A new report released this week from the nonpartisan Yale Budget Lab outlines the impact of high debt on inflation. The paper argues that America’s unsustainable fiscal outlook can have “significant consequences for price stability, interest rates, and overall economic performance.”

In an article about the report in the New York Times, Ernie Tedeschi, director of economics at the Yale Budget Lab, said “When you deficit finance policies, that is going to put upward cost pressure on American households.”

Here are the top five takeaways from the Yale Budget Lab report:

- Higher debt puts upward pressure on inflation in both the short- and long-term.

- Credible monetary policy can help fight inflationary pressure, but comes at the cost of higher interest rates for businesses and consumers.

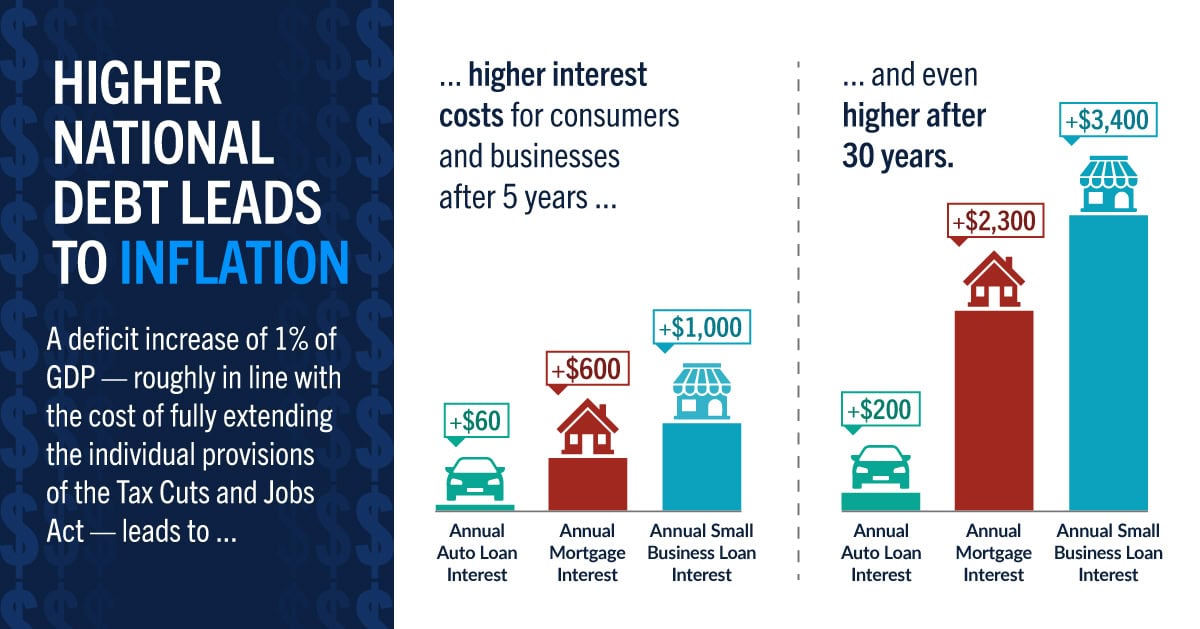

- A permanent deficit increase of 1% of GDP — roughly in line with the cost of fully extending the individual provisions of the Tax Cuts and Jobs Act — would:

-

- decrease household purchasing power by $300–1,250 over five years

- increase mortgage interest payments by $600–1,240 per year

- Debt rising unchecked risks substantial negative effects on capital accumulation, output, and living standards.

- As the U.S. debt-to-GDP ratio approaches historic highs, these findings emphasize the importance of prudent fiscal management and the need for policymakers to carefully consider the long-term consequences of persistent deficit spending.

Further Reading

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.

Experts Identify Lessons from History for America Today

A distinguished group of experts to evaluate America’s current fiscal landscape with an historical perspective.