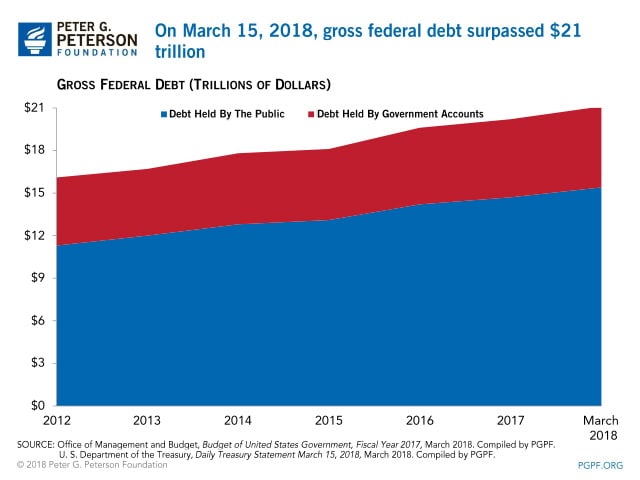

On March 15, 2018, the federal government passed an unfortunate milestone: $21 trillion dollars in gross federal debt.

Gross federal debt has grown by $5 trillion in just the last five years—from $16 trillion at the end of fiscal year 2012 to $21 trillion today. More than 80 percent of that growth has come from debt held by the public. It took just six months to add on the most recent trillion dollars.

The growth of our debt stems from a fundamental imbalance between spending and revenues. Growth in spending — driven by an aging population, rising healthcare costs, and mounting interest payments — is outstripping collections of taxes to pay for it. As a result, the national debt is on an unsustainable long-term trajectory that will undermine economic opportunities for individuals and families in the future.

As Foundation CEO Michael Peterson noted, this trend is especially troubling because our fiscal outlook has only begun to reflect the effects of fiscally irresponsible tax and spending legislation that has been enacted in recent months. During a time of low unemployment and economic expansion, now is the time to get the national debt under control — but lawmakers have been moving in the wrong direction.

Image credit: Photo by Alex Neill/Getty Images

Further Reading

National Debt Could More than Double the Size of the Economy

GAO’s findings add to a chorus of nonpartisan evidence and analysis showing that action is needed to improve our fiscal outlook.

Long-Term Budget Outlook Leaves No Room for Costly Legislation

As lawmakers consider costly legislation to extend expiring tax provisions this year, CBO’s latest projections serve as a warning that our fiscal outlook is already dangerously unsustainable.

Moody’s Warns Recent Policy Decisions Worsen U.S. Fiscal State, Maintains Negative Outlook Rating

Moody’s says that the United States is in fiscal deterioration, warning that government policy decisions in the near term could contribute to higher interest rates and worsening national debt.