The Coronavirus Pandemic Continues to Cause Record Claims for Unemployment Insurance

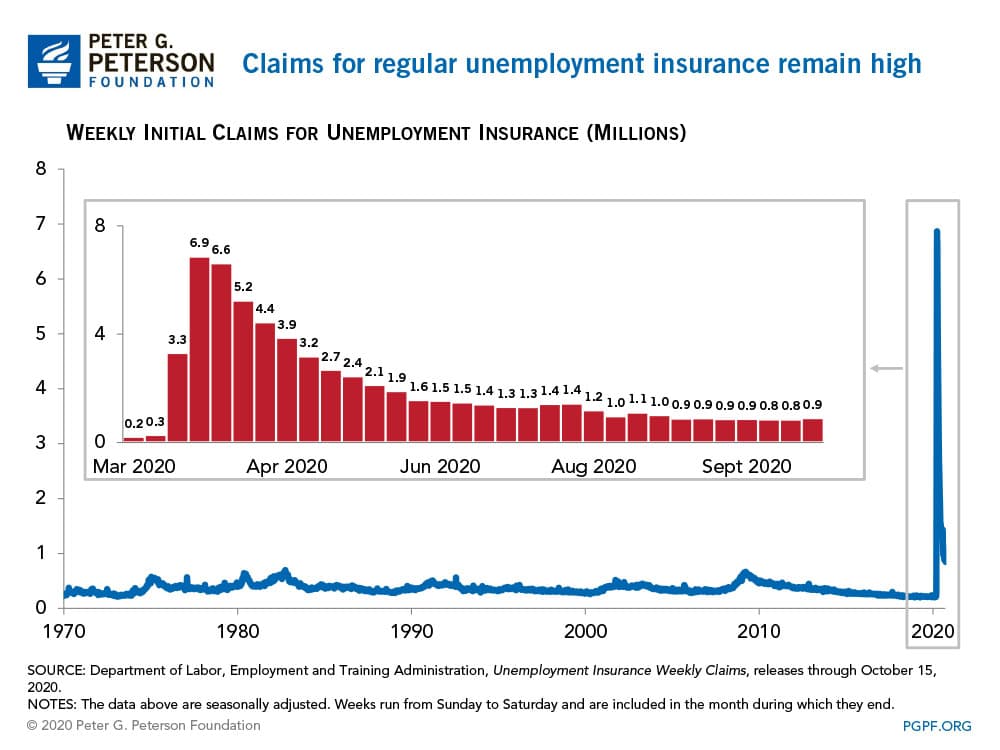

During the week that ended on October 15, 898,000 people filed for regular unemployment insurance, continuing a devastating trend in the labor market. Since March 15, 65 million claims have been filed, largely because of the coronavirus (COVID-19) pandemic and measures to mitigate it. Weekly claims are lower now than they were six months ago. However, in each of the past 30 weeks, more claims have been generated than in any week prior to the pandemic; the pre-pandemic record of 695,000 was set in the week that ended on October 2, 1982.

The chart below shows the latest claims for unemployment insurance in their historical context.

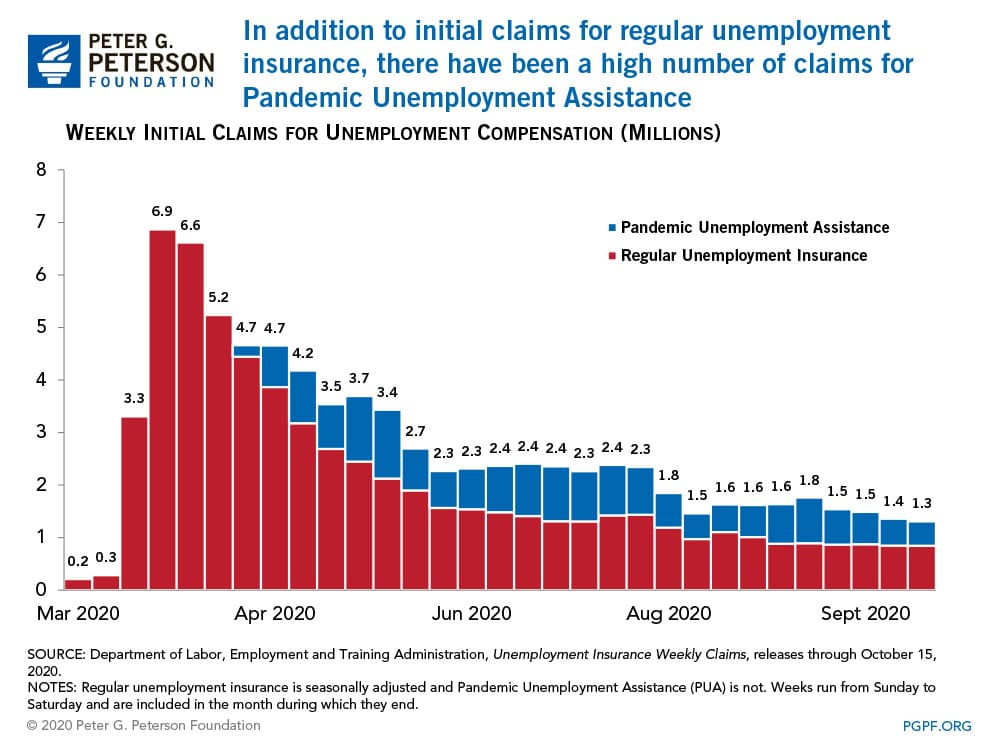

In addition to claims for regular unemployment insurance, there have also been a large number of claims for Pandemic Unemployment Assistance. That program provides up to 39 weeks of unemployment benefits to individuals that are not typically covered by the unemployment insurance program, such as those who are self-employed or independent contractors. Over the past 26 weeks, 20 million claims have been submitted for Pandemic Unemployment Assistance.

All told, there were 1.3 million claims for unemployment compensation last week, and 84 million claims have been filed since mid-March.

Photo by Spencer Platt/Getty Images

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.