Social Security is the largest program in the federal budget and makes up one-fifth of total federal spending. It provides benefits to nearly 9 out of 10 individuals over the age of 65, or 15 percent of the American population. Without Social Security, research finds, two-thirds of the elderly would be considered in poverty.

The program, however, is facing financing shortfalls, and its reserves are currently projected to be depleted in a little over a decade. At that point, unless Congress acts, it won’t be able to pay full benefits to its beneficiaries. One potential solution for improving the program’s financial outlook is increasing or eliminating the cap on earnings that are subject to Social Security payroll taxes.

What is the Social Security Payroll Tax?

Federal Insurance Contributions Act (FICA) taxes are the primary source of revenues for Social Security, and are the largest component of taxes that are commonly referred to as payroll taxes. Employers and employees each pay 7.65 percent of wages in FICA taxes; the portion dedicated to Social Security is 6.2 percent and is only levied up to a maximum amount, or income limit, that is determined annually. (The other 1.45 percent is dedicated to Medicare’s Hospital Insurance program and is not subject to an earnings cap.) Self-employed individuals also contribute to those funds through Self-Employment Contributions Act (SECA) taxes. The rates for SECA taxes are identical to those for FICA taxes, with the only difference being that the individual is responsible for paying both the employee and employer portions of the tax.

The limit on annual earnings subject to Social Security taxes is referred to as the taxable maximum or the Social Security tax cap. For 2024, that maximum is set at $168,600, an increase of $8,400 from last year. When the payroll tax dedicated to Social Security was first implemented in 1937, it was capped by statute at the first $3,000 of earnings (which would be equivalent to about $65,462 in today’s dollars). Since 1975, the taxable maximum has generally been increased each year based on an index of national average wages. About 6 percent of the working population earns more than the taxable maximum.

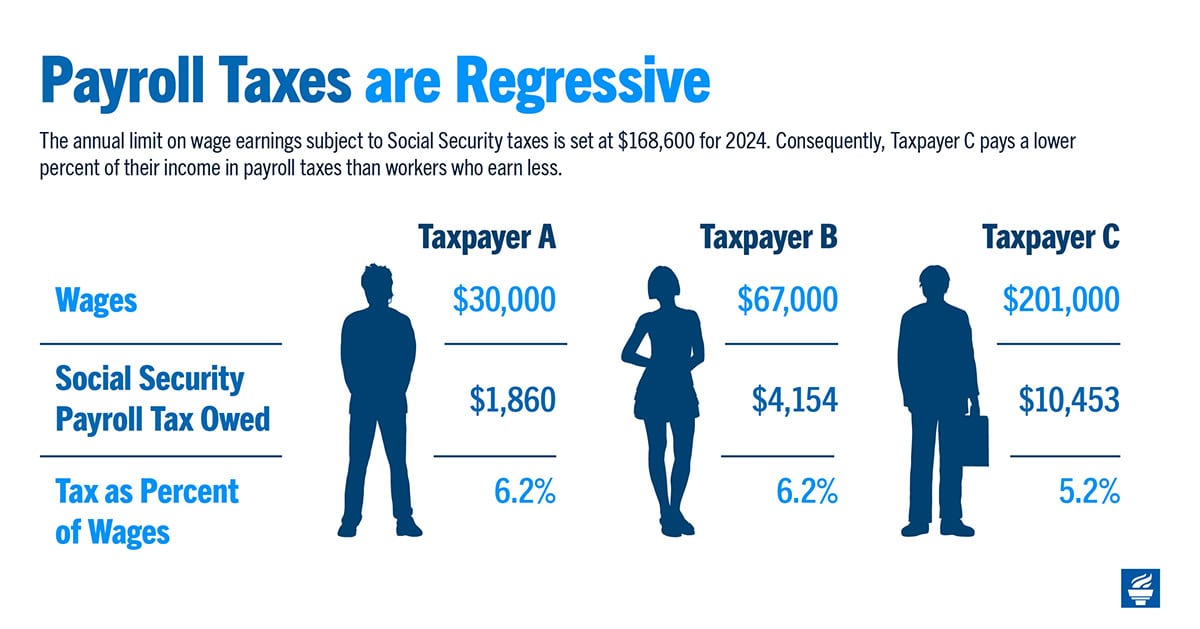

Individual income taxes in the U.S. are generally progressive, with higher-income taxpayers paying a larger share of their income in taxes. Low- and moderate-income individuals, though, pay a higher proportion of their income in payroll taxes than do higher-income taxpayers. In part, that situation stems from the existence of the tax cap for Social Security. For example, someone with wage income of $67,000 per year would owe $4,154 for their share of Social Security taxes. However, someone with triple that income — or $201,000 — would owe $10,453, which is two and a half times the amount of tax.

What Changes Could be Made to the Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

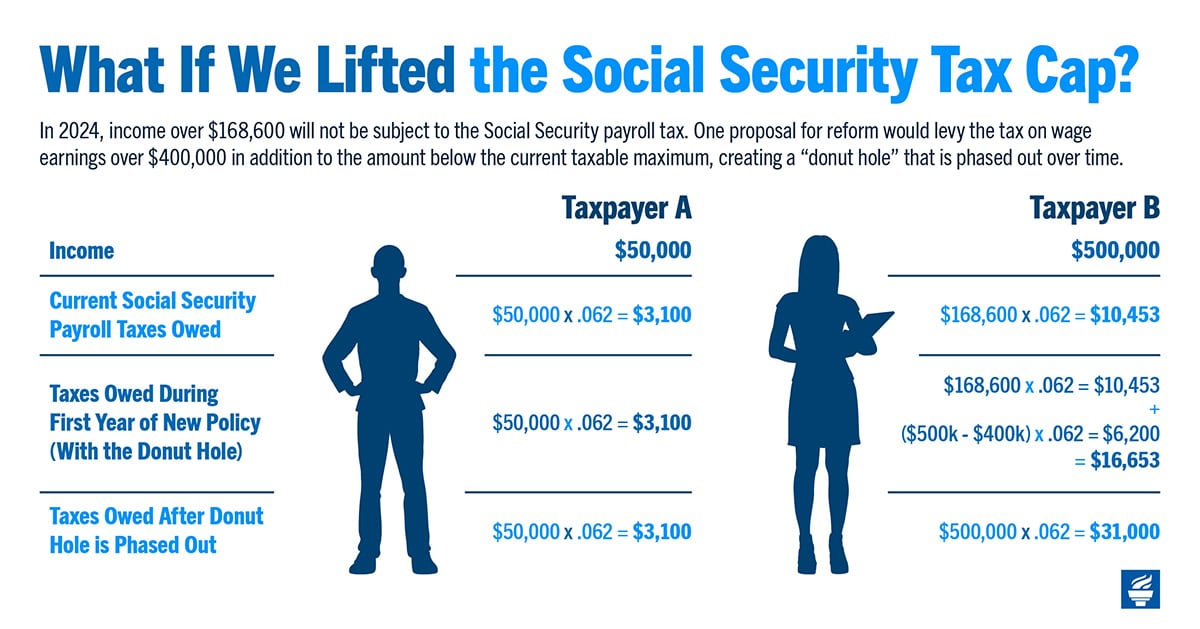

An example of one such proposal, the Social Security 2100 Act, would apply the Social Security payroll tax to earnings over $400,000 in addition to earnings below the current maximum taxable amount. The gap between the two would narrow over time as the maximum taxable amount increases and the $400,000 threshold remains unchanged. That gap has earned the nickname donut hole and would serve to gradually increase the program’s revenues over time while not subjecting earners who fall in the gap to immediate tax increases. While estimates vary based on assumed wage trends and the specific details of each proposal, economists project that it would take approximately 20 to 30 years for the donut hole to disappear. Such an approach is intended to make the tax more progressive by increasing the tax burden on higher-income Americans.

Another approach that has been proposed by economists is to set the tax cap as a portion of aggregate earnings rather than as a dollar figure. The proportion of total earnings that is subject to the Social Security tax has declined over time because the earnings of the highest-paid individuals have increased more quickly than those of other workers. In 1982, 90 percent of earnings were subject to the Social Security tax, but by 2017 the share had decreased to 84 percent. Setting a target for the portion of aggregate earnings that are subject to the Social Security tax — for example, 90 percent — would increase revenues and help improve the program’s solvency while making the tax more progressive.

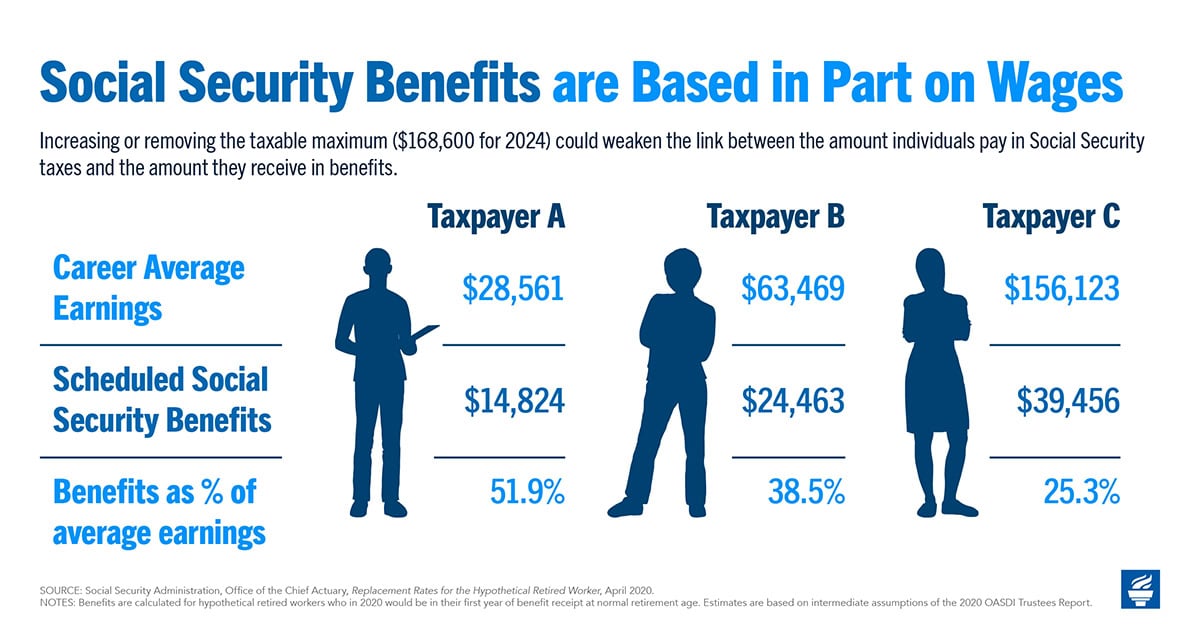

Finally, a consideration when raising or removing the cap on taxable earnings is whether wages above the current cap would also be counted in the formula that determines benefits. Under the current system, an increase in the cap would also raise benefit payments (the 2024 maximum monthly benefit for people at full retirement age is $3,822), thereby leading to higher expenditures for the program (although those would be more than offset by higher tax revenues).

Pros and Cons

Proponents of increasing or eliminating the limit on earnings argue that it would make the tax less regressive and be part of a solution to strengthen the Social Security trust funds. For example, the Congressional Budget Office estimates that subjecting earnings above $250,000 to the payroll tax in addition to those below the current taxable maximum would raise more than $1 trillion in revenues over a 10-year period. Another argument is that removing the taxable maximum would adjust for increasing income inequality and the fact that higher-income individuals generally have longer life expectancies, and thus receive larger Social Security benefit checks for a greater amount of time.

Opponents argue that increasing or removing the taxable maximum could weaken the link between the amount individuals pay in Social Security taxes and the amount they receive in retirement benefits if benefits are not adjusted upward to reflect tax contributions. Opponents also contend that while low-income earners may pay a greater share of their income in Social Security payroll taxes than do those who are wealthier, they also receive a disproportionate share of government transfer payments that are not subject to the tax. Those opponents cite programs that have been created to — at least partially — offset the regressive nature of the Social Security payroll tax. Finally, high-income beneficiaries may also be subject to income taxes on the Social Security benefits they receive.

Finally, some economists anticipate that if the limit were lifted, employers and employees might respond by shifting taxable compensation to a form of compensation that is taxed at a lower rate. For example, employers could decrease wages but increase retirement benefits, which are deductible under the corporate income tax, in an effort to offset the additional payroll taxes they would owe.

Increasing or eliminating the Social Security tax cap is just one of many solutions for improving Social Security’s financial outlook — but it’s clear that some sort of action must be taken to ensure the future of this vitally important program. More options are detailed here.

Photo by Douglas Sacha/Getty

Further Reading

Infographic: How the U.S. Tax System Works

One issue that most lawmakers and voters agree on is that our tax system needs reform.

A Bipartisan Roadmap for Social Security Reform

Lawmakers are running out of time before automatic reductions to benefits are activated; the Brookings Institution plan is a valuable contribution to the policy discussion.

No Taxes on Tips Would Drive Deficits Higher

Eliminating taxes on tips would increase deficits by at least $100 billion over 10 years. It could also could turn out to be a bad deal for many workers.