Last week, the topics for the third and final presidential debate were announced. “Debt and entitlements” was at the top of the list of six topics — and for good reason.

America’s unsustainable long-term debt threatens our economic future, and our fiscal policy will determine a number of important issues voters are concerned about, from healthcare to tax reform to national security.

Below are some important questions that moderator Chris Wallace could ask to start the conversation about our nation’s most pressing fiscal concerns.

1) What are your plans to stabilize and reduce the national debt in the decades to come?

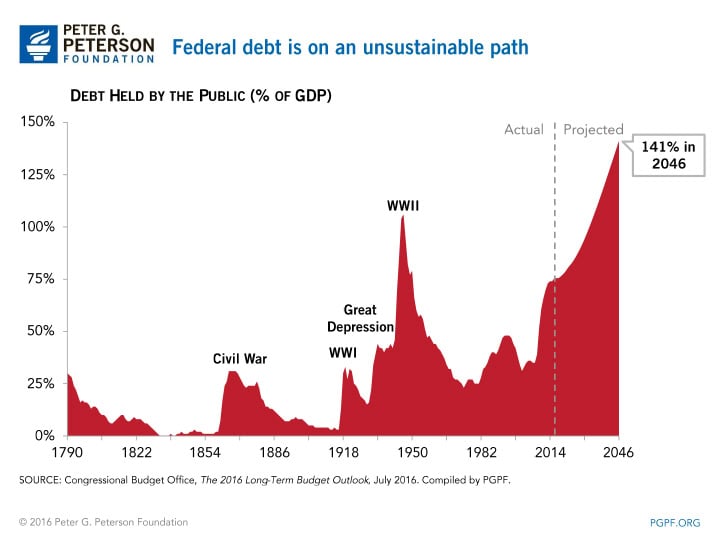

Our debt is already at historically high levels, and the nonpartisan Congressional Budget Office projects that it will soar to 141 percent of GDP in 30 years — well above the highest level of debt ever recorded.

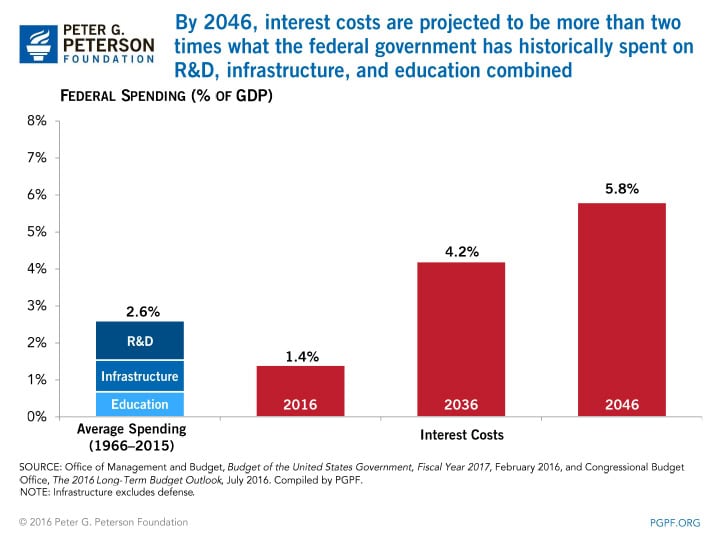

2) How will you reform our budget to slow the growth of interest costs and make sure we can finance investments in our future?

The Congressional Budget Office projects that net interest costs will total nearly $5 trillion over the next decade, crowding out important investments in education, infrastructure, and R&D.

3) What actions will you take in your first year of office to tackle our long-term fiscal challenges?

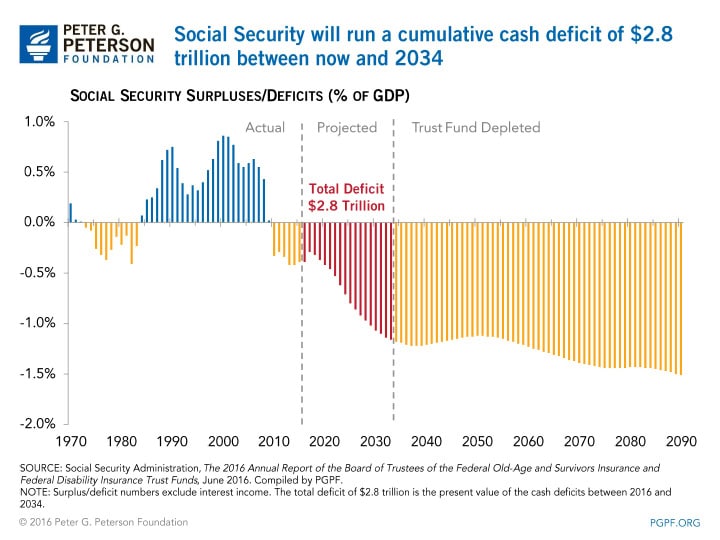

The trustees project that the Social Security trust funds will be fully depleted by 2034 — just 18 years from now. Without legislative action, all beneficiaries — 88 million in total — could face sudden, across-the-board benefit cuts of 21%.

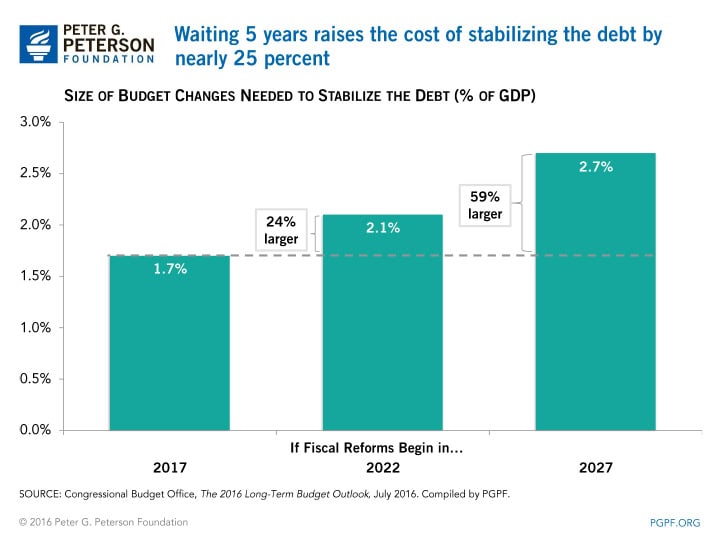

4) What actions will you take in your first year of office to tackle our long-term fiscal challenges?

Waiting just five years to address our fiscal challenges would raise the cost of stabilizing the national debt by nearly 25%, according to the Congressional Budget Office. So we are much better off getting started sooner rather than later.

5) How will you work with Congress to focus more on our long-term future?

The current budget process devotes most of its attention to the current fiscal year, but many of our fiscal challenges stem from revenue and spending policies over the long term.

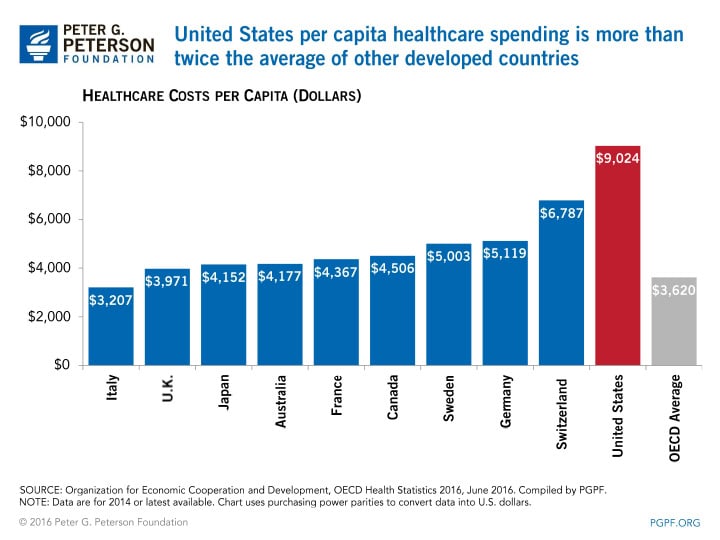

6) How will you work to restrain our nation's growing healthcare costs?

Rising healthcare costs are one of the major drivers of spending in the budget. Moreover, the United States’ healthcare system is the most expensive among advanced nations, yet America’s health outcomes are generally no better than those of our peers.

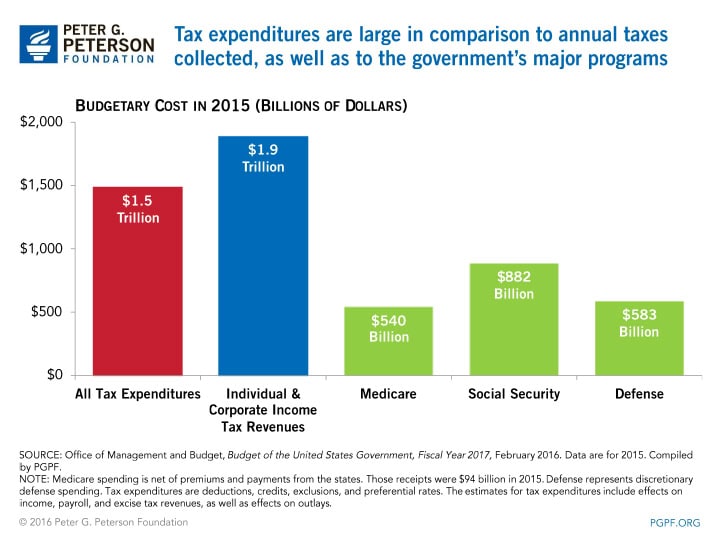

7) What are your plans to reform the tax code to make it fairer and more supportive of economic growth?

Our tax system is complex, inefficient, unfair, and produces inadequate revenues. The tax code is riddled with costly tax breaks — also called “tax expenditures” — that total $1.5 trillion per year, create market distortions, and damage economic growth.

While our nation’s fiscal challenges are serious, the good news is that there is still time for a solution. Policy experts from across the political spectrum have put forward viable plans to address our country’s fiscal challenges. Voters can let the candidates know directly that you care about our nation’s fiscal future, by asking them for a fiscal plan.

Photo by Win McNamee/Getty Images

Further Reading

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Let’s take a closer look at a few key characteristics of Treasury borrowing that can affect its budgetary cost.

Quarterly Treasury Refunding Statement: Borrowing Up Year Over Year

Key highlights from the most recent Quarterly Refunding include an increase in anticipated borrowing of $158 billion compared to the same period in the previous year.