projections. Such changes boosted projected deficits between 2025 and 2034 by $1.6 trillion.

Most of the legislative change ($945 billion) stems from incorporating the supplemental appropriations enacted in April. That legislation provided an additional $95 billion in funding for fiscal year 2024 for Ukraine, Israel, and countries in the Indo-Pacific region. Because that funding is not constrained by funding limitations, baseline rules direct CBO to incorporate such funding in future years (with adjustments for inflation).

Appropriations covered by the Consolidated Appropriations Act, 2024, and Further Consolidated Appropriations Act, 2024, were also higher than accounted for in February. Extrapolating that higher level of funding added $343 billion to CBO’s projections. About three-quarters of the spending increase was for defense and one-quarter was for nondefense programs.

Because legislative changes increased projected annual deficits, net interest outlays also were higher by $247 billion over the 10-year period, bringing the total for legislative changes to approximately $1.6 trillion.

Technical Changes

Technical changes are neither legislative nor attributable to economic conditions. They result from factors such as revisions to CBO’s models, new information or data from federal agencies, and changes in the way programs are administered. Such changes increased deficits over the 2025–2034 period by $1.1 trillion.

Due to technical changes, revenues are projected to decrease by $324 billion in the 10-year period. The largest change in revenues is from corporate income taxes, which are projected to decrease by $381 billion because of modeling refinements stemming from newly available data.

Technical revisions to mandatory outlays led to a higher projected spending of $399 billion over 10 years. The largest increases are for Medicaid and outlays for premium tax credits and related spending. For Medicaid, technical revisions increased CBO’s projections by $267 billion over the 2025–2034 period; for premium tax credits and related spending, CBO recorded a $244 billion increase in outlays.

Net interest outlays are projected to increase by $348 billion due to technical changes, mostly because of an increase in debt-service costs.

Economic Changes

Changes in the economic forecast that underlie CBO’s baseline budget altered assumptions for GDP, interest rates, the labor force, wages and salaries, and inflation, among others. The influence of those changes decreased the cumulative 10-year deficit by $0.6 trillion, mostly because of a projected increase in revenues.

Altogether, CBO increased projected revenues by $521 billion over the 10-year window. Individual income taxes rose by $612 billion compared to previous projections, in part because CBO expects that mortgage interest payments, which are deductible from federal taxes, will be lower than previously anticipated. Offsetting a portion of those increased revenues is a decrease in remittances by the Federal Reserve, which are $176 billion lower over the 10-year period because of an expectation of tighter monetary policy for a longer period.

Conclusion

CBO’s updated projections emphasize the nation’s unsustainable fiscal outlook, as the projections show deficits continuing to rise significantly over the upcoming decade. Moreover, the update demonstrates that various legislative, technical, and economic factors can have significant effects on our fiscal outlook. Given the nation’s troubling fiscal trajectory, it is important for policymakers to understand the factors that affect the outlook for debt, and prioritize responsible budgeting that puts U.S. finances on a better path.

Image credit: Photo by Anna Moneymaker/Getty Image

Further Reading

How Do Quantitative Easing and Tightening Affect the Federal Budget?

The Federal Reserve plays an important role in stabilizing the country’s economy.

Can a Rescissions Package Help Lawmakers Formalize DOGE Cuts?

There has recently been significant discussion surrounding spending cuts proposed by the Department of Government Efficiency (DOGE), including questions about how and whether cuts identified…

Long-Term Budget Outlook Leaves No Room for Costly Legislation

As lawmakers consider costly legislation to extend expiring tax provisions this year, CBO’s latest projections serve as a warning that our fiscal outlook is already dangerously unsustainable.